Within the fledgling discipline of quantum computing, IonQ (IONQ -2.12%) has emerged as one of many main start-up funding choices. It holds key contracts with prime gamers within the quantum computing discipline, just like the Air Power Analysis Lab, and affords top-notch know-how.

Though it is from a surefire wager, is that this quantum computing start-up the perfect likelihood at remodeling a meager funding into $1 million? In spite of everything, quantum computing has the potential to remodel high-powered computing. Let’s take a better look.

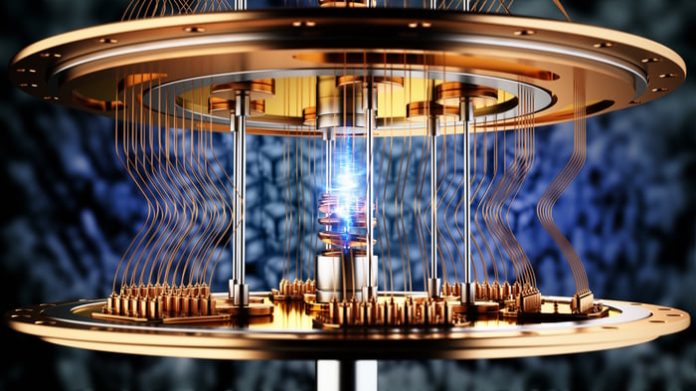

Picture supply: Getty Photographs.

1. IonQ’s error correction is among the many greatest

Quantum computing can probably be an absolute recreation changer within the high-powered computing world. It lets customers deal with issues they’ve by no means been in a position to absolutely mannequin earlier than (like climate patterns and logistics networks), nevertheless it additionally may have huge implications for synthetic intelligence (AI). Quantum computing may ship big worth for whichever firm can win the quantum computing arms race, however every competitor should resolve a key downside first: errors.

In contrast to conventional computing, quantum computing would not have a transparent black-and-white reply. Whereas conventional computer systems use bits to transmit data, which may solely be within the type of a 0 or a 1, quantum computing makes use of qubits. Whereas qubits collapse all the way down to a 0 or a 1 when measured, they’ll exist in a state between 0 and 1 throughout the calculation course of. This opens up many potentialities inside a calculation, which is why quantum computer systems may carry out higher at workloads with hundreds of potentialities.

One of the best ways most firms have discovered to take care of this error subject is to let the qubits work together with one another to scale back errors. Whereas many opponents have positioned their qubits in a grid-like system to let the qubits work together with their neighbors, IonQ has taken it a step additional. They use all-to-all connectivity, which lets each qubit work together with each different qubit. This results in unparalleled 2-qubit gate constancy, and IonQ’s course of already has better than 99.9% constancy.

This reveals that IonQ has already made a unbelievable begin on essentially the most important downside with quantum computing, which is why it has a number of key partnerships.

2. IonQ holds a number of important contracts

IonQ holds one of many largest contracts in quantum computing with the U.S. Air Power Analysis Lab, a facility identified for testing cutting-edge applied sciences. This means that quantum computing is not only a future know-how; it may be utilized in its present state.

To additional assist this selection, IonQ {hardware} is obtainable to be used on the three main cloud computing suppliers: Microsoft Azure, Alphabet‘s Google Cloud, and Amazon Net Companies. With IonQ’s {hardware} changing into extra broadly out there, it is making key progress on this race. If it may differentiate itself from its opponents and begin to seize a buyer base, it may create a foothold that may be onerous to disrupt.

3. There’s an enormous market alternative for quantum computing

To circle again to the unique query, can IonQ be a millionaire-maker inventory? I am unsure. There’s an enormous marketplace for quantum computing sooner or later, nevertheless it’s not that giant proper now. IonQ estimates that the market alternative will attain $87 billion by 2035, nevertheless it’s unlikely that one firm will seize that full market share.

Even when IonQ captures 50% of it and generates round $40 billion in annual income, that is nonetheless lower than one other key quantum computing competitor, IBM. IBM is a few $270 billion firm — about 27 instances the scale of IonQ.

So, can IonQ rework $10,000 into $1 million? Doubtless not. However can IonQ ship sturdy inventory efficiency if it wins the quantum computing arms race? Completely. Nonetheless, that is removed from a surefire wager, as the sector is ripe with potent competitors, and IonQ nonetheless has years to go earlier than proving business relevancy.

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Worldwide Enterprise Machines, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.