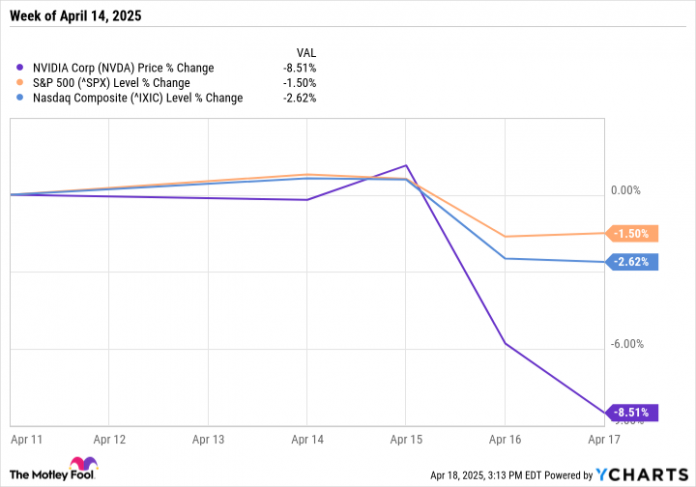

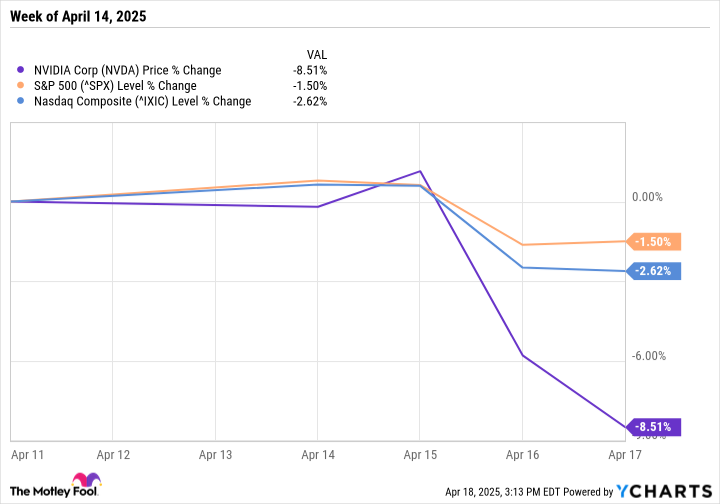

Shares of Nvidia (NVDA -3.01%), the main maker of synthetic intelligence (AI) chips, dropped 8.5% final week, which was a four-day buying and selling week because of the inventory market being closed for the Good Friday vacation. Nvidia inventory ended the week priced at $101.49 per share.

For context, final week, the S&P 500 index declined by 1.5% whereas the tech-heavy Nasdaq Composite index fell 2.6%. For added context, shares of Nvidia competitor Superior Micro Units (AMD) have been down 6.3%.

Beneath is a dialogue of the 2 main occasions that moved Nvidia inventory final week.

Knowledge by YCharts.

Tuesday, April 15: Nvidia inventory beneficial properties 1.3% on U.S. funding information

Nvidia inventory edged up 1.3% on Tuesday, a day that the S&P 500 slipped by about 0.2%. Traders preferred the information the corporate introduced in a Monday weblog publish, that it is “working with its manufacturing companions to design and construct factories that, for the primary time, will produce Nvidia AI supercomputers totally within the U.S.” Inside 4 years, it plans to supply as much as $500 billion of AI infrastructure within the U.S. via partnerships with a number of firms.

Particularly, Nvidia has began producing its new Blackwell chips at Taiwan Semiconductor Manufacturing Firm‘s (TSM 0.13%) vegetation in Phoenix, Arizona. TSMC is the world’s largest contract producer of semiconductors. It is lengthy been Nvidia’s major chip manufacturing companion. Furthermore, Nvidia can be “partnering with Amkor and SPIL [Siliconware Precision Industries Co., Ltd.] for packaging and testing operations” within the state.

As well as, Nvidia is constructing two supercomputer manufacturing vegetation in Texas: one with Foxconn in Houston and a second with Wistron in Dallas. “Mass manufacturing at each vegetation is anticipated to ramp up within the subsequent 12-15 months,” based on the weblog publish.

Wednesday, April 16: Nvidia inventory drops 6.9% on increasing export controls

Nvidia inventory fell 6.9% on Wednesday, following the tech big’s Tuesday evening disclosure by way of a submitting with the U.S. Securities and Trade Fee (SEC) that it plans to take expenses of as much as $5.5 billion on its fiscal first-quarter outcomes. The fees stem from the U.S. authorities enacting restrictions on the export of its H20 chip to China and choose different international locations.

The H20-associated expenses are for merchandise in stock, buy commitments, and associated reserves. In different phrases, Nvidia has buy orders from Chinese language firms for these chips that it does not consider will probably be capable of fulfill, and it has a listing of those chips that it both will not be capable of promote or must promote at important reductions. (Demand for these chips could be low from Nvidia’s main clients within the U.S. and different international locations not topic to the brand new export controls. Such firms are shopping for Nvidia’s strongest Hopper and Blackwell chips.)

