Bitcoin is as soon as once more below strain because the market navigates a risky and unsure part. After briefly reclaiming the $111K degree, the world’s largest cryptocurrency is struggling to take care of $110K as a secure help zone. Sellers are regaining management, and bearish merchants are calling for a deeper retrace towards decrease vary ranges — probably beneath the six-figure mark.

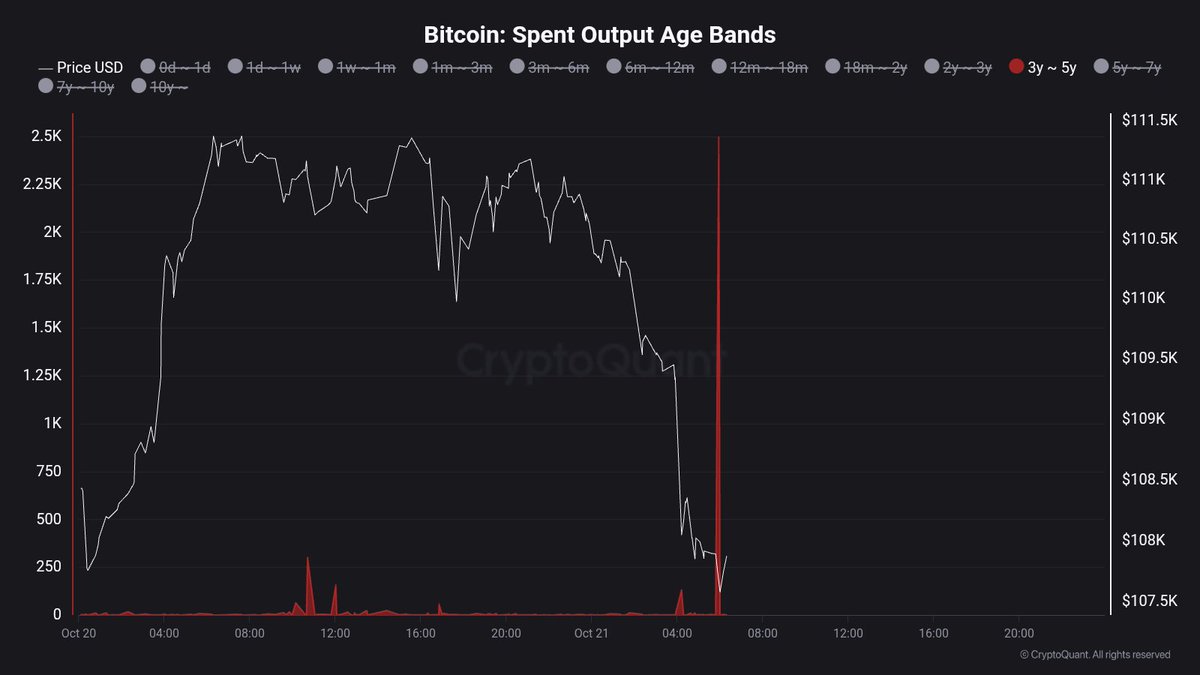

Including to the cautious tone, recent knowledge from CryptoQuant reveals a regarding on-chain growth: outdated Bitcoin cash are waking up. This metric, which tracks beforehand dormant BTC transferring on-chain, has proven a pointy improve amongst cash aged 3–5 years, indicating that long-term holders are beginning to transfer or promote a part of their holdings. Traditionally, such conduct has preceded phases of heightened volatility or deeper corrections, as these older cash typically characterize vital, high-volume provide getting into the market.

Whereas some analysts interpret these strikes as long-term holders taking earnings after the 12 months’s rally, others warn that renewed promoting from this group may intensify downward strain. As market sentiment turns defensive, merchants are watching intently to see whether or not Bitcoin can defend key help zones or if these “outdated cash” will gas the subsequent leg of a broader correction.

Lengthy-Time period Holders Transfer Provide as Promoting Strain Builds

High analyst Maartunn shared knowledge revealing a notable spike in long-term holder exercise, with 3–5-year-old BTC spent leaping to 2,496 BTC — a big transfer contemplating the sometimes dormant nature of this cohort. These “outdated cash” characterize Bitcoin that hasn’t moved in years, typically held by traders with excessive conviction. When this group turns into energetic, it normally alerts a significant shift in market dynamics.

Traditionally, such spikes in long-term holder exercise are inclined to happen close to macro turning factors, both as an indication of distribution throughout native tops or early reaccumulation phases after deep corrections. Within the present context, this rise in aged coin motion may imply two issues. First, it’d mirror profit-taking from early holders who’re capitalizing on good points as market volatility intensifies. Second, it may point out reallocation or strategic rotation, the place cash transfer between wallets as traders put together for renewed market turbulence.

This comes amid a backdrop of persistent promoting strain, with Bitcoin struggling to carry above the $110K degree. The broader market stays cautious, as liquidity thins and short-term merchants react to every draw back transfer.

Whereas long-term holders transferring provide can seem bearish within the brief run, it’s additionally a pure a part of market cycles — typically previous phases of redistribution that in the end strengthen long-term construction. If Bitcoin can take in this provide and preserve help above $106K–$108K, it may set the muse for a extra sustainable rebound. Nevertheless, failure to take action would possibly verify a deeper correction, doubtlessly testing the $100K zone as soon as once more.

Testing Assist Amid Renewed Weak point

Bitcoin is struggling to search out momentum after days of promoting strain, at the moment buying and selling round $107,800. The three-day chart exhibits BTC preventing to remain above the 200-day transferring common (inexperienced line) close to $106,000, an important help that has traditionally served as a base throughout main corrections. The bounce from the latest $103K low suggests some shopping for curiosity, however momentum stays fragile as bulls try to defend this key zone.

The 50-day transferring common (blue line), sitting above $112,000, now acts as short-term resistance, with a broader provide space forming round $117,500 — the identical degree that capped earlier rallies. A detailed above this threshold may verify a short-term reversal, signaling renewed purchaser confidence. Nevertheless, repeated failures to reclaim it could invite one other wave of promoting strain.

Market construction stays neutral-to-bearish, with volatility compressing following the October 10 flash crash. If BTC loses the $106K–$107K zone, draw back targets may prolong towards $100K, the place the yearly common provides the subsequent layer of help.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.