The crypto group has not too long ago mentioned the Neobank idea in Web3 extra often. Traders are paying nearer consideration to initiatives with real-world functions, and this sector is drawing vital curiosity.

Low-cap altcoins inside the Neobank narrative could also be undervalued. They create new alternatives for buyers.

What Potential Do Neobanks Have?

A Neobank in Web3 refers to a completely digital financial institution that operates completely on blockchain. It requires no bodily branches. It integrates DeFi options, together with self-custody, yield-bearing accounts, and Visa/MasterCard crypto spending playing cards.

Sponsored

Sponsored

In contrast to conventional neobanks, Web3 Neobanks emphasize transparency, the elimination of intermediaries, and cross-chain connectivity.

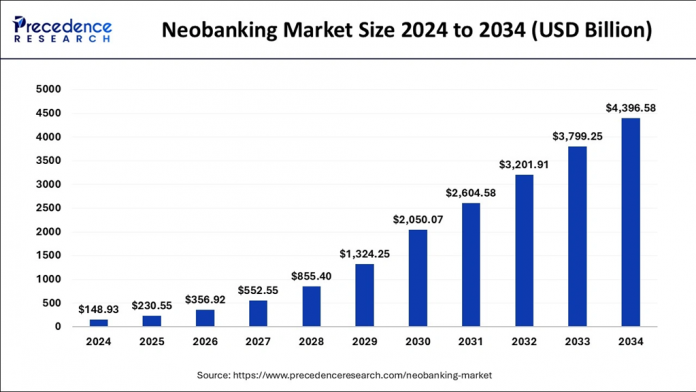

In response to a report from Priority Analysis, the worldwide neobanking market reached $148.93 billion in 2024. It’s projected to develop at a CAGR of 40.29% and hit $4,396.58 billion in 2034.

This huge development potential can profit Web3 Neobanks. The primary cause is the growing adoption of stablecoin use instances. The second is a shift in investor mindset towards crypto initiatives with real-world utility quite than hype-driven valuations.

“If stablecoin is to energy Neobanks on-chain, then the present Web2 id infra received’t have the ability to sustain,” investor Mike S predicted.

Coingecko signifies that the present Neobank class has a complete market capitalization of $4.19 billion, comprising 13 main initiatives. Mantle leads with a market cap of $3.31 billion, adopted by Ether.fi at $412 million.

Moreover, Dune knowledge point out that bodily card transaction quantity from Web3 neobank initiatives reached a report excessive final month, surpassing $379 million.

Though the transaction quantity stays small, analysts consider its development potential is large. In the meantime, the hyperlink between Web3 initiatives and conventional fee firms is turning into stronger.

Sponsored

Sponsored

Crypto buyers consider Neobanks will surge due to AI brokers and blockchain privateness. Some consultants go additional and predict that Neobanks will turn into one of many key narratives shaping crypto traits in 2026.

Can Low-Cap Altcoins within the Neobank Sector Ship Massive Returns for Early Traders?

Regardless of optimistic predictions, Coingecko’s prime three Neobank initiatives — Mantle (MNT), ether.fi (ETHFI) and Plasma (XPL) — all skilled extended worth declines in November.

Nevertheless, a number of low-cap altcoins with market caps under $100 million have not too long ago attracted recent capital and delivered robust performances.

1. Avici (AVICI)

Avici (AVICI) is a self-custodial crypto banking undertaking constructed on Solana. It focuses on spending playing cards and on-chain swaps. Over the previous two months, its market cap has elevated tenfold to $77 million, and its worth has exceeded $6.

Stalkchain reported a pointy rise in AVICI purchases in latest days. One pockets has actively accrued about $35,000 value of AVICI at a tempo of $266 per minute.

Sponsored

Sponsored

The undertaking introduced that Avici Card reached 100,000 transactions in November. It described the cardboard as turning into a day by day behavior and a part of customers’ on a regular basis routines. Some buyers anticipate AVICI to get $50–$100.

2. Cypher (CYPR)

Cypher is a protocol constructed on Base Chain. Customers can obtain CYPR tokens as rewards for card-based transactions.

Cypher goals to create an open financial mannequin that drives development amongst manufacturers, service suppliers, on-line influencers, AI brokers, and crypto card customers.

The undertaking’s market cap is at the moment below $10 million. Analysts consider it’s undervalued.

Sponsored

Sponsored

Alea Analysis not too long ago highlighted a number of causes for this view. Cypher processes fee worth roughly twice its market cap. It additionally ranks second after EtherFi in card transaction quantity. Low liquidity and restricted listings on main CEXs have prevented vital worth development.

3. Machines-cash (MACHINES)

Machines-cash (MACHINES) is a newly launched crypto fee platform targeted on privateness on Base. Its present market cap is below $5 million.

Analysts consider the undertaking might entice capital inflows much like these of AVICI, doubtlessly reaching a 10-fold improve. A number of causes assist this view. The event workforce consists of expertise with expertise from MetaMask, Belief Pockets, DARPA, Flipside Crypto, Paxful, and Polygon. An advisor from AVICI additionally participates within the undertaking.

Machines-cash permits nameless and safe Visa card funds. Customers can transact utilizing alias accounts that disguise pockets addresses, transaction histories, and private identities. This characteristic is particularly engaging as curiosity in privateness continues to rise.

Market sentiment stays gloomy, which is able to considerably have an effect on the potential of low-cap initiatives. Furthermore, as extra crypto neobanks emerge, choosing really high-quality initiatives turns into more and more difficult.

Jay Yu, a researcher at Pantera Capital, believes that retention, card transaction quantity, and person depend will decide the winners on this rising market.