What’s Zone Crack Alpha? 🎯

This indicator was developed to detect and mark key reversal zones with excessive precision. Its logic relies on an inside comparability of swing breakouts and failed continuations. When a zone will get “cracked,” it highlights the doubtless shift in market sentiment and provides a transparent visible affirmation on the chart. 💥

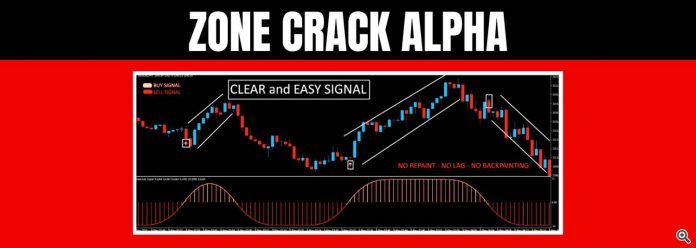

📊 Visible Readability

Zones are displayed straight on the chart with easy-to-read coloration schemes. These areas stand out sharply, even in fast-moving markets, serving to to make faster selections and determine superb entry or exit ranges.

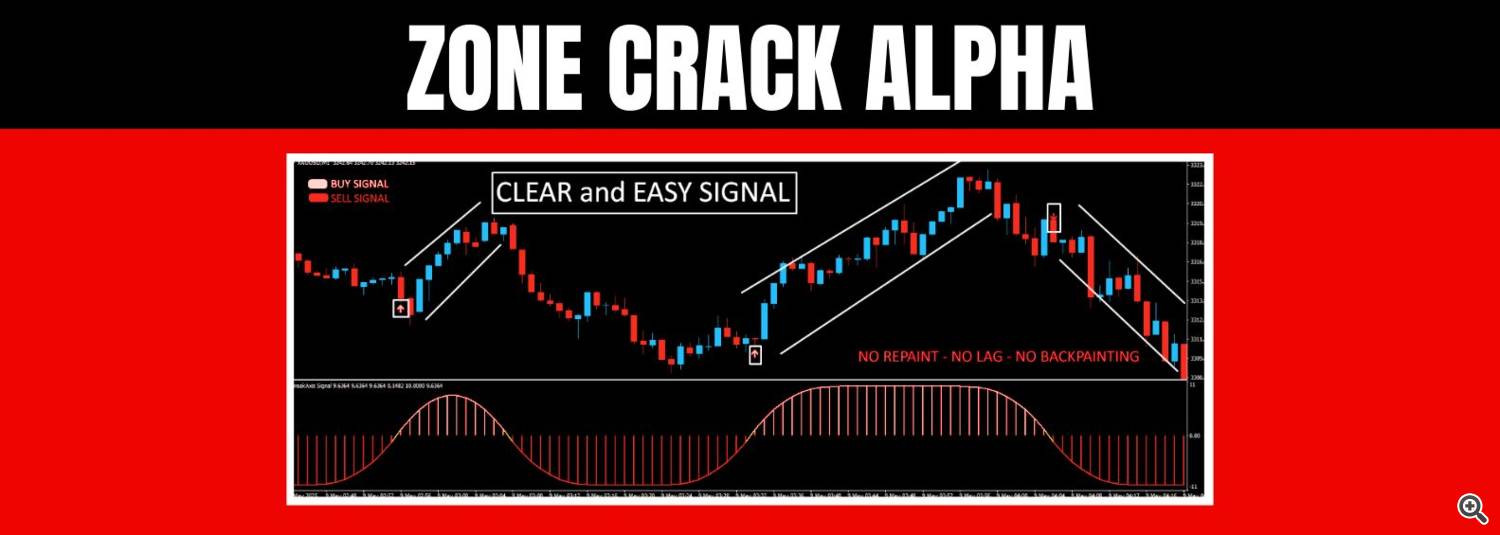

⚙️ How It Works

The system identifies worth zones the place reversals have traditionally occurred. If worth re-enters and fails to carry the zone, a “crack” is triggered, and an alert is plotted. These zones usually are not repainting and stay fastened as soon as confirmed.

🎯 Use Case

This software is particularly helpful for merchants who apply breakout-failure setups, reversal methods, or structure-based entries. It’s not restricted to 1 model—swing merchants, scalpers, and day merchants can profit equally.

🔬 Logic Behind the Alerts

The core logic revolves across the conduct of worth relative to swing buildings. Internally, the indicator evaluates:

- Earlier excessive/low failures — to detect invalidated continuations

- Break-and-reject eventualities — when worth breaks a degree and sharply pulls again

- Quantity-based candle traits — to filter out low-interest zones

When all these situations align, a zone is plotted and monitored for “crack” conduct, which is detected by calculating the typical deviation from the preliminary impulse leg and a affirmation of engulfing or inside-bar breakouts. This hybrid logic helps scale back false positives and offers stronger confidence in every zone printed.

📬 Have questions? Attain me out straight for those who want something! 💬