Regarding portfolio diversification, standard knowledge clashes dramatically with Warren Buffett’s funding philosophy. Whereas monetary advisors sometimes advocate holding 20 to 30 completely different shares, the Oracle of Omaha suggests a radically completely different strategy that has made him one of many world’s wealthiest buyers.

1. Buffett’s Philosophy: Diversification is Safety Towards Ignorance

“Diversification is safety in opposition to ignorance. It makes little sense if you understand what you might be doing,” Buffett famously said. This foundational precept separates his funding strategy from mainstream monetary recommendation. In keeping with Buffett, diversification is a security internet for buyers who lack the data or skill to research companies successfully.

Nevertheless, extreme diversification turns into counterproductive for individuals who actually perceive the way to consider firms and determine distinctive enterprises. This philosophy challenges the extensively accepted notion that spreading investments throughout quite a few holdings robotically reduces threat and improves returns.

2. The Downside with Standard Diversification Recommendation

The disconnect between idea and follow turns into evident when evaluating enterprise possession to inventory investing. If somebody in your native city owned three to 5 completely different companies—maybe a cake store and a dry cleaner—you’d doubtless contemplate them a well-diversified enterprise particular person. But consultants routinely counsel holding upwards of 20 to 30 completely different holdings in inventory market investing.

Buffett argues that this standard strategy displays a basic misunderstanding of what it means to personal shares. “We predict diversification as follow typically makes little or no sense for anybody that is aware of what they’re doing,” he explains, highlighting the contradiction between how we view enterprise possession versus inventory possession.

3. Buffett’s Early Portfolio Technique: The Sixties Blueprint

Buffett’s 1962 partnership letter gives perception into his early diversification technique, which he known as “The Generals.” Throughout this era, he sometimes allotted 5% to 10% of complete belongings to every of 5 – 6 core positions, with smaller positions in one other ten to fifteen shares. This construction meant that roughly 50% of his portfolio was concentrated in his prime picks, whereas one other 30% was distributed amongst extra holdings, totaling round 20 shares representing 80% of his capital.

His choice standards had been easy: firms obtainable at very low costs relative to their enterprise worth diversified throughout completely different industries to offer much less correlated portfolio threat. Buffett famous, “Combining this particular person margin of security, coupled with a variety of commitments, creates a most tasty package deal of security and appreciation potential.”

4. High quality Over Amount: Why Six Shares Could Be Sufficient

Buffett’s perspective on portfolio measurement emphasizes high quality over amount. “Only a few folks have gotten wealthy on their seventh finest concept. However many individuals have gotten wealthy with their finest concept,” he observes. For regular buyers working with smaller quantities of capital, Buffett means that six shares can present satisfactory diversification, offered they function in numerous industries and the investor has totally researched their fundamentals, worth motion, and historic tendencies.

This concentrated strategy requires buyers to concentrate on their highest-conviction concepts reasonably than spreading capital thinly throughout quite a few mediocre alternatives. The important thing lies in deep data and understanding of every funding reasonably than reaching diversification by means of sheer numbers.

