Traders strongly gathered a number of altcoins over the last week of August. They withdrew property from exchanges, resulting in a big decline in reserves.

As altcoin season turns into extra selective, trade reserve knowledge could provide helpful insights for buyers restructuring portfolios for the 12 months’s remaining quarter.

1. Chainlink (LINK)

Santiment knowledge reveals Chainlink’s (LINK) trade reserves fell to a one-year low within the final week of August.

About 186.6 million LINK stay on exchanges, down from 212 million in July. This implies greater than 25 million LINK have been withdrawn in simply over a month.

The launch of Chainlink Reserve in early August boosted investor sentiment. As of August 28, Chainlink Reserve held 193,076 LINK tokens.

By the tip of August, Chainlink introduced a partnership with the US Division of Commerce, which can deliver macroeconomic knowledge resembling GDP and the PCE Index on-chain, additional strengthening accumulation momentum.

Current charts illustrate a notable shift over the previous two months. Beforehand, LINK reserves on exchanges elevated together with worth rises, indicating promoting stress. Nonetheless, in current weeks, LINK’s worth has climbed whereas reserves have decreased, signaling ongoing optimism.

2. Numeraire (NMR)

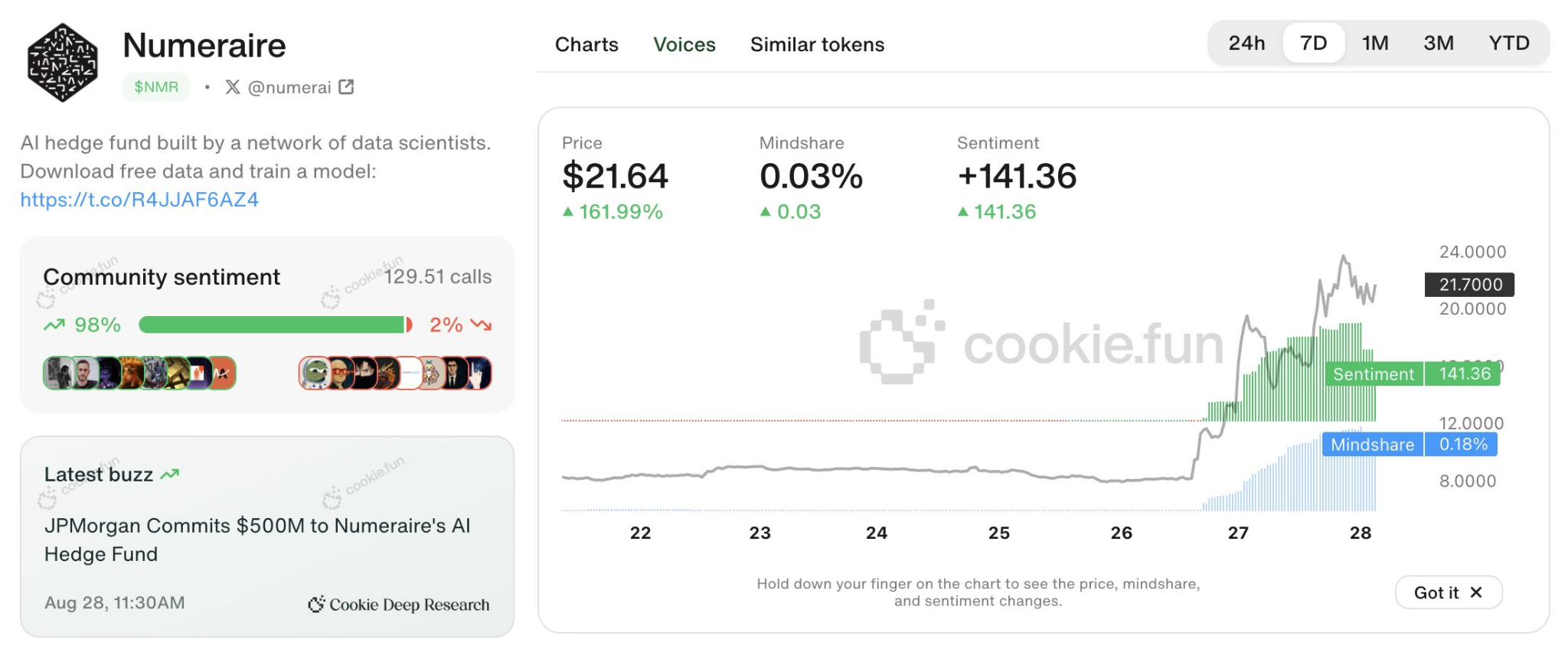

CoinMarketCap knowledge reveals NMR surged 120% within the final week of August, with 24-hour buying and selling quantity leaping from $460 million to over $1 billion. This sharp rise indicators renewed investor curiosity.

Santiment knowledge signifies that NMR’s trade reserves had steadily elevated for years, creating promoting stress that drove its worth down from above $70 to beneath $7.

