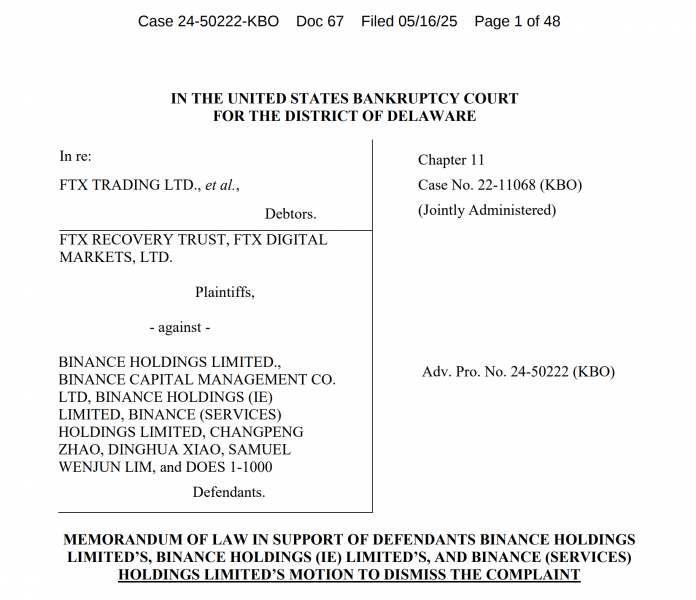

Binance’s authorized dispute with FTX has taken a brand new flip, with Binance submitting a movement to dismiss the $1.76 billion lawsuit filed by the FTX chapter property. Binance believes the lawsuit is baseless and seems to be a blame-shifting try.

Each events have been at loggerheads since FTX’s decline. In a submitting submitted to the Delaware Chapter Courtroom on Might 16, Binance argued that FTX’s failure had nothing to do with Binance or any alleged wrongdoing. As an alternative, it had the whole lot to do with inside fraud.

Binance’s submitting maintains that FTX didn’t collapse because of a hostile competitor. As an alternative, it argues that the collapse was triggered by huge fraud from inside. Binance additionally pointed to the conviction of Sam Bankman-Fried, the previous FTX CEO, who was discovered responsible of seven counts, together with fraud and conspiracy.

What Sparked the Lawsuit?

FTX’s property claims that Binance acquired billions in crypto throughout a 2021 share buyback deal. The brand new administration claims the funds had been allegedly misappropriated from buyer funds. Binance denies these allegations, stating that FTX remained financially lively for over a 12 months after that deal. In accordance with them, there’s no proof FTX was bancrupt on the time.

The lawsuit additionally factors a finger at former Binance CEO Changpeng Zhao, claiming his well-known tweet in 2022 contributed to FTX’s disastrous finish. Within the tweet, Zhao introduced Binance would liquidate its FTT token holdings, which some imagine triggered a selloff and FTX’s last collapse.

As a part of Binance’s exit from FTX fairness final 12 months, Binance acquired roughly $2.1 billion USD equal in money (BUSD and FTT). Resulting from latest revelations which have got here to gentle, we have now determined to liquidate any remaining FTT on our books. 1/4

— CZ

BNB (@cz_binance) November 6, 2022

Binance dismissed that principle, saying the tweet was based mostly on already public info, particularly a CoinDesk report that raised purple flags about Alameda Analysis’s stability sheet simply days earlier.

Additionally they defended Zhao’s feedback about “minimizing market affect,” saying there’s no proof Binance acted with malicious intent.

We’ll attempt to take action in a means that minimizes market affect. Resulting from market circumstances and restricted liquidity, we count on it will take just a few months to finish. 2/4

— CZ

BNB (@cz_binance) November 6, 2022

Questioning the Courtroom’s Authority

Binance additionally talked about jurisdiction as certainly one of its core considerations. The crypto trade argues that the entities named within the lawsuit function exterior the U.S. and subsequently don’t fall underneath U.S. court docket authority.

Furthermore, Binance accused the FTX property of counting on “hypothesis” and cherry-picked claims. Because of this, Binance’s legal professionals are asking the court docket to dismiss the case solely and with prejudice, which means FTX wouldn’t be capable of file it once more.

Disclaimer

The data mentioned by Altcoin Buzz shouldn’t be monetary recommendation. That is for academic, leisure, and informational functions solely. Any info or methods are ideas and opinions related to the accepted threat tolerance ranges of the author/reviewers, and their threat tolerance might differ from yours. We’re not chargeable for any losses chances are you’ll incur because of any investments straight or not directly associated to the data supplied. Bitcoin and different cryptocurrencies are high-risk investments, so please do your due diligence. Copyright Altcoin Buzz Pte Ltd.

The put up Binance Strikes to Toss $1.76B FTX Swimsuit, Factors Finger at SBF appeared first on Altcoin Buzz.