Bitcoin continues to showcase spectacular resilience, climbing over 10 % up to now week and outperforming conventional threat belongings just like the S&P 500. After enduring a number of weeks of uneven value motion and low liquidity, Bitcoin has reclaimed the $94,000 vary lows – a pivotal marker as this was the extent that underpinned the rally that despatched BTC to its all-time excessive in January. The restoration has been supported by a shift in macro sentiment, with renewed optimism round potential tariff reduction from the US administration sparking a broader risk-on transfer throughout international markets.

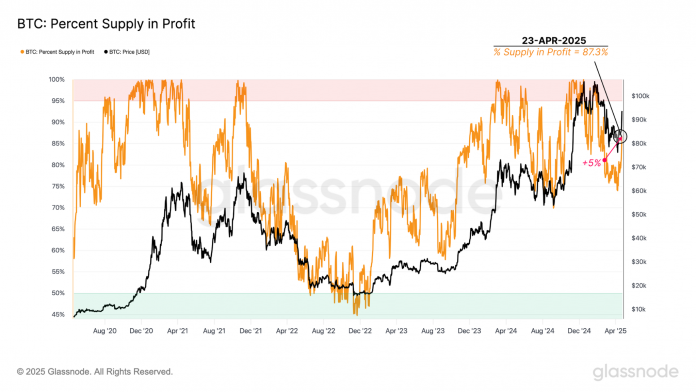

Bitcoin has now additionally reclaimed the Quick-Time period Holder Value Foundation degree at round $92,900, a essential on-chain pivot degree that usually separates corrective phases from renewed bullish momentum. Including to the constructive market construction, the P.c Provide in Revenue metric has additionally rebounded to 87.3 %, indicating enhancing market well being and investor profitability.

The following few weeks can be essential. We aren’t but at full euphoria ranges, and Bitcoin’s potential to take care of these beneficial properties within the coming weeks can be key to figuring out whether or not a brand new leg increased towards all-time highs is achievable, or if one other pullback is in retailer.

Latest US commerce insurance policies, particularly the imposition of excessive tariffs on imports from China and different international locations, are starting to pressure the financial system. Though preliminary jobless claims stay low and unemployment stands at 4.2 %, there are indicators of weakening confidence within the labour market.

Wage satisfaction and minimal acceptable wage expectations (reservation wages) have fallen sharply, indicating rising considerations about long-term job safety and wage development.

In the meantime, sturdy items orders rose considerably in March, pushed largely by a surge in industrial plane demand. Nevertheless, core capital items orders — a greater indicator of enterprise funding — confirmed nearly no development, reflecting cautious company sentiment amid tariff uncertainty. Corporations are delaying main investments, elevating considerations a few potential slowdown in financial momentum later this yr.

The US greenback has additionally weakened, pushed by decreased confidence in US financial management, sharply downgraded GDP forecasts, and stronger international competitors, significantly from Europe. The decline in client sentiment and the chance of rate of interest cuts by the Federal Reserve might speed up the greenback’s depreciation. Potential repatriation flows from Japanese buyers and interventions by the Financial institution of Japan might additional complicate the greenback’s trajectory.

On a constructive entrance, nonetheless, The Federal Reserve has eased crypto-asset guidelines by withdrawing prior supervisory necessities for the US banking sector, aiming to advertise innovation and simplify procedures for banks who need to interact in crypto and greenback token actions. This transfer alerts a extra supportive and adaptive regulatory stance towards the digital asset sector.

In a parallel growth, Securitize and Mantle launched the MI4 crypto index fund with a $400M dedication, providing regulated, diversified publicity to main cryptocurrencies for institutional buyers. The partnership displays the rising integration of blockchain into conventional finance and the development of asset tokenization.

CME Group additionally introduced the launch of XRP futures. This growth past Bitcoin and Ether futures highlights growing institutional curiosity in altcoins and goals to spice up XRP’s liquidity, value discovery, and mainstream monetary adoption following Ripple’s settlement with the SEC.

The submit Bitfinex Alpha | Bullish Momentum Beginning To Kind appeared first on Bitfinex weblog.