With fairness markets reeling as a result of President Donald Trump’s tariffs, many buyers are taking this chance to purchase shares of prime corporations on the dip. It is a terrific technique, nevertheless it’s important to keep away from these corporations that solely look undervalued however truly aren’t.

Some shares are lagging the marketplace for good causes — as a result of their companies look shaky and their prospects unsure. These are the firms to keep away from at the same time as they fall together with broader equities. Let’s take into account two examples: Teladoc Well being (TDOC 0.14%) and Tandem Diabetes Care (TNDM 0.12%).

1. Teladoc Well being

Teladoc Well being, a telemedicine specialist, won’t really feel a considerable direct affect from Trump’s tariffs. The corporate makes cash from subscriptions to varied digital care choices, together with a main care unit, a remedy section known as BetterHelp, and a persistent care enterprise.

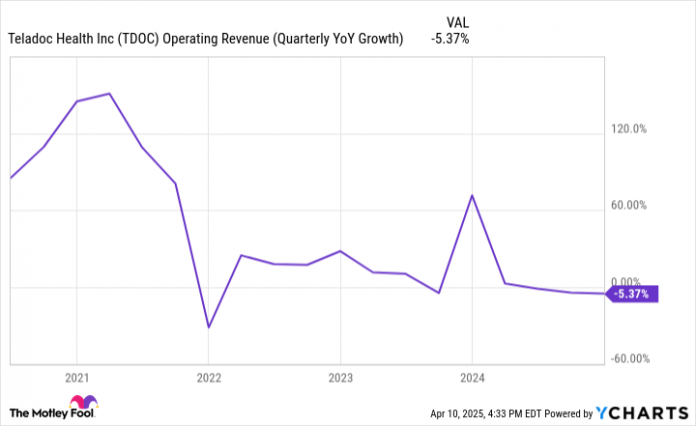

Nevertheless, Teladoc has different points that make the corporate unattractive. For the reason that pandemic began receding, Teladoc’s income progress has declined considerably:

TDOC Working Income (Quarterly YoY Development) knowledge by YCharts.

BetterHelp, as soon as a key progress driver for the telehealth skilled, confronted stiff competitors and seems to be dropping market share. Within the fourth quarter, BetterHelp’s income declined by 10% yr over yr, whereas the platform’s variety of paying customers dropped by 6%.

Furthermore, Teladoc stays unprofitable regardless of its excessive progress margins. The corporate can not maintain bills — significantly advertising prices — down, as a result of it is searching for to determine itself as a pacesetter within the increasing telemedicine trade.

One among Teladoc’s most enjoyable progress alternatives comes from its worldwide enlargement efforts. Within the fourth quarter, worldwide income grew by 10% yr over yr to $105.1 million. Complete income was down 3% to $640.5 million. Here is the difficulty, although: These worldwide initiatives may result in vital will increase within the firm’s bills. It is not clear whether or not this faster-growing section will probably be sufficient to permit Teladoc to show worthwhile.

True, the corporate is engaged on different initiatives. It may earn third-party protection for BetterHelp, which could jolt the platform’s progress. It additionally launched a number of synthetic intelligence initiatives that might appeal to extra prospects and enhance effectivity.

That mentioned, Teladoc Well being’s poor outcomes in recent times and lack of a transparent path to profitability make it far too dangerous a inventory to put money into proper now.

2. Tandem Diabetes Care

Tandem Diabetes Care develops progressive insulin pumps. One among its best-known units is the t:slim X2, whose declare to fame is its dimension. It is a discreet choice that may nonetheless maintain about as a lot insulin as most of its rivals. Sufferers also can pair this pump with different units, corresponding to DexCom‘s steady glucose monitoring programs, to automate insulin supply.

Regardless of these perks, Tandem has struggled up to now few years, for a number of causes. First, financial troubles led to fewer sufferers buying new pumps from the corporate. Second, it has loads of competitors, together with from corporations with far more money, corresponding to Medtronic. Third, Tandem is just not constantly worthwhile.

These headwinds have led to a horrible stock-market efficiency up to now three years. To make issues worse, Tandem’s shares have plunged by 54% already this yr.

Trump’s tariffs threaten the state of the financial system, which may very well be a major headwind for the corporate: Tandem depends closely on different international locations, together with Mexico and China, to fabricate its insulin pumps. So these tariffs may have a direct affect on its bills, and squeeze each the underside line (which is already not spectacular) and its margins. They may additionally result in inflation or a recession, lowering the demand for its merchandise — which might imply decrease income.

Tandem Diabetes Care’s prospects look bleak in the meanwhile regardless of its extremely progressive attributes. For now, it is best to keep away from the inventory.

Prosper Junior Bakiny has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Teladoc Well being. The Motley Idiot recommends DexCom and Medtronic and recommends the next choices: lengthy January 2026 $75 calls on Medtronic, lengthy January 2027 $65 calls on DexCom, brief January 2026 $85 calls on Medtronic, and brief January 2027 $75 calls on DexCom. The Motley Idiot has a disclosure coverage.