It is tough to seek out any firms which have benefited from the expansion of synthetic intelligence (AI) like Nvidia (NVDA 4.08%). The inventory has been a rocket ship for shareholders, hovering 34,200% during the last 10 years. Even traders who thought they had been late in 2022 could be up over 1,010% on their funding.

Nvidia simply turned the primary firm to hit a $4 trillion market cap (inventory value multiplied by shares excellent), however this progressive semiconductor enterprise nonetheless presents wonderful return prospects for brand new traders. Listed here are 10 causes you must take into account including some shares to your portfolio in the present day.

Picture supply: Nvidia.

1. AI is a generational funding alternative

Synthetic intelligence may add trillions of worth to the economic system within the coming years. Each main cloud service supplier, or hyperscaler, makes use of Nvidia’s graphics processing models (GPUs) of their servers. Nvidia has been a frontrunner in GPUs for 20 years, placing the corporate in a first-rate place to profit from this chance.

2. Knowledge heart gross sales are booming

Nvidia’s income from promoting chips and different merchandise to information facilities made up practically 90% of its enterprise final quarter, and it is nonetheless rising at strong charges. It reported $39 billion in information heart gross sales final quarter, up 73% over the year-ago quarter.

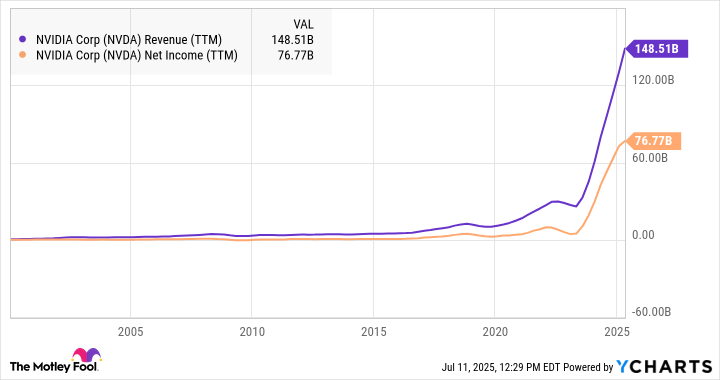

3. Nvidia is likely one of the most worthwhile firms on the planet

The inventory is price $4 trillion for motive. Nvidia’s dominance in AI chips permits it to earn very excessive margins. Nvidia made $77 billion in internet revenue on $148 billion of income during the last yr, and its internet revenue has elevated 892% during the last three years.

Knowledge by YCharts

4. Promoting chips to a number of industries protects Nvidia’s lead

Nvidia isn’t just promoting a chip. It presents computing platforms tailor-made for particular markets. Nvidia Drive is the corporate’s autonomous automobile coaching platform, which is on tempo to generate over $2 billion in income this yr. It additionally presents superior computing options for healthcare, manufacturing, robotics, and extra. It’s enabling AI adoption throughout the worldwide economic system.

5. A rising variety of AI researchers depend on Nvidia

Nvidia’s CUDA (compute unified machine structure) was launched in 2006. This allowed builders to program Nvidia’s GPUs to work throughout plenty of complicated computing duties past enjoying video video games and different graphics-intensive functions. There have been over 5.9 million builders utilizing Nvidia’s CUDA final yr, up from 4.7 million the yr earlier than, pointing to its rising AI management all over the world.

6. Nvidia is pacing for one more robust yr of progress

Nvidia is off to a powerful begin in 2025 because of rising demand for its new Blackwell computing system, designed for essentially the most superior AI workloads. Whole income grew 69% yr over yr in fiscal 2026’s first quarter, and present Wall Road estimates have its income rising 53% this yr to achieve $200 billion.

7. Progress in information heart spending is a significant tailwind

Annual information heart spending globally is anticipated to achieve $1 trillion by 2029, in keeping with Dell’Oro Group. Because the chief in not simply chips, but additionally networking {hardware}, Nvidia stands to seize a big portion of that spending.

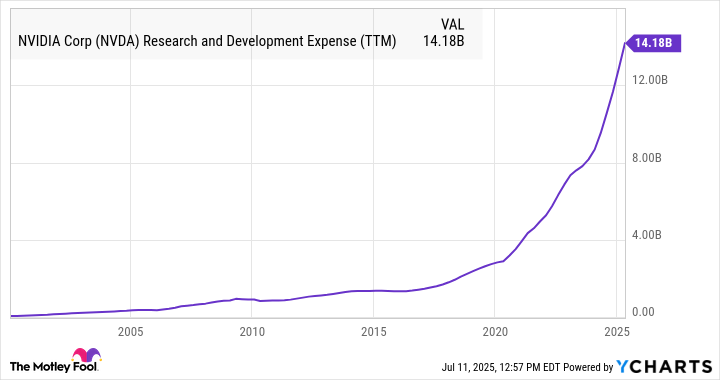

8. Nvidia is plowing billions into new merchandise

Buyers can see Nvidia going after an enormous alternative by wanting on the charge of enhance in its analysis and growth (R&D) expense. Nvidia’s R&D has doubled during the last three years to $14 billion on a trailing-12-month foundation. R&D consists of the spending on engineering and new merchandise. The latest acceleration displays the funding in Blackwell chips which can be driving income progress proper now. Nvidia has introduced the next-generation Vera Rubin chips for 2026, with Rubin Extremely deliberate for 2027.

Knowledge by YCharts.

9. Innovation resulting in extra buyer offers

In Could, the U.S. Division of Power introduced a brand new contract with Dell Applied sciences to develop a brand new flagship supercomputer for the Nationwide Power Analysis Scientific Computing Middle. The supercomputer shall be powered by Nvidia’s next-generation Vera Rubin platform. It will likely be used for molecular dynamics, high-energy physics, and AI coaching and inferencing.

10. Nvidia has wonderful management

CEO Jensen Huang has guided Nvidia from humble beginnings. For a few years, Nvidia’s GPUs had been used to run graphics software program and video video games, however these chips at the moment are working essentially the most highly effective computer systems on the planet. Nvidia’s market cap has grown from $4 billion in 2000 to $4.15 trillion in 2025.

The inventory was buying and selling round 50 instances earnings in 2000, and it is buying and selling on the similar valuation in the present day. With analysts projecting the corporate’s earnings to develop 29% within the subsequent few years, traders can nonetheless purchase shares and see nice returns on their funding.