The quantum computing arms race is beginning to warmth up.

Quantum computing is not a straightforward space to spend money on proper now. Most firms agree that 2030 can be a turning level for the business and commercially viable quantum computer systems can be out there then. That is nonetheless a methods off, and traders have to be cautious to not get in too early; in any other case, there might be a big alternative price that might be incurred by investing in quantum computing as an alternative of different attainable areas.

Nonetheless, I believe there might be an enormous alternative in case you spend money on the fitting quantum computing shares proper now. I’ve bought 5 shares that may be bought in a bunch that ensures traders get publicity to quantum computing in addition to present market developments, and I believe it is extremely probably that this cohort outperforms the market over the subsequent few years.

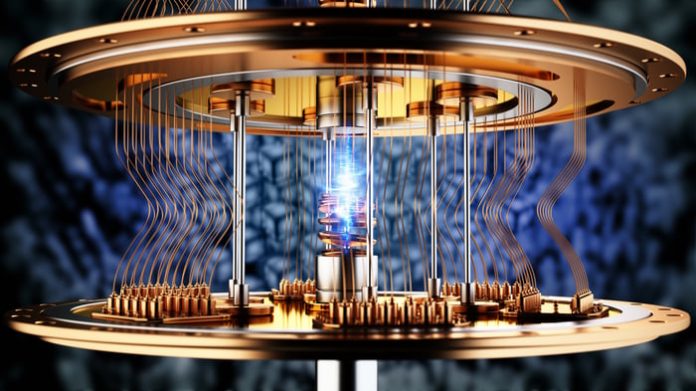

Picture supply: Getty Photographs.

Legacy tech gamers

Quantum computing is not an business reserved for start-ups; a few of the greatest names in tech are additionally investing on this know-how. Two of the most important are Alphabet (GOOG 0.52%) (GOOGL 0.46%) and Microsoft (MSFT -0.40%). Each of those firms are creating their very own quantum computing chip in-house, which might lead to large earnings down the street if every develops a viable quantum computing resolution.

Each firms will use quantum computing for themselves, however may even supply it to shoppers via their respective cloud computing providers. Proper now, the large development drivers for cloud computing are the migration of conventional workloads and synthetic intelligence, however quantum computing might present one other development driver. Microsoft’s CEO said that he believes quantum computing would be the subsequent accelerator within the cloud, which might imply additional development for each Alphabet and Microsoft.

One other legacy tech participant that may profit is Nvidia (NVDA -0.85%). Whereas Nvidia is not instantly creating quantum processing models, it is serving to quantum computing gamers take a hybrid computing method between conventional and quantum computing strategies. It is also creating a quantum-focused model of its CUDA software program, which helped it set up dominance within the conventional computing panorama.

All three of those firms are excelling within the AI-driven market, but additionally have long-term investments ongoing within the quantum world. By investing in these three at this time, traders can guarantee they’ve publicity to each present and rising developments. However there are additionally a number of pure performs that look intriguing.

Quantum computing pure performs

I additionally like including picks like IonQ (IONQ -1.93%) and D-Wave Quantum (QBTS -6.44%) into this basket, as a result of it provides traders the large upside of a pure-play quantum computing firm. These two aren’t very huge firms, but when they make quantum computing viable, they may flip into enormous winners for traders.

Whereas some could argue these two are on account of be outspent and outclassed by rivals like Alphabet and Microsoft, they’re really taking a special method to quantum computing totally.

Most quantum computing rivals like Alphabet and Microsoft are utilizing a superconducting method for his or her chips. Nonetheless, IonQ is utilizing a trapped ion approach, and D-Wave is utilizing a quantum annealing method. All three of those approaches have their use circumstances, however will probably be a while earlier than traders know which is one of the best.

By having publicity to all three, traders have one of the best likelihood to make a revenue on this rising business. Though we’re nonetheless a number of years out from quantum computing relevance, I believe proudly owning a basket of legacy and rising gamers is a brilliant method to make sure traders make an incredible revenue.

Keithen Drury has positions in Alphabet and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.