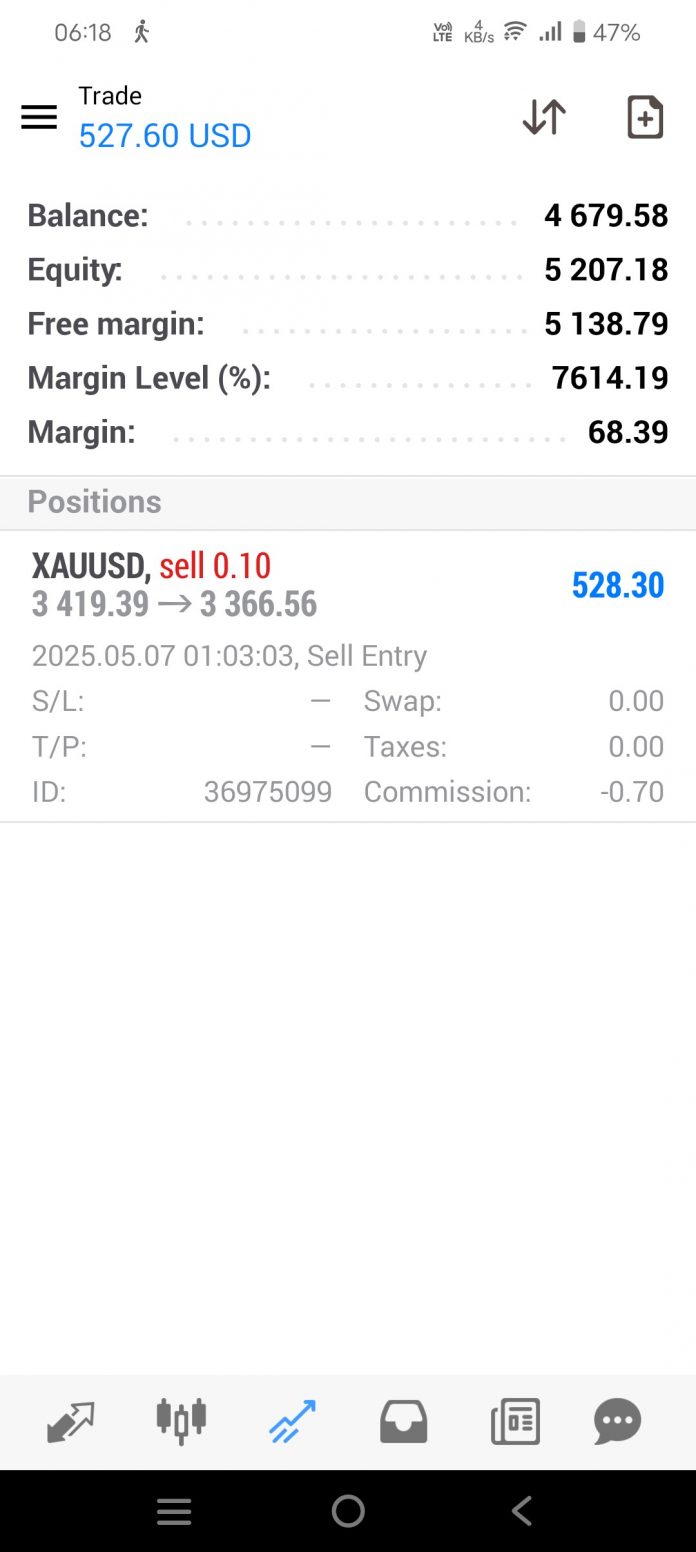

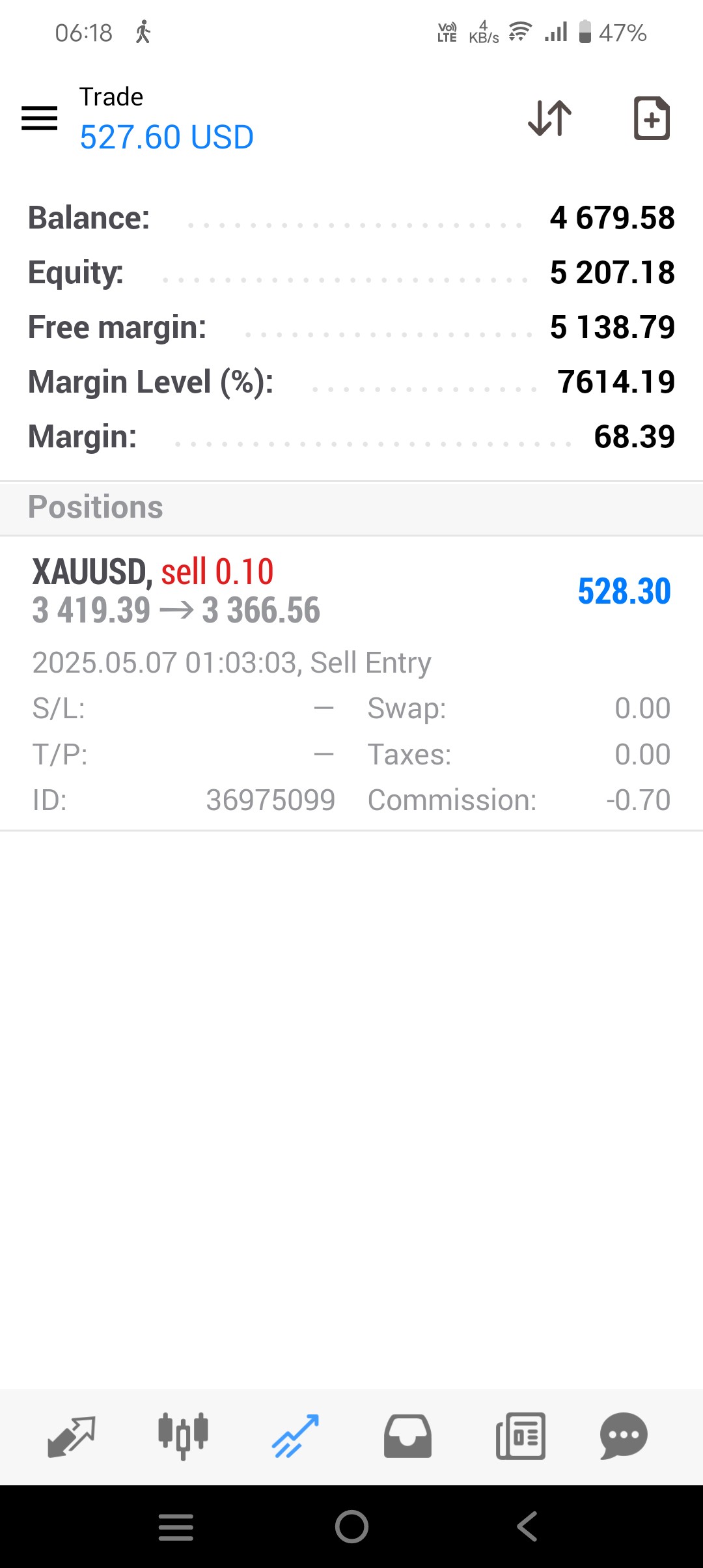

XAUUSD Day by day Chart Evaluation – Might 7, 2025

The current worth motion within the XAUUSD (Gold/USD) each day chart reveals a big shift in market momentum, as evident from the bullish restoration adopted by a slight correction.

Key Highlights:

Present Worth: 3387.30

Earlier Excessive/Low: 3438.14 / 3377.00

Indicators

:

ADX(14):32.54 – Signifies a robust pattern.

RSI(14): 61.55 – Momentum is presently bullish however approaching overbought territory.

A powerful bullish candle on Might 6 pushed worth upwards from the 3230–3260 demand zone, breaking previous the psychological stage of 3300 and reaching above 3400.

The current pink candle exhibits some revenue reserving or minor correction after a robust rally.

The dotted inexperienced markers counsel attainable parabolic SAR factors, indicating that the bullish pattern would possibly nonetheless be intact until there’s a shut under 3370.

Development Power (ADX Evaluation):

ADX worth above 30 confirms a robust directional pattern.

The DI+ (blue) is rising whereas DI− (orange) is declining, confirming bullish management over the market.

Momentum (RSI Evaluation):

RSI at 61.55 suggests shopping for power however is getting nearer to the overbought zone (70).

If RSI continues to rise with worth help, we’d see one other upward leg.

Conclusion:

Gold has proven a robust reversal with a possible continuation of the uptrend. Merchants ought to look ahead to a each day shut above 3400 to substantiate bullish continuation. A drop under 3370 may result in additional correction towards the 3300 stage.

Steered Technique:

Purchase above 3406 with goal: 3440 / 3480

Promote under 3370 with goal: 3330 / 3300

Use correct threat administration and make sure with candlestick patterns or quantity for entries.