After many synthetic intelligence (AI) firms lately led the Nasdaq Composite (^IXIC -2.70%) into correction territory, it is time to begin desirous about what is going to occur subsequent. Many are nervous that an financial slowdown triggered by unknowns round tariffs may sluggish AI investments and damage many of those firms. Nonetheless, there have not been any indicators of this occurring but, and this correction appears to be like like a good time to scoop up a few of the greatest AI shares on the market.

I’ve received three firms that I believe can emerge stronger than ever, and buyers want to concentrate to them, as they probably will not keep crushed down for lengthy.

Nvidia is driving a growth

Though AI hyperscalers have constructed a ton of computing capability, they’re removed from completed. An enormous sum of money is being spent on AI infrastructure, and people numbers are anticipated to achieve file ranges this yr.

This clearly advantages the businesses which might be on the {hardware} aspect of AI, which means firms together with Nvidia (NVDA -1.51%), Taiwan Semiconductor (TSM -1.27%), and ASML (ASML -2.24%) are primed to emerge from this correction even stronger.

Nvidia has been powering the AI arms race because it kicked off, with its graphics processing items (GPUs) being the computing muscle behind AI fashions. GPUs can course of a number of calculations in parallel, in contrast to a CPU, which may do separately. This impact will be multiplied by connecting hundreds of GPUs in clusters. By doing this, AI hyperscalers can rapidly practice AI fashions.

With every technology of AI modes changing into extra complicated, this requires extra computing capability, and Nvidia advantages.

Nvidia CEO Jensen Huang sees huge development in knowledge heart computing. He has predicted knowledge heart buildout of $1 trillion.

Whereas which may be a daring projection, with the way in which AI spending goes, a determine like that would not shock me. And I believe Huang higher understands the place the trade is heading than most individuals do, so this prediction may very well be extra correct than most suppose.

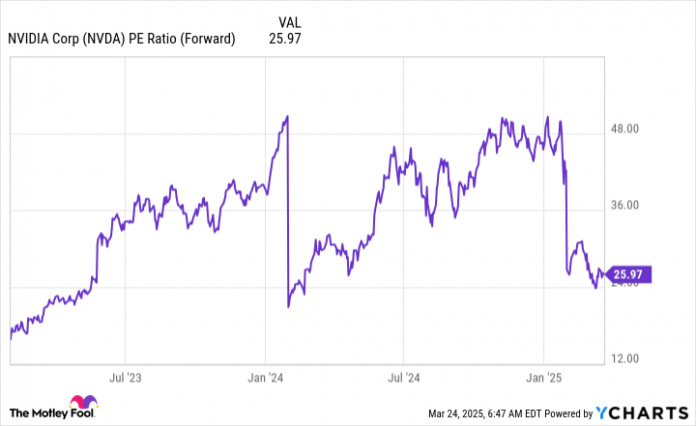

Regardless, Nvidia’s enterprise shall be simply superb over the following few years, and the latest inventory market dip appears to be like like an incredible motive to scoop up shares, particularly as a result of they’re buying and selling for 26 instances ahead earnings.

NVDA PE Ratio (Ahead) knowledge by YCharts

Contemplating Nvidia’s potential development, this looks like a no brainer worth to pay for the inventory, and I would not be stunned to see it soar all through the remainder of 2025.

Extra chips are wanted to satisfy demand

Extra GPUs imply extra chips, and with Nvidia not having the manufacturing capabilities to provide chips itself, it farms out that work to Taiwan Semiconductor. With President Donald Trump ramping up tariffs on items imported to the U.S., TSMC in early March introduced a further $100 billion funding in U.S. manufacturing capabilities.

Whereas critics say that Trump’s strain brought on this, Taiwan’s president and Taiwan Semiconductor’s CEO stated that the rationale for the U.S. enlargement was the large demand for U.S.-produced chips, which have offered out manufacturing capability by means of 2027.

There’s a enormous demand for extra chips, and Taiwan Semiconductor’s administration sees important development forward. They anticipate AI-related chip income to extend at a forty five% compounded annual development charge (CAGR) over the following 5 years, with companywide income rising at round a 20% CAGR. That is monster development and makes for a implausible inventory to purchase proper now.

ASML has a key position

If you hear about chip firms standing up new amenities, you need to consider ASML, which makes excessive ultraviolet (EUV) lithography machines, that are essential within the manufacturing means of high-end chips. ASML is the one firm on this planet with the expertise to do that, so it is an organization that everybody should work with after they’re increasing manufacturing capability.

By holding a technological monopoly, ASML is a good way to play the enlargement of chip demand. With its inventory off round 35% from its all-time excessive, proper now makes for a superb time to scoop up shares, as a lot better instances are forward for ASML.

Though the sell-off hasn’t been enjoyable, it has opened up a number of implausible funding alternatives out there’s greatest AI shares. Now’s a good time to select up profitable firms on sale.

Keithen Drury has positions in ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.