Palantir CEO Alex Karp simply delivered a curt, easy message to the corporate’s rivals.

Dr. Alex Karp is not your typical company government. He does not maintain an MBA, and his public remarks typically come within the type of unscripted, philosophical musings. But as CEO of knowledge analytics powerhouse Palantir Applied sciences (PLTR -2.14%), Karp has led the corporate’s transformation from a secretive authorities contractor into a number one pressure in synthetic intelligence (AI) adoption throughout the enterprise software program panorama.

What many buyers as soon as considered as a distinct segment hall, the intersection of protection operations and AI has swiftly grow to be fertile floor supporting Palantir’s generational run. The corporate has secured a number of the Division of Protection’s (DOD) most complicated, mission-critical contracts, value billions of {dollars}, cementing its function as a trusted associate in nationwide safety.

Following Palantir’s monster Q2 earnings report earlier this month, Karp’s confidence was on full show. Throughout an interview on monetary information program CNBC, he delivered a blunt message to Palantir’s rivals: “learn ’em and weep.”

Let’s unpack what Karp actually meant and assess why buyers in competing platforms reminiscent of BigBear.ai (BBAI 5.14%) can now not afford to disregard Palantir’s commanding lead within the AI protection enviornment.

Palantir is setting the tempo to grow to be the AI spine for army operations

In the course of the second quarter, Palantir’s income surged 48% 12 months over 12 months to $1.0 billion. Whereas that progress is spectacular by itself, the finer particulars reveal simply how deeply Palantir has embedded itself within the army operations pocket of the AI panorama.

The corporate’s authorities section grew 49% 12 months over 12 months, barely outpacing total progress. Drilling down additional, Palantir’s U.S. authorities income rose by an excellent stronger 53% — reaching $426 million within the quarter. This momentum is supported by a string of high-profile Pentagon offers.

In March, Palantir partnered with protection contractors Northrop Grumman and L3Harris Applied sciences, together with autonomous techniques specialist Anduril, in a $178 million U.S. Military deal to assist construct the Tactical Intelligence Focusing on Entry Node (TITAN) floor transportation system.

Simply months later, the Military prolonged its relationship with Palantir, awarding a $795 million extension to proceed utilizing the corporate’s Maven Good System(MSS) platform — bringing the full deal worth above $1.2 billion.

Extra lately, Palantir additional strengthened its public sector footprint with two further contracts: a multiyear contract with the Military value as much as $10 billion, in addition to a separate award to assist develop a surveillance system for Immigration and Customs Enforcement (ICE).

Picture supply: Getty Pictures.

Why is that this necessary for BigBear.ai buyers?

Throughout BigBear.ai’s second-quarter earnings name, CEO Kevin McAleenan acknowledged that the corporate has “seen disruptions in federal contracts from effectivity efforts this quarter, most notably in applications that help the U.S. Military, as they search to consolidate and modernize their knowledge structure.”

Given the small print outlined above, there is a robust risk that the “disruptions” McAleenan referenced replicate Palantir profitable these contracts. Whereas BigBear.ai operates in a number of the identical broad fields as Palantir, reminiscent of AI analytics and machine studying, I believe the comparability between the 2 firms is more and more lopsided.

Every new authorities contract awarded to Palantir deepens its aggressive moat. The corporate’s Foundry and Gotham platforms are evolving right into a complete, built-in ecosystem for the general public sector — supporting a variety of mission-critical wants.

Somewhat than true “community results,” Palantir is having fun with a cumulative aggressive edge that is compounding with every deployment of its software program — finally broadening the corporate’s footprint, strengthening its relationships, and making the price of switching to competing platforms extra expensive.

These dynamics have successfully given Palantir a mini-monopoly on sure pockets of public sector deal stream, past the capacities of conventional protection contractors specializing in manufacturing {hardware} or gear.

Is BigBear.ai inventory a purchase?

Karp’s soundbite wasn’t simply swagger, nor was it merely geared toward short-sellers who’ve been betting towards Palantir for years. It was a direct shot at each competing platform.

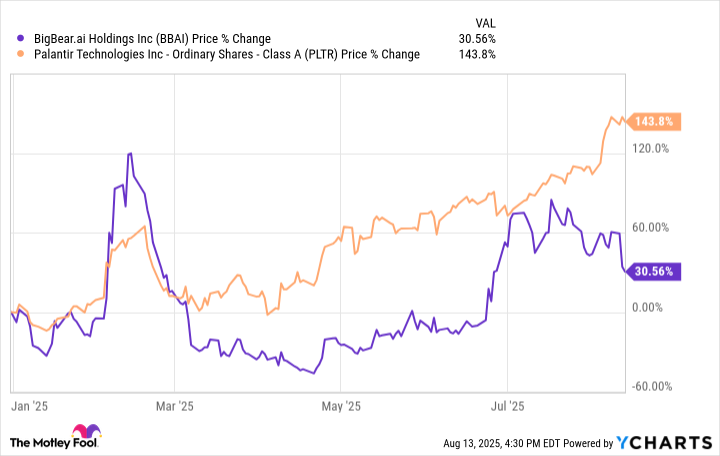

The 2025 inventory chart reflecting Palantir and BigBear.ai tells a really totally different story.

Palantir has constructed regular momentum on the again of rising deal stream, translating immediately into accelerating income and profitability. BigBear.ai, in contrast, has seen way more unstable worth swings, with its strikes typically pushed by hype and the hopeful narrative that it might someday grow to be the “subsequent Palantir.”

That final result seems more and more unbelievable. Every new authorities contract Palantir secures widens the hole between it and smaller rivals struggling to maintain tempo.

For buyers looking for publicity to AI’s function in army operations, Palantir affords a confirmed observe document over speculative counterparts reminiscent of BigBear.ai, whose traction stays extra aspirational than tangible.