Warren Buffett’s legendary funding success stems from his disciplined utility of mathematical ideas to inventory market investing. Whereas he famously acknowledged that advanced math isn’t crucial for profitable investing, his wealth-building technique constantly depends on easy basic mathematical ideas that present a scientific framework for evaluating alternatives and managing threat. Listed here are the ten math guidelines that made Warren Buffett a billionaire.

1. The Compound Curiosity Method

Buffett found the ability of compound curiosity early in life, understanding that point transforms modest investments into extraordinary wealth by way of the mathematical method A = P(1 + r/n)^nt. This equation demonstrates how principal quantity, rate of interest, compounding frequency, and time develop exponentially. Buffett has known as compound curiosity the eighth marvel of the world, emphasizing that beginning early maximizes the time element within the equation.

The mathematical great thing about compounding lies in incomes returns not simply in your unique funding, however on all beforehand collected beneficial properties. A $10,000 funding incomes 10% yearly turns into $11,000 after one 12 months, however the second 12 months’s 10% return applies to the complete $11,000, creating $12,100.

Over the many years, this accelerating impact has develop into dramatic, which explains Buffett’s choice for purchasing and holding high quality firms for prolonged intervals slightly than frequent buying and selling. This rule applies to compounding capital beneficial properties and reinvested dividends, which Buffett has optimized.

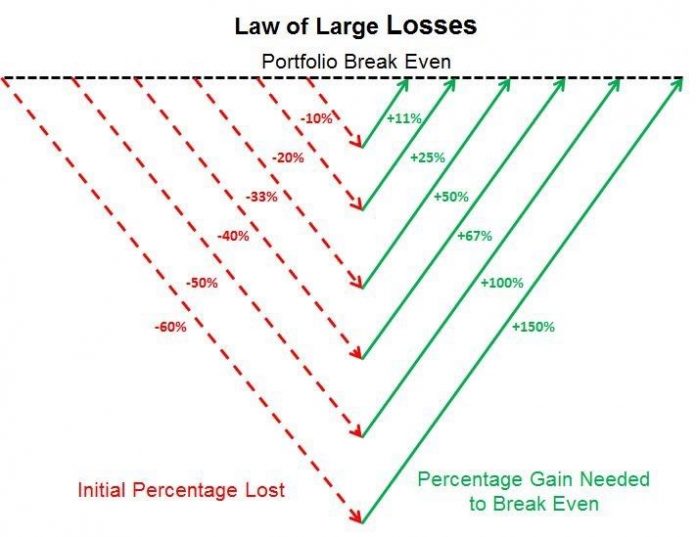

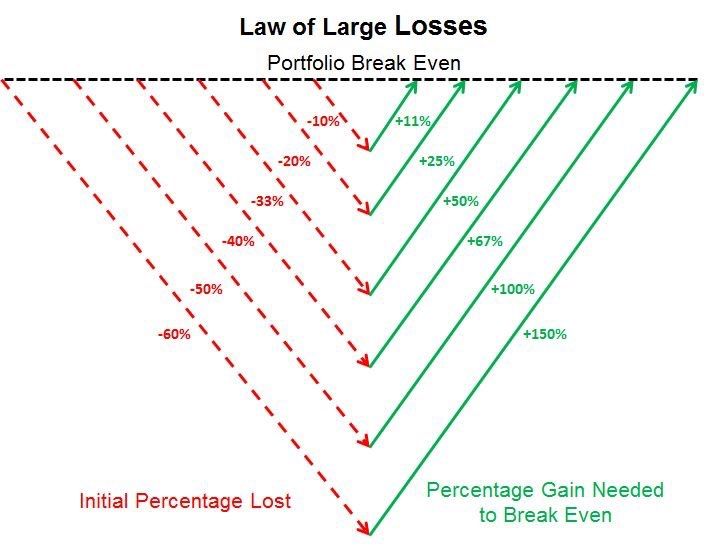

2. The 50% Loss Equals 100% Acquire Restoration Rule

Buffett’s well-known precept, “By no means lose cash,” stems from the mathematical asymmetry of losses and beneficial properties. When an funding loses 50% of its worth, it wants a 100% achieve to interrupt even. This mathematical actuality turns into extra extreme with bigger losses: a 75% decline requires a 300% achieve for restoration, whereas a 90% loss calls for a 900% achieve.

This mathematical drawback explains Buffett’s conservative method to threat administration. Relatively than chasing high-risk, high-reward alternatives, he focuses on preserving capital by investing in firms with predictable earnings and substantial aggressive benefits.

The arithmetic clearly present that avoiding vital losses contributes extra to long-term wealth creation than often hitting dwelling runs whereas struggling substantial setbacks.

3. The Discounted Money Move Rule

Buffett determines intrinsic worth by calculating the current worth of an organization’s future money flows utilizing discounted money move evaluation. The method IV = Σ(CFt / (1 + r)^t) represents the sum of all future money flows divided by one plus the low cost charge raised to the ability of intervals. This mathematical method values firms primarily based on their potential to generate money for shareholders slightly than market sentiment or hypothesis.

Buffett defines “proprietor’s earnings” as web earnings plus depreciation and amortization, minus capital expenditures and extra working capital necessities. This calculation supplies a extra correct image of money out there to shareholders. By evaluating this intrinsic worth to the present market worth, Buffett identifies undervalued alternatives the place the mathematical evaluation suggests the inventory trades beneath its basic worth.

