The regular appreciation within the Ethereum worth continues to reflect how resilient the cryptocurrency has turn out to be available in the market. Regardless of the waves of skepticism skilled up to now, there appears to have been a current main shift in investor conduct, which exhibits a stage of optimism within the potential progress of the Ether token.

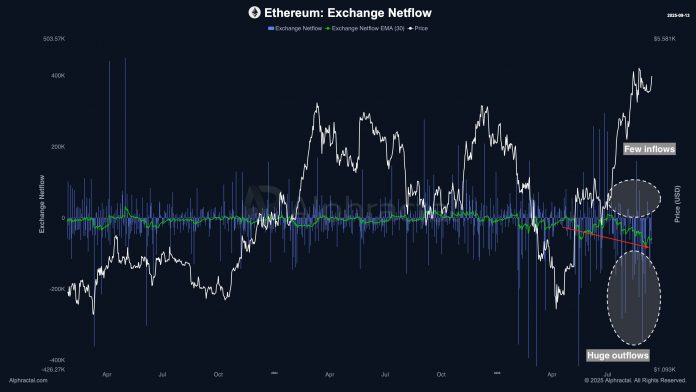

Ethereum Netflow Throughout Exchanges Persistently Detrimental

In a September 13 submit on social media platform X, on-chain analyst Darkfost revealed how Ethereum’s buyers have been appearing behind the scenes over the previous few months.

Associated Studying

In line with Darkfost, there was a significant shift in investor conduct since Ethereum’s final worth drop from $4,000 to $1,500. On the time, the prevailing investor temper was concern, uncertainty, and doubt (FUD) — feelings which didn’t play a lot of a task in affecting the long-term exercise of buyers.

Darkfost reported that the netflow throughout all exchanges has been “constantly unfavourable” because the main Ethereum worth drop; which means extra ETH is leaving exchanges than they’re being deposited.

In line with the on-chain analyst, round 56,000 ETH is being withdrawn day by day over a mean of 30 days. Apparently, this determine has not been seen because the depths of the final bear market.

Not too long ago, there have been days when greater than 400,000 ETH had been withdrawn. What’s extra attention-grabbing is that the alternate netflows haven’t turned optimistic since July.

As earlier inferred, this development of token motion represents a shift within the holding conduct of Ethereum buyers, as they transfer their property off buying and selling platforms to non-custodial wallets for long-term storage. In the end, this implies that holders have gotten more and more assured within the ETH’s long-term promise.

As of this writing, the Ether token is valued at round $4,660, reflecting no vital worth change up to now 24 hours. In line with knowledge from CoinGecko, the worth of Ethereum has elevated by virtually 10% up to now seven days.

BTC And ETH Reserves Drop 23% And 20% Respectively

In a separate submit, Darkfost analyzed the Bitcoin and Ethereum Change Reserve metrics throughout all exchanges and estimated how a lot of those cryptocurrencies have left exchanges in 2025.

In line with the web pundit, Bitcoin reserves throughout all exchanges have dropped by virtually 1 / 4 of their complete holdings because the 12 months’s starting. The BTC alternate reserves have dipped by 23% to about 2.47 million BTC from 3.05 million BTC as of January 1, 2025.

Associated Studying

Ethereum alternate reserves, alternatively, didn’t instantly begin to decline till the month of Could. As talked about within the earlier submit, ETH provide on exchanges started to fall following a reversal triggered by its fall to under $1,500. Over the past 4 months, Ethereum reserves have fallen to 17.1 million from 20.6 million, representing a 20% decline.

A big decline in alternate reserves is commonly interpreted as an indication of accumulation amongst buyers. This development may very well be a bullish catalyst for the 2 largest cryptocurrencies, particularly Ethereum, contemplating that the coin motion began extra lately.

Featured picture from iStock, chart from TradingView