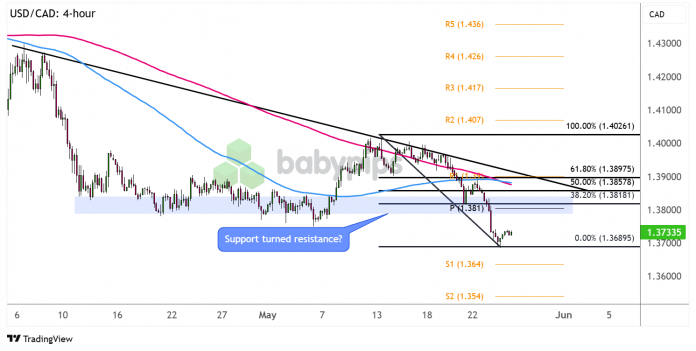

USD/CAD remains to be cruising under its descending pattern line, and it appears like a fast retest of a damaged assist zone is due.

Will the realm of curiosity maintain as a ceiling?

Let’s check out these close by inflection factors on the 4-hour chart.

USD/CAD 4-hour Foreign exchange Chart by TradingView

Market gamers aren’t precisely exhibiting the greenback a lot love today, because the U.S. could possibly be going through a ballooning authorities deficit if Trump’s tax invoice will get authorised in Senate.

Don’t overlook that Moody’s already downgraded the U.S. credit standing final week, permitting USD/CAD to bounce off its descending pattern line resistance.

The pair appears to be discovering some assist close to the 1.3700 main psychological degree in the interim, presumably resulting in a retest of the damaged flooring close to the pivot level degree (1.3810) and 38.2% Fib.

Can this space of curiosity maintain positive aspects in examine?

Do not forget that directional biases and volatility circumstances in market worth are sometimes pushed by fundamentals. In case you haven’t but carried out your homework on the U.S. greenback and the Canadian greenback, then it’s time to take a look at the financial calendar and keep up to date on every day elementary information!

If the 38.2% retracement degree holds, look out for a continuation of the selloff again to the swing low or to the following bearish targets at S1 (1.3640) then S2 (1.3540).

Alternatively, a bigger correction might nonetheless check resistance on the 61.8% Fib that strains up with the pattern line, dynamic resistance on the transferring averages, and R1 (1.3900).

Simply make sure to maintain your eyes peeled for lengthy inexperienced candlesticks closing above the falling pattern line since these might trace {that a} reversal from the selloff is so as.

Whichever bias you find yourself buying and selling, don’t overlook to observe correct threat administration and keep conscious of top-tier catalysts that would affect total market sentiment!

Disclaimer:

Please remember that the technical evaluation content material offered herein is for informational and academic functions solely. It shouldn’t be construed as buying and selling recommendation or a suggestion of any particular directional bias. Technical evaluation is only one side of a complete buying and selling technique. The technical setups mentioned are meant to focus on potential areas of curiosity that different merchants could also be observing. In the end, all buying and selling choices, threat administration methods, and their ensuing outcomes are the only accountability of every particular person dealer. Please commerce responsibly.