Nucor (NUE 1.10%) is likely one of the largest steelmakers in North America, however that is not what separates it from the pack. The large story right here is the truth that Nucor is a Dividend King. And proper now, the inventory seems to nonetheless be in Wall Road’s doghouse, which might be a shopping for alternative for buyers whose holding interval is ceaselessly. Here is what it’s essential know.

What does Nucor do?

Nucor makes metal, however that is solely a part of the story. The opposite piece is that it makes use of electrical arc mini-mills within the course of. This expertise tends to be extra versatile than blast furnaces that make major metal. Thus, the corporate can ramp manufacturing up and down based mostly on demand extra simply. That enables it to assist its revenue margins by way of the business’s cycles.

Picture supply: Getty Photos.

The steelmaking cycle is price contemplating. Demand and pricing usually rise and fall together with financial exercise. Given the commercial significance of metal, that is sensible. Nevertheless, it additionally signifies that the enterprise is a bit risky and the inventory is susceptible to large value swings.

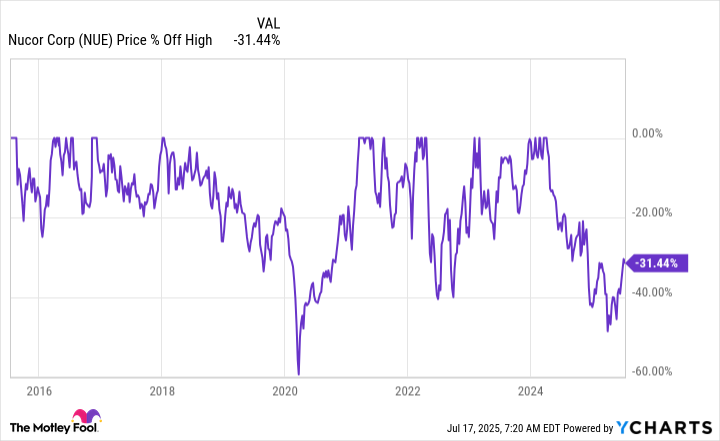

Proper now, the inventory is down round 30% from the peaks it achieved in 2024. That seems like an enormous decline, however it’s really an enchancment from the greater than 40% it had been down earlier than a rally.

Declines of 40% or extra occurred in 2020 and 2022. So basically, that is actually only a regular swing. However that does not imply it is best to ignore the chance right here.

Nucor is a Dividend King

Regardless of the inherent volatility of the metal sector, Nucor has managed to extend its dividend each single 12 months for over 50 consecutive years. An organization does not obtain Dividend King standing by chance; it requires a robust enterprise mannequin that’s properly executed in each good markets and unhealthy.

In truth, administration’s aim is usually to provide greater highs and better lows for its enterprise. It does this with a capital funding plan that focuses on upgrading expertise; increasing product choices; and broadening out to incorporate new, greater margin merchandise.

As the corporate’s enterprise grows so, too, does its capability to generate income and earnings. And that results in greater highs and better lows on the earnings entrance over time.

With roughly $3 billion in capital spending on faucet in 2025, extra development appears possible for the enterprise and the dividend. That mentioned, you will need to spotlight one factor: The dividend yield is only one.7%. This is not a inventory you purchase since you want revenue. It’s a inventory you purchase since you need long-term publicity to the metal sector, and also you need to get that publicity by way of the business’s most dependable dividend inventory.

You purchase Nucor when Wall Road is placing it on sale

As a cyclical inventory, the very best time to purchase Nucor is not when buyers are enamored with it. The time to step aboard is when the inventory is out of favor, which stays the case as we speak.

Would it not have been higher to purchase when the inventory was down over 40%? Positive, however 30% continues to be a cloth drawdown, and if you’re meaning to personal Nucor for the long run, the value stays enticing. The important thing to the story, nevertheless, is that this Dividend King has proved that its enterprise mannequin can survive absolutely anything the market and the economic system throws at it.