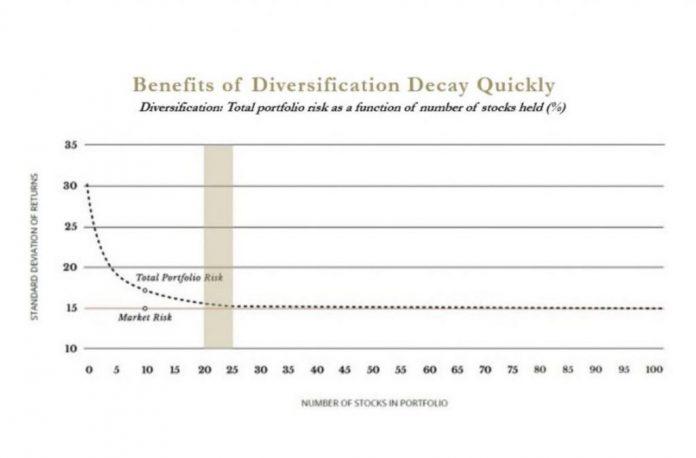

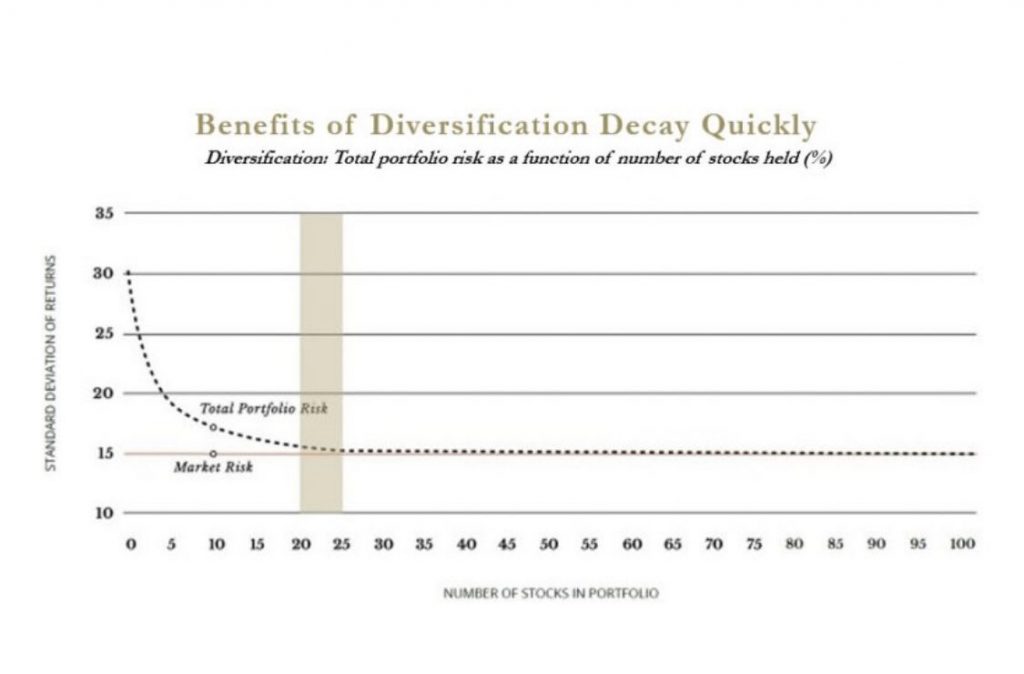

5. The Candy Spot: 20-25 Shares Most for Energetic Buyers

Analysis signifies that because the variety of shares in a portfolio reaches 20 to 25, the volatility-reducing advantages of diversification strategy zero. This vary represents the candy spot for buyers looking for to beat the market whereas capturing significant diversification advantages.

Analysis signifies that because the variety of shares in a portfolio reaches 20 to 25, the volatility-reducing advantages of diversification strategy zero. This vary represents the candy spot for buyers looking for to beat the market whereas capturing significant diversification advantages.

Past this threshold, extra holdings present minimal threat discount whereas probably diluting the influence of an investor’s finest concepts. Buffett acknowledges that few folks want this many positions, positioning 20 to 25 shares as the utmost quantity the place diversification continues to supply tangible advantages to inventory buyers.

6. When 40+ Shares Turns into “Absolute Madness”

Buffett’s longtime associate, Charlie Munger, doesn’t mince phrases when discussing extreme diversification: “It’s absolute madness to assume proudly owning 100 shares as an alternative of 5 makes you a greater investor.” Buffett agrees, stating that 40 particular person shares are far too many for a small investor.

As a substitute of making an attempt to handle such an unwieldy variety of positions, he recommends that buyers buy an S&P 500 index fund for broad market publicity. This index gives diversification throughout over 500 shares spanning all main sectors, eliminating the complexity and time dedication required to analysis and monitor dozens of particular person firms whereas nonetheless reaching the diversification that buyers search.

