The rise of Web Capital Markets (ICM) tokens has divided the crypto group on X (Twitter) over what the way forward for this area will appear like. Supporters spotlight the sector’s potential to drive important enterprise development and democratize capital formation.

Nevertheless, skeptics stay uncertain, dismissing ICM tokens as an elevated model of meme cash.

Are Web Capital Markets Tokens the Way forward for Crypto?

For context, Web Capital Markets is a trending crypto meta. Companies and builders at the moment are tokenizing their app concepts, web sites, or initiatives, remodeling them into tradable digital property on blockchain platforms. Primarily, this permits customers to put money into an app’s potential by shopping for tokens tied to its idea.

Analyst Frank emphasised the liberating potential of this pattern in a publish on X. He defined that these tokens supply a extra accessible, liquid, and decentralized different to conventional fairness possession.

“It’s going to be approach larger than buying and selling meme cash,” he predicted in early 2025.

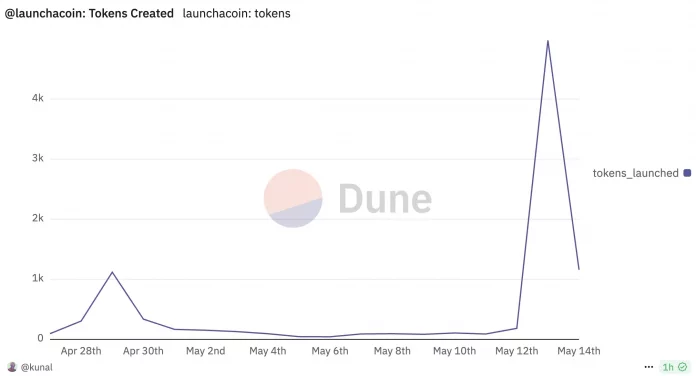

Although the sector has existed for a while, it has gained important traction not too long ago with the emergence of many new tokens. This heightened consideration has fueled spectacular development within the area, making Frank’s prediction appear much less far-fetched.

In response to the most recent information from Dune, 7,619 tokens have been launched on the Imagine app, which is the launchpad for ICM tokens. This represents a 138.6% improve from yesterday.

Furthermore, 423 tokens have already been activated. That’s not all. Imagine Screener revealed that the whole market capitalization of tokens has nearly doubled from round $220 million on Could 13 to $427 million at press time.

These figures exemplify the group’s optimism towards the sector. In truth, many market watchers have now topped it as a meta that may’t be missed.

“It’s a thrill to not be missed — and when extra builders be part of the fun, we degens on the opposite facet gonna have a giant platter of alternative to generate income,” Hitesh Malviya, founding father of on-chain analytics platform DYOR, posted on X.

As well as, analyst Evan Luthra emphasised that Web Capital Markets are compressing the hole between an idea and its real-world affect. This acceleration basically adjustments how concepts are delivered to life and funded, permitting for faster realization and iteration of initiatives.

“Each monetary revolution appears to be like like a rip-off at first. However the level of ICMs isn’t assured upside. It’s radical accessibility to early-stage web initiatives.” Luthra remarked.

Meme Cash vs. ICM Tokens: Is There a Distinction?

Regardless of this, the pattern has additionally attracted many critics. Many argue that Web Capital Market tokens are little greater than a rebranded model of meme cash, which have lengthy been criticized for his or her volatility and lack of intrinsic worth.

“Web capital markets is only a fancy approach of claiming meme coin. Similar trash,” an analyst posted.

One other person raised an analogous concern. He drew parallels between Imagine and platforms like Pump.Enjoyable, suggesting there is likely to be no actual distinction.

“What stops devs from monetising their thought on web on these apps vs consider?” the person questioned.

Nonetheless, Malviya identified that the primary distinction between meme cash and ICM tokens lies within the credibility of the builders.

“In memes any random dude might change into dev and launch token — right here you get builders with observe document launching apps, you’re speculating on app not on cultural relevance of meme,” he stated.

But, when requested how lengthy the narrative would final, Malviya gave a much less optimistic response. He estimated it might solely final round 4-6 weeks.

In the meantime, authorized issues additional complicate the narrative. A person identified that many meme coin initiatives embrace disclaimers about their tokens providing no actual utility or expectations. He careworn that this isn’t random however a deliberate alternative as a result of integrating real use circumstances or buyback mechanisms is difficult.

For ICM builders, this raises a big problem. Whereas launching tokens might be an interesting option to increase capital shortly, growing tokens with real use circumstances requires cautious planning, substantial technical infrastructure, and a transparent long-term product imaginative and prescient. It additionally entails compliance with advanced authorized and regulatory frameworks, which might improve prices for builders.

“Web capital markets. The place in some way startups are ready to spend 150% of their income on authorized charges to be related to a token,” he wrote.

These issues spotlight the murky authorized framework surrounding Web Capital Market tokens, which might hinder their mainstream adoption. Thus, whereas the sector is booming now, its trajectory stays unsure.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.