The inventory market is in turmoil resulting from tariffs this yr, and one sector that is taking a giant hit is retail. The SPDR S&P Retail ETF has declined by greater than 14% since January, as buyers fear about rising prices but once more for a lot of retailers.

However one inventory that has been in a position to keep away from this sell-off up to now is Costco Wholesale (COST 1.35%) — it is up greater than 6% yr to this point (on the time of this writing). Can this be a protected inventory to speculate into proper now, even in the event you’re nervous about extra volatility and a possible bear market?

Costco’s enterprise continues to point out resiliency

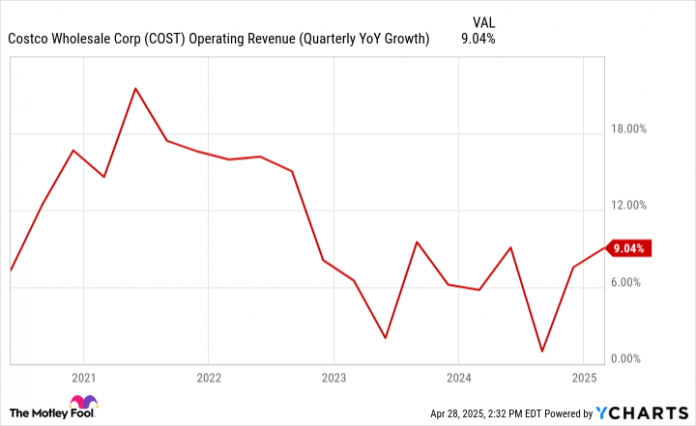

What has made Costco a implausible development inventory to spend money on through the years is its continued dominance in retail. Customers proceed to flock to its shops in quest of nice worth. And offered that you just aren’t trying to purchase in modest portions, you may typically purchase in bulk to avoid wasting appreciable cash. The numbers do not lie, and Costco has been persistently producing constructive development for years, at the same time as different retailers have struggled.

COST Working Income (Quarterly YoY Progress) knowledge by YCharts

Costco’s sturdy means to barter low costs with its distributors may make it much less weak to the consequences of tariffs. CEO Ron Vachris hopes to supply stability for the corporate’s prospects, stating on Costco’s latest earnings name that, “Our purpose will probably be to attenuate the influence of associated price will increase to our members.”

If it will probably try this efficiently, then this development of constructive development might very nicely proceed in upcoming quarters. However the development charge is probably not the largest query mark across the inventory today. That will should do with its rising valuation.

Is Costco’s valuation too wealthy?

Costco’s inventory has risen by greater than 200% prior to now 5 years, which is greater than double the S&P 500 index’s returns of round 90% over the identical time-frame. That surging inventory value signifies that buyers who purchase shares of Costco at the moment are paying a hefty premium.

COST PE Ratio knowledge by YCharts

At a price-to-earnings a number of of greater than 56, Costco’s inventory is buying and selling nicely above its five-year common of 43. The hazard in paying such a excessive a number of for the inventory is that leaves no margin of security.

Even when costs do not improve, a recession may result in shoppers pulling again on purchases. Skipping a visit to Costco can generally be a simple manner to save cash by avoiding the temptation to buy much more than you meant. If shoppers try this and Costco’s development charge slows down, that would make this extremely priced inventory weak to a sell-off as a result of at such a excessive valuation, it is successfully priced for perfection.

Costco is a superb enterprise, nevertheless it’s not a inventory I would spend money on at the moment

Whereas Costco’s enterprise has a variety of development potential and it is probably that the inventory will turn out to be extra worthwhile sooner or later, my concern is {that a} important chunk of that future development is already priced into its valuation. Returns for buyers who purchase the inventory at the moment might be minimal resulting from its steep price ticket.

There are additionally many different development shares in the stores at extra enticing valuations than Costco. Whereas the enterprise is sound and its fundamentals are strong, I do not assume this can be a protected haven inventory to be holding, as a result of in a bear market, it might be ripe for a steep decline.

David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Costco Wholesale. The Motley Idiot has a disclosure coverage.