Nonetheless, NMR’s trade reserves dropped by the final week of August to 1.61 million, which means about 350,000 tokens have been withdrawn in contrast with highs earlier this 12 months.

Though the discount was not huge, it marked a big turning level that might sign an upcoming accumulation outdoors exchanges.

That very same week, Numeraire introduced that JPMorgan, one of many world’s largest allocators to quantitative methods, dedicated $500 million in fund capability. This announcement seemingly revived optimistic sentiment.

Cookie.enjoyable knowledge confirmed that mindshare and sentiment round NMR spiked dramatically.

“JP Morgan dedicated half a billion to Numerai. Mindshare and sentiment jumped from close to flatline to hovering ranges after the information broke, and $NMR adopted, climbing over 160% since. Indication of Wall Road’s rising affect on the crypto markets?” Cookie DAO said.

3. Toncoin (TON)

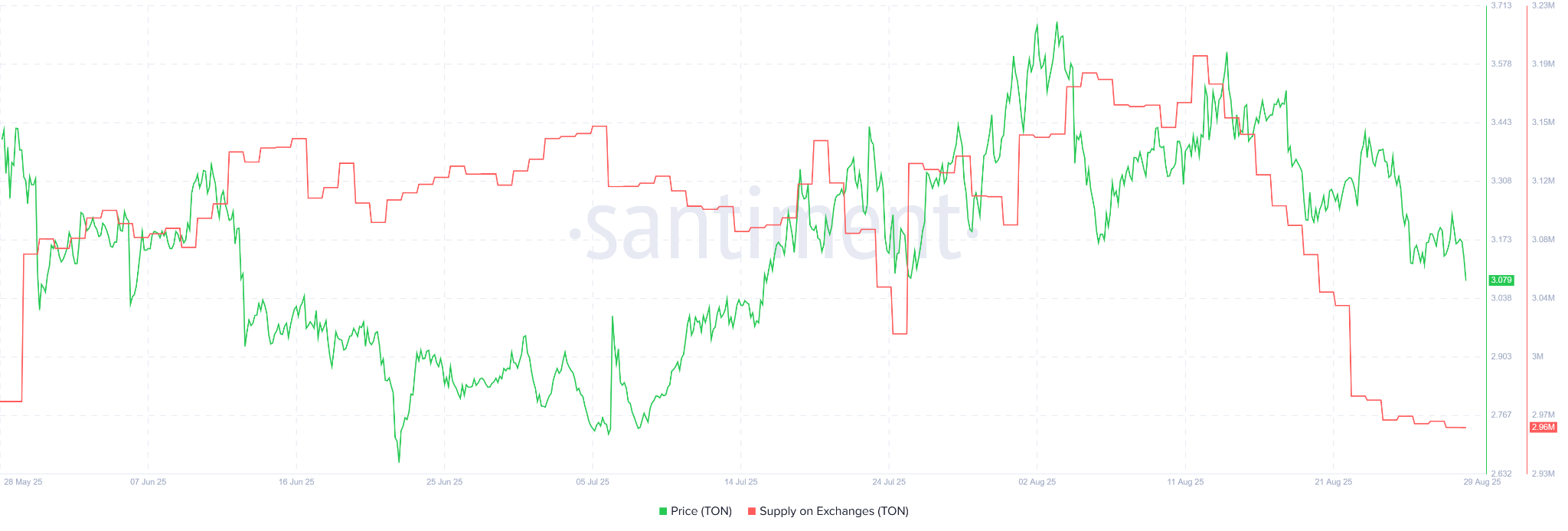

Santiment knowledge reveals Toncoin’s (TON) trade reserves dropped to 2.96 million in late August, the bottom degree in three months. This got here after a decline from 3.2 million only a week earlier.

Regardless of TON’s worth hovering round $3 for many of the 12 months, this off-exchange accumulation may sign the beginning of a brand new part.

The reserve decline coincided with Verb Know-how (NASDAQ: VERB) saying the TON Treasury technique, aiming to personal greater than 5% of Toncoin’s circulating provide. The corporate accomplished a $558 million personal placement with over 110 institutional and crypto buyers, utilizing most proceeds to purchase TON as its main treasury reserve asset.

Moreover, Robinhood listed Toncoin within the remaining week of August, opening the asset to recent US investor capital.

“Toncoin simply listed on Robinhood. And it comes as no shock. 36.2 million new customers onboarded. Month-to-month energetic wallets on ton_blockchain have soared to 12.4 million, a powerful 110× progress. TVL rose from $537,000 in early January to a file $773 million by July. Over $1 billion USDT issued in circulation, the quickest milestone in Tether’s historical past.” — Mario Nawfal, founding father of IBC Group, stated.

The decline within the trade reserves of the above three altcoins displays the affect of US monetary establishments and regulators. It additionally means that real-strength tasks usually tend to enter the mainstream via partnerships with authorities businesses and main monetary entities.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.