Market sentiment shifted into excessive concern on December 1. Quick positions are dominating the derivatives market. A number of main altcoins are exhibiting extreme imbalances of their liquidation maps, which may set off a brand new file in liquidations.

The next evaluation highlights the underlying components that would trigger the market to deviate from short-term expectations within the first week of December.

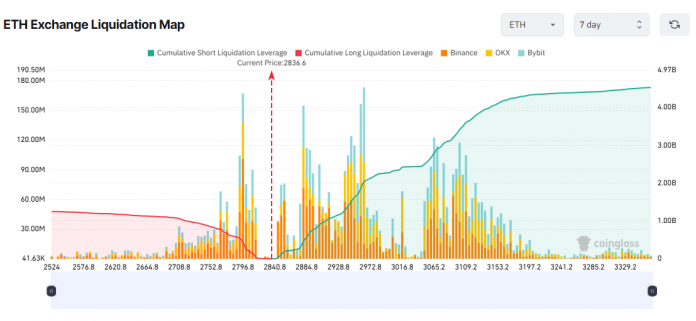

1. Ethereum (ETH)

ETH’s 7-day liquidation map exhibits that cumulative liquidation quantity from brief positions considerably outweighs that of lengthy positions. This means that merchants are aggressively shorting ETH.

Sponsored

Sponsored

If ETH rebounds to $3,150 this week, cumulative brief liquidations may exceed $4 billion.

What dangers ought to brief sellers contemplate? On-chain knowledge on ETH change balances could also be an essential sign.

CryptoQuant knowledge exhibits that ETH provide on exchanges has dropped to an all-time low of 16.6 million ETH. The pattern of withdrawing ETH from exchanges has accelerated over the previous month, regardless of ETH’s value decline.

“With ETH change reserves hitting file lows… I imagine Ethereum will lead the following market leg up,” investor Momin predicted.

Though many analyses counsel additional draw back, the continued accumulation, mirrored in falling change provide, may quickly amplify shortage as promoting stress weakens. This might set off a sudden restoration in ETH.

Sponsored

Sponsored

2. Solana (SOL)

Just like ETH, SOL exhibits a transparent imbalance in its liquidation map. Merchants have been actively shorting SOL in early December.

If SOL rebounds to $145 this week, cumulative brief liquidations may surpass $1 billion.

Is there a foundation for SOL to get better this week? On-chain indicators are reflecting constructive alerts. Nansen reported that Solana continued to steer in transaction depend in the course of the week.

On prediction markets, many traders nonetheless count on a value vary of $150–$200 in December. Moreover, US-based SOL ETFs have skilled 5 consecutive weeks of inflows.

Not too long ago, BitMEX co-founder Arthur Hayes additionally acknowledged that solely Ethereum and Solana have the institutional use circumstances obligatory for long-term survival.

Sponsored

Sponsored

3. XRP

XRP’s 7-day liquidation map signifies that brief exercise is dominant. If XRP rebounds above $2.30 this week, cumulative brief liquidations may exceed $500 million.

Quick sellers ought to contemplate a number of components.

With these drivers, many analysts predict that XRP may attain $2.6 this month. Such a transfer would severely affect brief sellers.

Sponsored

Sponsored

Rising Stablecoin Provide Indicators a Potential Market Rebound

One other issue price contemplating is the renewed enlargement in stablecoin provide.

Coinglass knowledge exhibits that the mixed market cap of USDT, USDC, DAI, and FDUSD reached a brand new excessive of $267.5 billion at first of December.

The rising stablecoin provide means that market liquidity might improve this month. Analyst Ted famous that this uptrend ends a four-week decline in stablecoin market cap.

“Stablecoin MCap goes up once more. It went down for 4 consecutive weeks, which additionally explains the explanation behind the dump. If this goes up from right here, contemporary liquidity will enter the crypto market, which is sweet for BTC and alts,” Ted mentioned.

The three main altcoins talked about above account for a mixed $5.5 billion in potential liquidation quantity if the market rebounds unexpectedly.

If a real restoration happens, a brand new file for liquidation could also be set. Buyers may have to contemplate all these components to reduce dangers to their positions.