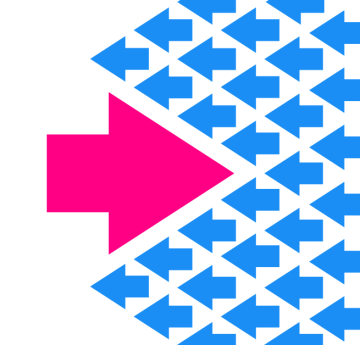

Some days, most foreign exchange pairs are simply going in a single specific path, and it is senseless to go towards the herd.

Nevertheless, for those who’re a fan of choosing tops or bottoms and for those who suppose that these sturdy tendencies are already exhausted, you shouldn’t be afraid to take a contrarian method to your foreign exchange trades.

When all charts level to a single path and the present market sentiment is supported by the newswires, it’s simple to know why many merchants hesitate to go towards the herd.

However as funding pundit Warren Buffett famously mentioned,

“We must also be fearful when others are grasping and grasping when others are fearful.”

You see, simply because a majority of the merchants on the market have a sure buying and selling bias, it doesn’t essentially imply that they’re proper.

Generally, sturdy momentum merely displays the doorway of buying and selling amateurs who simply waft with out understanding what’s driving worth motion.

That is why following the flock blindly can result in herding bias – one of many 5 widespread buying and selling errors merchants make.

Ask anybody who has efficiently tried buying and selling towards the herd, and they’re going to let you know that it could really feel intimidating when your evaluation leads you to an unpopular bias.

However generally, it pays to go towards the herd and be the odd one out – to be the contrarian.

Contrarian buying and selling is a foreign exchange technique that favors going towards the present market bias in anticipation of a shift in market sentiment. It entails shopping for a foreign money when it’s weak and promoting it when it’s sturdy.

Contrarian merchants attempt to make the most of moments when the markets get carried away by sturdy momentum.

When everybody and his grandma are prepared and prepared to push costs increased, it could generally result in overpriced belongings. Likewise, when everyone seems to be hell-bent on promoting an asset, alternatives to purchase at a cut price come up.

One of many predominant advantages of contrarian buying and selling is that it permits you to get good costs and catch reversals proper as they start.

In flip, this typically results in very engaging reward-to-risk ratios, supplying you with extra bang on your buck.

Nevertheless, contrarians commerce towards the development, and that doesn’t at all times work out of their favor. Because the saying goes, “The development is your good friend,” however it may be a imply son of a gun once you struggle it.

When a development is especially sturdy, it could bust proper throw potential reversal factors and wash away those that go towards the circulate.

Not at all am I saying that it is best to go towards the development only for the heck of it.

What I’m merely saying is that if, after completely conducting your personal elementary and technical evaluation, you will have sufficient motive to imagine that the market is about to show, don’t be afraid to go towards the herd and take a contrarian place.

Bear in mind, you don’t at all times should waft; loads of profitable buying and selling alternatives come up from straying from the gang.