Vanguard Excessive Dividend ETF is not good, nevertheless it might fill an vital function for earnings buyers.

Vanguard Excessive Dividend Yield ETF (VYM 0.56%) has its flaws, however then so does each different funding you’ll ever purchase. What’s fascinating concerning the dividend-focused exchange-traded fund (ETF) is what it does properly. This is why some, although not all, dividend buyers might need to again up the truck and purchase this income-focused ETF like there isn’t any tomorrow.

1. Vanguard Excessive Dividend Yield ETF has a horny yield

With the phrase dividend within the title, you’re in all probability taking a look at Vanguard Excessive Dividend ETF as a supply of earnings. So the dividend yield is the place to begin on this evaluate. However the story actually wants to begin with the scant 1.2% dividend yield on provide from the S&P 500 index (^GSPC 0.78%). Vanguard Excessive Dividend ETF simply bests that bar, providing a yield of roughly 2.6%.

Picture supply: Getty Pictures.

Providing greater than twice the yield of the S&P 500 is tough to complain about. Nevertheless, you may simply discover ETFs with increased yields. So if yield alone is all you checked out, Vanguard Excessive Dividend ETF would not be the winner. However there are different components that assist set it aside.

2. Vanguard Excessive Dividend ETF is low price

One of many large advantages supplied by exchange-traded funds extra broadly is low prices. Vanguard Excessive Dividend ETF’s expense ratio is a really low 0.06%. There are cheaper ETFs to personal, however that is nonetheless a really low expense ratio. In actual fact, you’d in all probability need to go along with an S&P 500 index ETF to discover a lower-cost ETF choice. Word that some dividend-focused ETFs have expense ratios which can be multiples of what you will pay to personal Vanguard Excessive Dividend ETF.

3. Larger numbers over time with Vanguard Excessive Dividend ETF

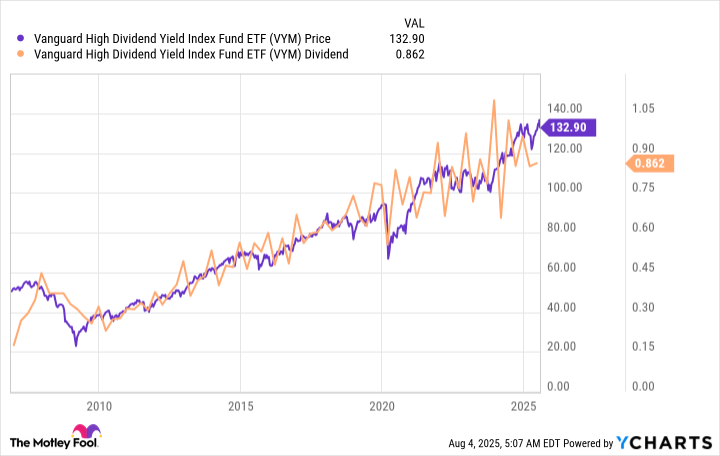

Because the chart beneath highlights, Vanguard Excessive Dividend ETF’s dividend has trended increased over time. And, on the identical time, the worth of the ETF has additionally trended increased over time. So that you get a rising earnings stream and capital appreciation. That is a pleasant mixture that may assist buyers offset the ravages of inflation.

4. Vanguard Excessive Dividend ETF is easy to know

Some exchange-traded funds are pretty advanced, and others are very simple. Vanguard Excessive Dividend ETF leans towards the straightforward aspect. It tracks the FTSE Excessive Dividend Yield Index. This index mainly takes all the dividend-paying corporations out there on U.S. exchanges and buys the half with the very best yields. Very clearly, that is targeted on dividend yield, however the secret’s that this strategy results in a large portfolio of round 580 shares.

5. Diversification is the massive story with Vanguard Excessive Dividend ETF

That brings the story to the ultimate and most vital level. The explanation you’ll need to purchase Vanguard Excessive Dividend ETF like there isn’t any tomorrow is due to the diversification that proudly owning over 500 shares offers. It might simply substitute an S&P 500 index fund for buyers that need to bias their portfolios towards dividends. Yow will discover higher-yielding ETFs. Yow will discover ETFs with higher returns. You may even discover ETFs with extra diversification. However Vanguard Excessive Dividend ETF is a strong mixture of all of those components in a single easy funding.

It could possibly be your solely inventory ETF in a easy two-ETF balanced portfolio. It could possibly be a basis on which you layer different dividend ETFs. It might even be the inspiration on which you construct a dividend inventory portfolio. It is not good, nevertheless it might nonetheless be the proper selection for some buyers.

If you happen to perceive Vanguard Excessive Dividend ETF, it could possibly be an excellent selection

Every of the gadgets above is framed as a optimistic, however for some buyers these positives may be framed as flaws. For instance, if yield is all you care about, then offering greater than twice the yield of the S&P 500 index in all probability will not be thrilling sufficient. And the diversification the portfolio provides, because of the very huge internet the choice course of casts, successfully limits the yield the ETF can generate.

By successfully proudly owning half of the dividend payers, the portfolio has no selection however to achieve additional down the yield scale. And but Vanguard Excessive Dividend ETF nonetheless offers a superb compromise throughout many components that may make it an excellent match for lots of buyers.

Reuben Gregg Brewer has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Vanguard Whitehall Funds-Vanguard Excessive Dividend Yield ETF. The Motley Idiot has a disclosure coverage.