7. The 90/10 Rule: Buffett’s Recommendation for Common Buyers

For buyers preferring a passive strategy, Buffett advocates the 90/10 rule, which allocates 90% of funding capital to stock-based index funds whereas putting the remaining 10% in lower-risk investments resembling authorities bonds. His most well-liked car is an S&P 500 index fund, choices just like the SPDR SPY ETF or Vanguard’s VOO.

This technique stems from his commentary that the S&P 500 constantly beats most actively managed mutual funds and hedge funds whereas providing considerably decrease administration charges. Buffett has publicly said that his spouse’s inheritance will observe this allocation, demonstrating his confidence on this strategy for buyers who don’t want to analysis particular person shares actively.

8. Three Fantastic Companies vs. 50 Common Ones

Buffett’s confidence in focus over diversification is maybe finest illustrated by his assertion: “I might pick three of our companies, and I might be thrilled in the event that they had been the one companies we owned.” He believes three fantastic companies present greater than sufficient basis for monetary success, stating that “three fantastic companies is greater than you want on this life to do very effectively.”

Historic evaluation helps this view, as most American fortunes weren’t constructed by means of portfolios of fifty firms however reasonably by means of concentrated investments in distinctive companies. Coca-Cola is a major instance, creating quite a few fortunes for individuals who acknowledged its potential early and held substantial positions.

9. Why Trendy Portfolio Idea is “Twaddle” In keeping with Munger

Charlie Munger reserves explicit criticism for Trendy Portfolio Idea, dismissing a lot of what’s taught in finance programs as “twaddle.” Regardless of its complexity and mathematical sophistication, he argues that Trendy Portfolio Idea affords no actual utility past educating buyers “the way to do common.”

Munger observes that the speculation’s elaborate formulation, Greek letters, and sophisticated fashions create an phantasm of sophistication whereas including no precise worth. His critique extends to the broader educational strategy to investing, suggesting that if buyers actually understood Buffett’s rules, total finance programs could possibly be condensed right into a single week, eliminating the mystique that usually surrounds funding idea.

10. Focus vs. Diversification: How Buffett Constructed His Fortune

Buffett’s private funding strategy completely exemplifies his philosophy. He incessantly mentions proudly owning basically one inventory personally—Berkshire Hathaway—representing practically his total wealth. This excessive focus technique was instrumental in making him a billionaire by age 50 and sustaining his place among the many world’s wealthiest people for many years.

His private inventory portfolio has remained virtually totally concentrated in Berkshire Hathaway all through most of his grownup life, demonstrating that concentrated investing, primarily based on deep understanding and conviction, can generate extraordinary wealth over time.

The Buffett portfolio, which he usually discusses along with his Coca-Cola and Apple shares, and so forth, is admittedly the Berkshire inventory portfolio he manages. He follows his recommendation with this portfolio, concentrating his finest concepts on the highest holdings.

11. Sensible Pointers: How Many Shares Ought to You Personal?

The sensible software of Buffett’s philosophy relies upon primarily on an investor’s data stage and involvement. For educated buyers who totally perceive enterprise evaluation, three to 6 fastidiously chosen shares might present optimum returns.

Energetic buyers looking for to beat the market ought to contemplate a most of 20 to 25 positions to seize diversification advantages with out diluting their finest concepts.

Nevertheless, buyers preferring a passive strategy or lack the time and experience to research particular person firms ought to embrace the 90/10 rule, focusing totally on low-cost S&P 500 index funds. The important issue isn’t the particular variety of holdings however reasonably the investor’s real understanding of their investments.

Conclusion

Warren Buffett’s strategy to portfolio building challenges standard knowledge by prioritizing data and conviction over broad diversification. His philosophy means that buyers face a basic selection: develop the experience to determine and focus on distinctive companies, acknowledge their limitations, and embrace broad market diversification by means of index funds.

Buffett concludes, “When you discover three fantastic companies in your life, you’ll get very wealthy,” offered you genuinely perceive what makes these companies distinctive. The important thing lies not in following a prescribed variety of holdings however in actually assessing your capabilities and investing accordingly.

Whether or not you select focus or diversification, success in the end will depend on matching your technique to your data stage and remaining disciplined.