With the Nasdaq Composite (^IXIC 2.61%) down roughly 12% from its highs, many tech-related shares have offered off closely.

Making issues worse, a few of these shares simply reported earnings that had been lower than excellent (in accordance with the market), giving them a double whammy of negativity. Add within the uncertainty round tariffs in the intervening time, and the market has offered off quite a few in any other case high-quality companies out of concern.

One firm squarely on the intersection of this trio of headwinds is international e-commerce enabler International-e On-line (GLBE 0.47%)

Nevertheless, whereas the market has despatched International-e shares down 42% from their 2025 highs, I consider now could be the time to purchase the spectacular tech inventory. Listed here are 4 explanation why it’s a promising funding in the present day.

1. International-e On-line is the main power in an enormous market

Promoting merchandise globally is usually such a sophisticated activity that almost all small companies (and even some enterprise-sized corporations) both cannot do it successfully, or do not consider it’s definitely worth the trouble to even attempt.

That is the place International-e On-line’s end-to-end, international e-commerce platform takes over. Serving to retailers in 30 international locations (and counting) promote to over 200 international locations throughout the globe, the corporate presents an array of options, together with:

- Native pricing in 100-plus currencies

- Over 150 fee choices

- Transport choices from greater than 20 suppliers, together with native returns

- Messaging in over 30 languages

- Assured calculations for native import duties and tariffs

- Zero-risk fee fraud administration and help

- Know-how and knowledge on every native market

Simply how complicated are these options?

Regardless of being one of many leaders within the e-commerce realm, Shopify selected to put money into and accomplice with International-e fairly than construct out its personal cross-border options. Powered by International-e’s platform, the 2 mixed to create Shopify Administration Markets, which lets retailers in Shopify’s ecosystem promote in overseas markets. With 10,000 retailers utilizing the service in simply 18 months after its launch, it appears there’s loads of curiosity in doing so.

Whereas companies can attempt to go it alone once they promote internationally, they could be leaving cash on the desk. Retailers that switched to International-e’s platform averaged a 40% uplift in worldwide site visitors conversion.

International-e’s retailers are rising their gross merchandise quantity by 4 to 5 instances quicker than the worldwide e-commerce progress fee of 8% in 2024, demonstrating the corporate’s progress potential.

Rising income by 32% in 2024 and guiding for 25% progress in 2025, International-e ought to proceed to quickly achieve share of a goal addressable market that it believes is price $3 trillion.

2. Tariffs and International-e

Whereas this steerage for 25% gross sales progress in 2025 was sufficient to maintain me completely satisfied, it did not impress the market. Frightened concerning the influence larger (or new) tariffs in the USA might have on International-e’s enterprise, the market appeared to take a sell-first, ask-questions-later stance on the inventory.

Nevertheless, co-founder and president Nir Debbi downplayed the influence of those tariffs throughout the firm’s fourth-quarter earnings name — even hinting that they might be a long-term profit, stating:

We do consider that there will probably be uncertainty. It would have an effect on short-term consumption. However total, in the long run, we do anticipate it would behave the identical means we have seen in Brexit, the place total, it created far more demand for our providers.

Put collectively, there’ll in all probability be short-term troubles, however they could create long-term worth. To me, that is a Silly alternative.

3. Bettering margins trace at a large moat

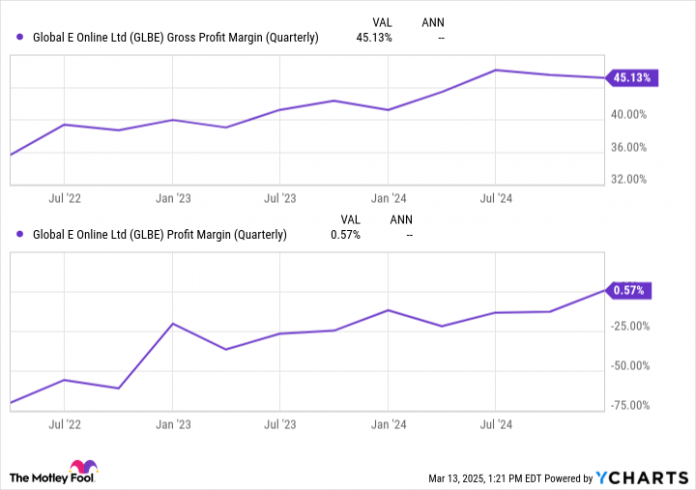

Misplaced amid International-e’s “disappointing” This autumn outcomes was the truth that the corporate reached break-even profitability for the primary time within the quarter and expects to stay worthwhile going ahead. During the last two years, the corporate’s margins have quickly improved, serving as a testomony to the large moat it’s constructing round its operations.

GLBE Gross Revenue Margin and Revenue Margin (Quarterly) knowledge by YCharts.

International-e’s web greenback retention (NDR) fee of 123% or larger during the last 4 years additionally reinforces the concept the corporate is constructing a large moat. Measuring how a lot current prospects improve their gross sales from one 12 months to the following, an NDR persistently above 120% reveals that International-e’s options are nearly a “no-brainer,” and retailers are completely satisfied to spend extra every year.

4. An all-time low valuation

Greatest but for buyers, regardless of International-e’s management place, bettering margins, and widening moat, the corporate trades at an all-time low valuation.

GLBE P/S and P/FCF Ratio knowledge by YCharts.

Buying and selling at 37 instances free money circulation (FCF) — simply barely north of the S&P 500‘s (^GSPC 2.13%) common price-to-FCF ratio of 32 — International-e’s progress (which is multiples larger than the market’s) seems cheaply priced.

Already certainly one of my core holdings, I will probably be wanting so as to add to International-e On-line quickly as the corporate continues to forge its path because the main international e-commerce enabler.