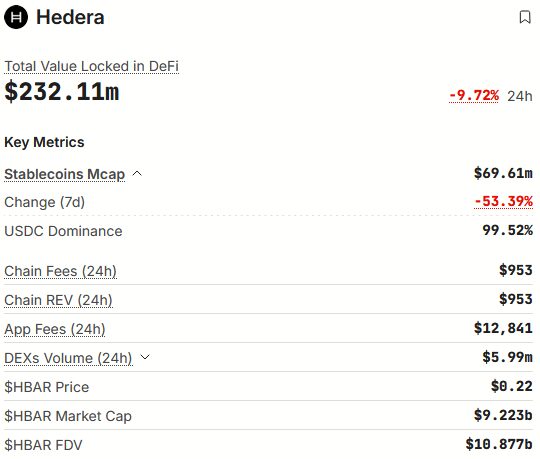

As Hedera’s native HBAR coin simply crumbled 7.38%, an even bigger difficulty is detected by the on-chain sleuths on the community’s liquidity. In accordance with DefiLlama’s blockchain explorer, the Distributed Ledger Know-how (DLT) using HBAR Community noticed a stupendous 53.39% drop in its stablecoin market, signaling an uncanny bearish shift as crypto markets bleed out on Monday.

After this on-chain liquidity flop, there’s at present simply over $69 million in stablecoin liquidity, with the overwhelming majority of it dominated by Circle USD (USDC). Zooming out, the overall worth locked (TVL) on Hedera’s native chain took a softer blow, dropping 9.72% of its market capitalization from the day before today.

Primary HBAR Value Eventualities & Key Occasions

Hedera’s (HBAR) upcoming worth motion extremely relies on the important thing assist stage at $0.21. This, falling according to the lowest-tier Bollinger Band (BOLL), would function a catalyst for crypto bulls to regain the steering wheel. Presently, the Bull Bear Energy (BBP) metric tells us an ultra-bearish story on the 4-hour charts. With the BBP metric posting the worst outcome since July 25, 2025, an analogous sentiment is felt amongst crypto whales.

As of now, the biggest HBAR holders are nonetheless lowering their positions, with the Chaikin Cash Stream (CMF) flashing -0.18.

Moreover, the favored altcoin is forecasted to show the tides in the direction of a brand new all-time excessive if any of the 2 HBAR ETFs get accredited this 12 months. Fortunately, Bloomberg’s ETF analysts see a 90% likelihood of this taking place by year-end, however Hedera (HBAR) is competing with a flurry of different fashionable altcoins like Ripple (XRP), Litecoin (LTC) & Solana (SOL).

So, whereas right now’s decentralized finance (DeFi) led to a short-term liquidity crunch, the recognition of HBAR in cross-border funds, together with the continuing SWIFT testing, paints a brighter image in the long run. For now, traders of HBAR ought to brace themselves for the September 29, 2025 replace on Mission Acacia’s use of HashSphere.

Dig into DailyCoin’s high crypto scoops:

Pi Community Serves Key KYC Replace: What Pioneers Should Know

Huge Liquidations Rock Crypto. Wholesome Shakeout or Market Prime?

Folks Additionally Ask:

Hedera’s stablecoin market cap tanked 53% prior to now week, falling from ~$150M to $70M, per DefiLlama information. This alerts a fast exit of liquidity, which means much less cash flowing by means of the community for trades and apps.

It’s tied to weaker person exercise and broader crypto market jitters—fewer of us are depositing stablecoins like USDC or USDT for DeFi or funds. This creates a “liquidity crunch,” slowing transactions and scaring off contributors.

HBAR dropped 7% over the week to round $0.24, nearing its 2025 low. Much less liquidity means decrease demand for HBAR (used for charges), pushing costs down additional—analysts see extra draw back if it doesn’t rebound.

Dangerous information short-term: Fewer transactions might stall development in apps and partnerships. However Hedera’s pushing enterprise stuff like stablecoin tokenization, so a restoration in inflows may flip the script.

No must panic —dips like this are widespread in crypto. Should you’re long-term bullish on Hedera’s tech (quick, low-cost txns), maintain and look ahead to stablecoin bounces. Newbies: DYOR, diversify, and keep away from leverage amid these bear vibes.