The market has moved previous the midway level of November, and the whole altcoin market cap has fallen beneath $1 trillion. The power of altcoins to rebound whereas sentiment hits all-time low could set off volatility and large-scale liquidations in a number of property.

Which altcoins face this threat, and what particular elements deserve shut consideration? Particulars observe beneath.

Sponsored

Sponsored

1. Ethereum (ETH)

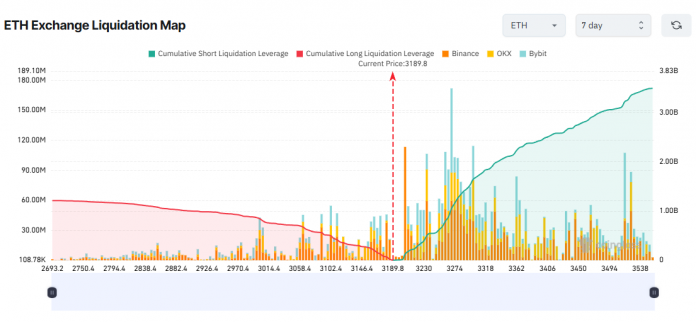

Ethereum’s liquidation map exhibits a transparent imbalance between potential liquidation volumes on the Lengthy and Quick sides.

Merchants are allocating extra capital and leverage to Quick positions. In consequence, they might undergo heavier losses if ETH rebounds this week.

If ETH rises above $3,500, greater than $3 billion price of Quick positions might be liquidated. In distinction, if ETH drops beneath $2,700, Lengthy liquidations would whole solely about $1.2 billion.

Quick sellers have causes to keep up their positions. ETH ETFs recorded $728.3 million in outflows final week. Moreover, crypto billionaire Arthur Hayes has lately bought ETH.

Nevertheless, on the technical facet, ETH stays at a main assist zone round $3,100. This degree has the potential to set off a powerful restoration.

The sentiment indicator for ETH has additionally fallen into excessive concern. Traditionally, ETH has usually rebounded sharply from related situations.

Sponsored

Sponsored

Due to this, an ETH restoration has a strong foundation and will set off important losses for Quick merchants.

2. Solana (SOL)

Just like ETH, Solana’s liquidation map additionally exhibits a powerful imbalance, with Quick liquidation quantity dominating.

SOL’s drop beneath $150 in November has led many short-term merchants to count on a additional decline towards $100. Not solely retail merchants, however whales have additionally proven short-selling habits this month.

Nevertheless, SOL ETF knowledge paints a extra optimistic image. Based on SoSoValue, U.S. SOL ETFs recorded a web influx of greater than $12 million on November 14 and over $46 million for the previous week. In the meantime, each BTC ETFs and ETH ETFs noticed unfavourable web flows.

Sponsored

Sponsored

This provides SOL a purpose to rebound, as traders nonetheless see robust ETF demand. The liquidation map exhibits that if SOL climbs to $156, Quick liquidations could attain almost $800 million.

Conversely, if SOL falls to $120 this week, Lengthy liquidations might attain round $350 million.

3. Zcash (ZEC)

In distinction to ETH and SOL, ZEC’s liquidation map exhibits that Lengthy merchants face the majority of potential liquidation threat.

Sponsored

Sponsored

Quick-term merchants seem assured that ZEC will proceed forming larger highs in November. They’ve causes for this outlook. ZEC locked within the Zcash Shielded Pool has elevated sharply this month, and a number of other consultants nonetheless count on ZEC to succeed in as excessive as $10,000 doubtlessly.

Nevertheless, ZEC has confronted repeated rejections close to the $700 degree. Many analysts, subsequently, fear a couple of correction this week.

If a correction happens and ZEC drops beneath $600, Lengthy liquidations might exceed $123 million.

Furthermore, Coinglass knowledge exhibits that ZEC’s whole open curiosity reached an all-time excessive of $1.38 billion in November. This displays a excessive degree of leveraged publicity, which will increase the chance of risky strikes and large-scale liquidations.

Due to this, holding Lengthy positions in ZEC might supply short-term good points. However with out clear take-profit or stop-loss plans, these positions might shortly face liquidation stress.