Investor demand for Ethereum-backed spot exchange-traded funds (ETFs) is heating up amid the asset’s bullish worth strikes.

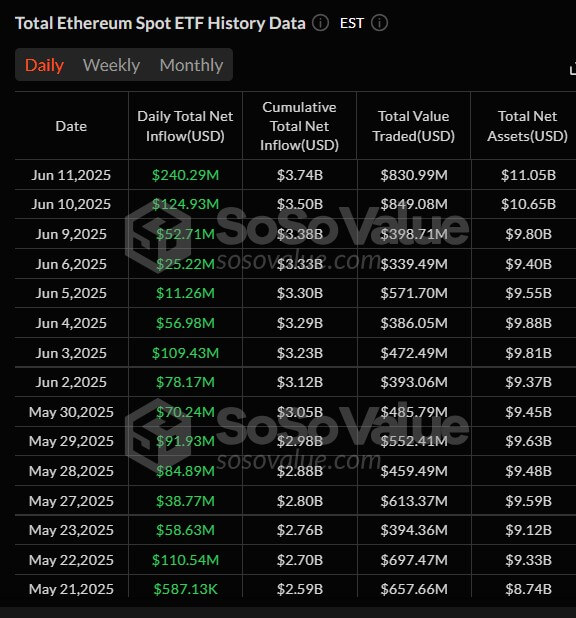

In accordance with knowledge from SoSoValue, spot Ethereum ETFs recorded $240 million in internet each day inflows on June 11, their second-highest complete for 2025.

BlackRock’s iShares Ethereum Belief (ETHA) led the cost with $160 million inflows, adopted by Constancy’s FETH at $37 million. Grayscale’s two Ethereum merchandise introduced in additional than $32 million, whereas Bitwise’s ETHW fund added one other $6 million.

This marks the strongest influx day for Ethereum ETFs since Feb. 2, when mixed inflows surpassed $300 million.

It additionally continues a rising pattern the place traders have added capital to Ethereum ETFs for 18 consecutive buying and selling periods, pushing cumulative inflows over the previous few weeks to roughly $1.2 billion.

Nate Geraci, president of ETF Retailer, highlighted the resilience of this pattern regardless of structural limitations. He famous that the present ETF choices don’t but help staking rewards or in-kind transactions, leaving additional room for future product evolution.

Ethereum-linked ETFs maintain $3.74 billion in internet inflows and $11.05 billion in internet belongings, representing round 3.25% of the crypto’s market worth.

Bullish sentiments encompass Ethereum

Ethereum’s strengthening ETF flows mirror a broader bullish flip in its market efficiency. The asset just lately climbed previous $2,800, its highest stage in practically 4 months.

Valentin Fournier, lead analysis analyst at BRN, advised CryptoSlate that ETH’s rising inflows and sustained power counsel it’s well-positioned to steer the following market rally, pushed by growing institutional confidence within the asset.

This bullish view is unsurprising contemplating the spinoff markets mirror rising institutional curiosity. In accordance with CryptoSlate’s Perception, open curiosity in Ethereum futures just lately set a brand new file, topping $41 billion.

Market observers linked this surge in exercise to Ethereum’s profitable Pectra improve in Might. The replace tackled long-standing challenges and made the community extra enticing to builders and customers.

In addition to that, regulatory indicators have additionally added to the optimistic outlook.

US SEC Chair Paul Atkins just lately steered that the company is contemplating regulatory flexibility for DeFi individuals. Such strikes are seen as a step towards making a extra supportive surroundings for blockchain innovation that might considerably profit ETH’s development.

Observers additionally level to current developments on the Ethereum Basis as additional proof of the blockchain community’s ambition to cement its management amongst good contract-enabled platforms.