Nvidia inventory continued to say no on Thursday.

The second growth spherical of the export restrictions that started in August 2022

This newest transfer by the U.S. authorities marks the second growth spherical of the August 2022 export controls on chips and programs for knowledge facilities able to dealing with superior AI workloads. The primary growth occurred in October 2023. The restrictions are on account of nationwide and worldwide safety considerations.

The October 2023 growth affected a considerable variety of Nvidia’s merchandise inside its knowledge heart platform, which accounts for the majority of its income. (Knowledge heart income accounted for 90.6% of the corporate’s whole income in its most just lately reported quarter.) Following this growth, Nvidia particularly designed the H20 chip as a then-export control-compliant chip for the Chinese language market, which has traditionally been a considerable marketplace for the corporate. The H20 is a robust chip, however not as highly effective as Nvidia’s most superior chips.

In different phrases, the goalpost retains shifting for what chips Nvidia is restricted from exporting to China and different unfriendly international locations.

As to specifics, Nvidia stated in its submitting that on April 9, the U.S. authorities knowledgeable it {that a} license could be required for the export of the H20 chip to China and choose different international locations. The federal government indicated that the license requirement stems from the chance that the H20 might be utilized in a supercomputer in China. Moreover, the submitting acknowledged that Nvidia was notified on April 14 that the license requirement would stay in impact for the “indefinite future.”

The license requirement basically quantities to a ban. To my information, there have been no revealed stories of the U.S. authorities issuing a license to Nvidia or different affected chipmakers that may allow them to provide chips included within the export controls to China or different affected international locations.

Placing expenses of as much as $5.5 billion in perspective

The important thing query for traders is how a lot the brand new export controls will have an effect on Nvidia’s monetary outcomes. Nvidia’s first quarter of fiscal yr 2026 ends on April 27, 2025. The corporate has already introduced its earnings launch date, which is after the market closes on Wednesday, Could 28.

For fiscal Q1, Nvidia had guided for income of $43 billion, which interprets to 65% year-over-year progress and 9.4% sequential progress. So, $5.5 billion in H20-related expenses quantities to 12.8% of the corporate’s forecasted income. Nvidia nearly all the time beats its steerage, so it is most likely secure to imagine it can generate income of, for instance, $43.5 billion to $44.5 billion earlier than accounting for the fees. Assuming Nvidia would have taken in income of $44 billion, excluding the fees, its income could be about $38.5 billion with the fees included.

How does $38.5 billion in income stack as much as the outcomes for the prior quarter and the year-ago quarter? Final quarter (This fall of fiscal 2025), Nvidia’s income was $39.33 billion. So, it appears doubtless that Nvidia’s fiscal Q1 income will most likely be barely decrease than final quarter’s, with the best-case state of affairs being income akin to that of final quarter.

Within the year-ago interval (Q1 of fiscal 2025), Nvidia’s income was $26.04 billion. So, if we assume the corporate’s fiscal Q1 2026 income might be roughly $38.5 billion, year-over-year progress might be about 48%. Whereas that is fairly a bit decrease than 65%-plus, it will nonetheless be darn good annual progress!

After all, the $5.5 billion in expenses may also damage Nvidia’s internet revenue, or earnings. This impact shouldn’t be quantifiable as a result of the corporate does not escape any type of revenue (resembling working revenue or internet revenue) by its goal market platforms (e.g., knowledge facilities, gaming, skilled visualization, auto/robotics).

Nonetheless, we all know from prior administration feedback that the information heart platform’s profitability is bigger than the corporate’s total profitability. So, it is most likely secure to imagine that the hit to the corporate’s internet revenue might be higher than the roughly 12% to 13% discount in income.

Nonetheless a fantastic long-term funding

I will not mince phrases: The H20 expenses are going to considerably damage Nvidia’s fiscal Q1 outcomes and can doubtless considerably damage the corporate’s outcomes for at the least a number of extra quarters. With out its H20 chip, Nvidia may have a really difficult time competing within the knowledge heart market in China. Due to this fact, traders can doubtless count on Chinese language knowledge heart income to say no considerably.

That stated, there are good causes to stay very bullish on Nvidia inventory as a long-term funding. The corporate’s whole addressable geographic market stays large, even with out China. Nvidia’s graphics processing items (GPUs) are the market chief, by far, for AI chips for each coaching and inferencing (operating AI purposes), with demand extraordinarily sturdy. Furthermore, the following phases of AI — agentic AI and bodily AI (resembling self-driving autos and robots) — are within the early phases of speedy progress.

Traders ought to maintain the large image in thoughts: Granted, Nvidia inventory is down 32% from its all-time closing excessive of $149.43, reached on Jan. 6 of this yr, however it’s nonetheless up 19.9% from a yr in the past. In the meantime, the broader market, as proxied by the S&P 500, has returned 6.9% over the past yr.