Financial institution of America simply raised its worth goal on Palantir to $215 per share.

Over the past three years, Palantir Applied sciences (PLTR 0.43%) has emerged as one of the vital polarizing synthetic intelligence (AI) shares on Wall Avenue.

Skeptics usually level to Palantir’s hovering valuation, arguing that its inventory worth has raced past acceptable ranges of fundamentals. Bulls, nonetheless, counter that the corporate’s accelerating adoption throughout authorities and enterprise prospects justifies additional upside.

Simply this week, fairness analysis analyst Mariana Perez Mora of Financial institution of America raised her worth goal on Palantir to $215 — implying 20% upside from present buying and selling ranges as of Sept. 25.

On this evaluation, I will break down Mora’s argument and examine it to a different latest eyebrow-raising name on Palantir. From there, I will dig into Palantir’s valuation profile and wrap up with a balanced tackle whether or not Palantir inventory is a purchase proper now.

Picture supply: Getty Photos.

Why does Wall Avenue see Palantir as a prime AI inventory?

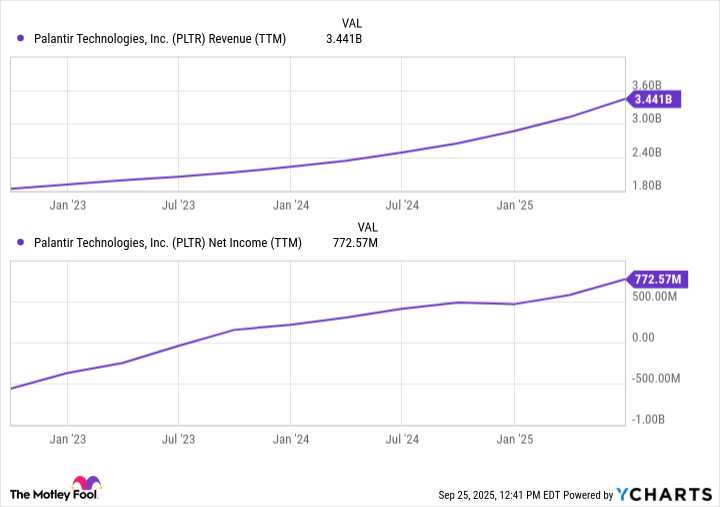

The steepening slopes of each income and revenue development are sufficient to seize investor consideration in the case of Palantir. Producing sturdy gross sales is one factor, however sustaining more and more worthwhile unit economics locations the information mining specialist in uncommon territory inside the software-as-a-service (SaaS) trade.

PLTR Income (TTM) knowledge by YCharts

Compelling financials are solely a part of the story, although. What actually excites Wall Avenue is the place development is coming from. Palantir’s AI suite — Foundry, Gotham, and Apollo — has been the spine of a number of headline-grabbing contracts this yr:

Offers of this magnitude present Palantir with enviable income visibility and long-term money circulate sturdiness, qualities that usually command a premium valuation to start with.

What makes Mora’s worth goal enhance stand out is her reasoning that, “if it really works, it isn’t costly.” This comment might have been a refined response to Salesforce CEO Marc Benioff, who just lately criticized Palantir’s software program as being overly expensive.

In some methods, Mora’s justification echoes that of Jim Cramer — who just lately argued that Palantir inventory is reasonable when measured on its Rule of 40 rating.

Palantir’s valuation: Breaking down development expectations

For traders, the takeaway is that some analysts view Palantir’s distinctive mix of economic momentum with accelerating contract wins as sufficient validation to assist a traditionally elevated a number of.

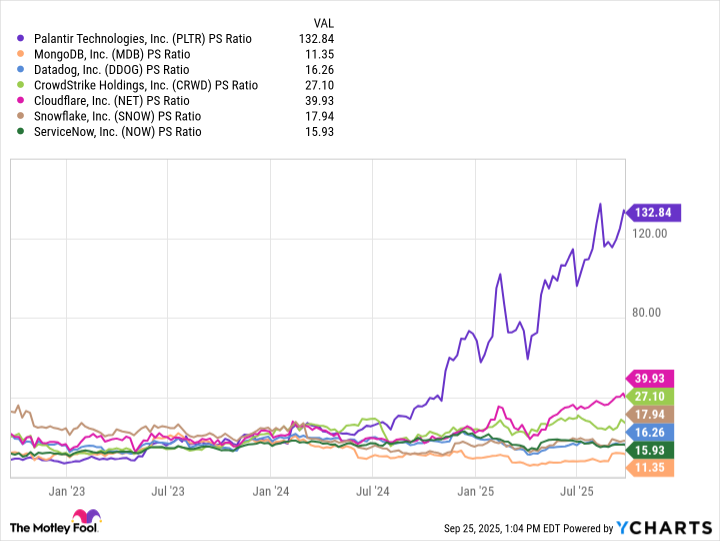

The important thing commentary from the chart under is that Palantir presently trades at a price-to-sales (P/S) ratio of 133 — a stage that towers above its friends within the SaaS sector. On the floor, this merely signifies that Palantir inventory instructions a premium a number of relative to comparable software program companies.

PLTR PS Ratio knowledge by YCharts

Digging deeper, nonetheless, the narrative does not change a lot. Primarily based on Wall Avenue’s consensus income estimates over the subsequent couple of years, I’ve calculated implied ahead P/S multiples:

| Metric | 2026 Consensus Income Estimate | 2027 Consensus Income Estimate |

|---|---|---|

| Income | $5.6 billion | $7.6 billion |

| Implied ahead P/S a number of | 76.8 | 56.6 |

Knowledge Supply: YCharts

Even when Palantir executes completely and meets its development forecasts, its ahead valuation nonetheless sits properly above the place its friends commerce at this time.

Is Palantir inventory a purchase now, or is it priced to perfection?

Considered by way of this valuation lens, Palantir’s present market capitalization of roughly $430 billion appears to be like stretched. For traders, this raises a vital query: How a lot of Palantir’s future development is realistically priced into the inventory?

If you happen to ask billionaire cash supervisor Stanley Druckenmiller, the reply could be all of it. His fund, Duquesne Household Workplace, just lately liquidated its complete place in Palantir — doubtless a transfer to lock in positive factors because the inventory continued its parabolic climb.

From my perspective, a chronic pullback feels inevitable. No inventory rallies in a straight line ceaselessly, and when Palantir finally undergoes a valuation rerate, its share worth may normalize properly under at this time’s ranges — with no assure of a fast rebound.

In my eyes, Palantir inventory is priced to perfection. Whereas momentum merchants could be tempted to proceed driving the wave larger and stomaching sharp volatility, long-term traders perceive that there are extra cheap worth factors to construct a place.

Financial institution of America is an promoting companion of Motley Idiot Cash. Adam Spatacco has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Cloudflare, CrowdStrike, Datadog, MongoDB, Palantir Applied sciences, Salesforce, ServiceNow, and Snowflake. The Motley Idiot has a disclosure coverage.