4. The Alternative Value Optimization Rule

Each funding resolution includes alternative price – the return foregone by selecting one funding over options. Buffett applies mathematical considering by always evaluating potential returns throughout completely different alternatives, even in unrelated industries. This optimization course of requires evaluating risk-adjusted returns to allocate capital to probably the most enticing alternatives.

Buffett’s method includes creating psychological hurdle charges that investments should exceed to be thought-about. When evaluating a possible inventory buy, he compares its anticipated returns to bonds, different shares, and holding money. This mathematical framework ensures capital flows towards alternatives providing one of the best risk-adjusted returns slightly than merely probably the most acquainted or handy choices.

5. The 5/25 Focus Rule

Buffett advocates concentrating investments in your greatest concepts slightly than diversifying throughout many mediocre alternatives. His method includes itemizing potential investments, figuring out the highest 5 most tasty choices, and focusing completely on these whereas avoiding the temptation to pursue the remaining twenty. This mathematical method to portfolio development acknowledges that diversification can dilute returns when utilized excessively.

The arithmetic of focus works as a result of distinctive firms generate outsized returns that common performers can’t match. On the identical time, diversification reduces volatility however limits upside potential while you genuinely consider in superior alternatives. Buffett’s concentrated method requires thorough evaluation however permits mathematical compounding to work in your greatest concepts slightly than being diluted throughout quite a few common investments.

6. The Return on Fairness Rule

Return on Fairness measures how effectively an organization generates earnings from shareholder fairness: ROE = Internet Revenue ÷ Shareholder Fairness. Buffett seeks firms with constantly excessive ROE, which signifies administration’s potential to create worth from invested capital. This mathematical metric reveals how successfully firms deploy shareholder cash to generate earnings.

Firms with sustainable excessive ROE possess aggressive benefits that enable them to earn superior returns on invested capital. These companies usually require minimal further funding to develop, permitting them to compound shareholder wealth effectively.

Buffett’s deal with ROE displays his mathematical understanding that companies producing excessive returns on fairness create extra worth than these requiring fixed capital infusions to take care of progress.

7. The Margin of Security Rule

Buffett solely purchases shares after they commerce considerably beneath the calculated intrinsic worth, making a margin of security that’s expressed as intrinsic worth minus market worth. This mathematical buffer protects in opposition to analytical errors, unexpected circumstances, and market volatility. The bigger the margin, the higher the safety in opposition to everlasting capital loss.

This precept, inherited from Benjamin Graham, acknowledges that funding evaluation includes estimates and assumptions that will show incorrect. Buffett reduces the chance of serious losses whereas rising potential returns by requiring a considerable mathematical cushion between intrinsic worth and buy worth. The margin of security transforms investing from hypothesis right into a mathematical train with favorable odds.

8. The Numerical Comparability Rule

Buffett develops numerical literacy by always analyzing monetary statements and constructing a psychological database of enterprise metrics. This quantitative method permits speedy comparability of funding alternatives by shortly assessing key ratios, progress charges, and monetary traits. The mathematical framework turns into second nature by way of repetitive evaluation of a whole lot of firms.

This numerical fluency permits sample recognition throughout industries and intervals. Buffett can instantly evaluate its monetary metrics to comparable firms and historic precedents when evaluating a possible funding. This mathematical method transforms advanced enterprise evaluation into a scientific comparability of quantifiable elements that point out long-term funding attractiveness.

9. The Excessive Likelihood Rule

Buffett focuses on high-probability funding eventualities slightly than making an attempt to foretell unsure outcomes. This mathematical method acknowledges that good data is unattainable, however some conditions supply considerably higher odds of success than others. He improves the mathematical chance of favorable outcomes by concentrating on predictable companies with sturdy aggressive benefits.

The arithmetic of chance works in investing as a result of many small benefits compound over time into vital outperformance. Relatively than requiring certainty about particular outcomes, this method seeks conditions the place a number of elements counsel favorable odds. Constant utility of this probability-based considering creates a mathematical edges that accumulate into substantial wealth over many years.

10. The Mathematical Edge Rule

Buffett solely makes investments when mathematical evaluation suggests a positive anticipated final result. This edge is likely to be maybe a 55% chance of success versus a forty five% chance of loss, however when utilized constantly throughout many selections, small mathematical benefits compound into vital outperformance. The important thing lies in having real analytical benefits slightly than counting on luck or hypothesis.

This mathematical edge emerges from superior evaluation, longer time horizons, and emotional self-discipline throughout market volatility. Whereas particular person investments might not all the time succeed, the mathematical legislation of enormous numbers ensures that constant utility of slight edges produces superior long-term outcomes. Buffett’s success demonstrates how mathematical considering utilized to investing creates sustainable aggressive benefits.

Conclusion

Warren Buffett’s extraordinary wealth outcomes from constantly making use of mathematical ideas to funding choices. These guidelines exhibit that profitable investing requires quantitative evaluation, probabilistic considering, and mathematical self-discipline slightly than advanced formulation or market timing primarily based on predictions and opinions.

By understanding and making use of these mathematical ideas, buyers can construct wealth by way of the identical systematic method that created one among historical past’s biggest fortunes.