It has been a tricky yr for the inventory market, with the broader benchmark S&P 500 down 12% yr thus far, and way more from from highs reached within the again half of February.

The tech-heavy Nasdaq Composite is down 18% to date this yr. It could possibly be tough sledding within the close to time period, as traders attempt to navigate President Donald Trump’s ongoing tariffs and commerce negotiations and perceive the implications they might have on the broader financial system, which had already begun to indicate cracks.

Investing is about wanting towards the longer term and making an attempt to benefit from sell-offs to purchase shares at good costs. Listed below are three shares that Wall Road analysts assume can rally at the least 40% over the subsequent 12 months.

Amazon: 43% upside

E-commerce and tech conglomerate Amazon (AMZN -2.90%) has not been spared in Trump’s tariff saga, with shares down 23% this yr. Analysts at Wedbush estimate that roughly 70% of products offered on Amazon are made in China, and the commerce dispute with the world’s second-largest financial system appears removed from over. At the moment, Trump has imposed 145% tariffs on items from China, which has hit again with 125% tariffs on U.S. items. Larger costs for Chinese language items may harm Amazon, as may weak shopper demand.

Nonetheless, Amazon CEO Andy Jassy not too long ago advised CNBC he thinks most of the firm’s third-party sellers can efficiently cross their increased prices on to shoppers. Jassy additionally stated Amazon has performed preparation by negotiating “strategic ahead stock buys,” and can try to hold some costs low by negotiating higher offers on choose buy orders.

Analysts at Citigroup assume Amazon’s cloud enterprise will stay resilient, and that effectivity beneficial properties made by way of automation and by regionalizing a few of its enterprise can help the corporate’s margins. Forty-six analysts have issued analysis studies on Amazon over the past three months, and 45 of them have a purchase ranking on the inventory, with a median value goal of almost $260, based on TipRanks. That suggests near 43% upside from the inventory’s value as I write this.

Provided that the inventory at present trades barely under 29 occasions ahead earnings, effectively under its five-year common of 39.4, Amazon is effectively positioned to be a very good long-term purchase, because it has constructed a moat that will not be simply penetrated. Whereas tech shares might really feel stress within the close to time period, the corporate’s core on-line retail and e-commerce companies are constructed to final.

Financial institution of America: 39% upside

Financial institution of America (BAC -1.32%), the second-largest financial institution within the U.S. by property, has been hit onerous this yr, with its inventory down 16%. Financial institution shares got here into the yr with promise as a result of the Trump administration seemed poised to push deregulation and make it simpler for mergers and acquisitions to get accredited. Banks may additionally see decrease and extra favorable regulatory capital necessities, or at the least not have to fret about increased necessities.

However because the tariffs have come into play, extra economists and market strategists have grown involved a few potential recession — and banks are cyclical. An financial slowdown may result in increased mortgage losses, much less mortgage development, and fewer funding banking exercise, simply to call a number of of the results.

Nevertheless, Financial institution of America is a “too huge to fail” financial institution, which means the federal government and the Federal Reserve cannot afford to let the financial institution fail as a result of it’s too ingrained within the international monetary system. And as we noticed through the pandemic, BofA can simply navigate a tricky backdrop whereas taking vital credit score reserves for mortgage losses — reserves minimize into earnings, though they are often launched in later quarters if mortgage losses do not materialize. During the last three months, 18 analysts have issued analysis studies on the financial institution, based on TipRanks. The common value goal on the inventory is roughly $51 per share, implying about 39% upside for the inventory value as I write this.

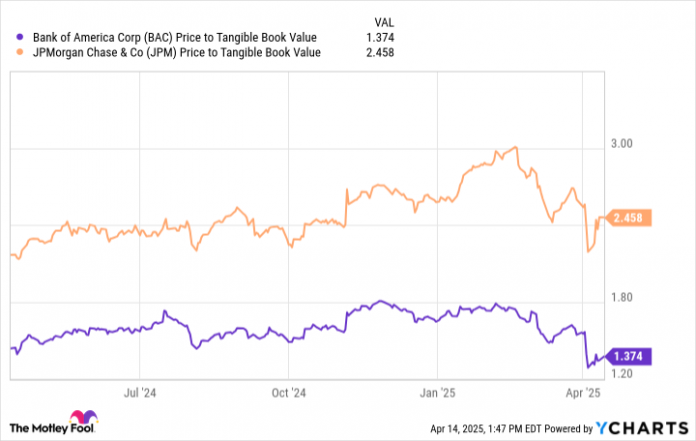

Citigroup analyst Keith Horowitz not too long ago pointed to the “substantial low cost” between Financial institution of America’s valuation and that of JPMorgan Chase.

BAC Value to Tangible E-book Worth information by YCharts.

Financial institution of America CEO Brian Moynihan has grown the stability sheet conservatively because the Nice Recession, and ideally, the widening of yields between the two-year U.S. Treasury and 10-year U.S. Treasury bonds may improve revenue margins within the financial institution’s lending enterprise, particularly if latest issues within the bond market dissipate.

Financial institution of America is usually a very good purchase under 2 occasions tangible guide worth, and who is aware of, perhaps someday, banks will re-rate increased in the event that they proceed to show resilience throughout financial downturns and generate constant and excessive returns on fairness.

Archer Aviation: 79% upside

Electrical plane firm Archer Aviation (ACHR -1.18%) has excited traders with the prospect of bringing industrial air taxis to the lots. Archer has designed an electrical plane that may take as much as 4 passengers and a pilot on 20- to 50-mile journeys. The plane are reportedly in a position to recharge shortly and are usually not terribly noisy, both.

Whereas the idea of business air taxis continues to be novel, Archer has made super progress towards bringing them to fruition: The corporate has achieved vital regulatory milestones and accomplished a whole bunch of check flights. In February, it introduced it plans to construct 10 of its Midnight plane this yr for continued testing and launch applications with companions.

The corporate has additionally introduced a “launch version” program to distribute its plane commercially in “dozens of early adopter markets prematurely of sort certification of the plane by the FAA (Federal Aviation Administration).” Archer stated its first Launch accomplice might be Abu Dhabi Aviation, later this yr.

In late February, Canaccord Genuity analyst Austin Moeller stated he sees many alternatives for the corporate to safe not solely industrial contracts, but in addition authorities contracts by way of Archer’s partnership with Anduril Industries, which does numerous work with the Division of Protection.

During the last three months, seven analysts have issued analysis studies on Archer Aviation with a median value goal of $12.83, based on TipRanks. That suggests near 79% upside for its value as I write this.

Provided that the corporate has but to generate income and has a multibillion-dollar market cap, its inventory could possibly be much more risky than these of bigger, extra established firms like Amazon or Financial institution of America.

Nevertheless, given Archer Aviation’s potential of being a primary mover on this new market, the upside could possibly be large. For a high-risk, high-reward inventory like Archer, I would suggest a smaller, extra speculative place to start out. You possibly can then accumulate extra shares as the corporate achieves regulatory, operational, and monetary targets.