At this time, The Blockchain Group (ALTBG), listed on Euronext Development Paris and acknowledged as Europe’s first Bitcoin Treasury Firm, has introduced the acquisition of 75 extra bitcoins for roughly €6.9 million. The acquisition brings the corporate’s complete bitcoin holdings to 1,728 BTC, at present valued at round €155.8 million.

The acquisition was funded via the ultimate completion of a €7.2 million capital improve, carried out through the Firm’s wholly-owned Luxembourg subsidiary. The funding got here completely from TOBAM managed funds via an “ATM-type” fairness program introduced on June 17, 2025, with shares priced at a mean of €4.49 every.

The press launch said, “the Firm additionally introduced its resolution to hold out, making use of the delegation of authority granted to him by the Board of Administrators on June 11, 2025, itself performing below the twelfth decision permitted by the Basic Assembly of Shareholders on June 10, 2025, a capital improve for a complete quantity of €7,191,143.60, via the issuance of 1,603,306 new peculiar shares at a mean subscription value of €4.49 per share.”

This follows the conversion of all OCA A-01 Tranche 1 bonds held by TOBAM, which had been become 1,838,235 new ALTBG shares at a subscription value of €0.544 per share, a 30% premium over the volume-weighted common value (VWAP) previous the Board assembly of March 4, 2025.

“The Firm confirms as we speak the ultimate conversion of all 1,000,000 OCA Tranche 1 by TOBAM, ensuing within the issuance of 1,838,235 new peculiar shares of the Firm, at a subscription value of €0.544 per share,” said the press launch.

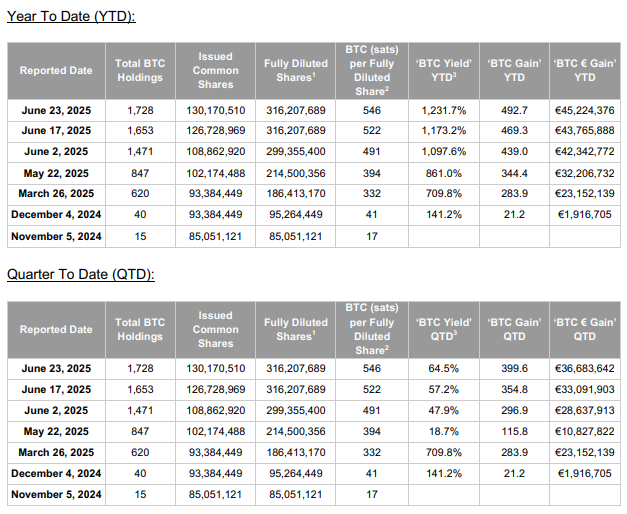

The Firm experiences a BTC Yield of 1,231.7% year-to-date, with a BTC Acquire of 492.7 BTC and a BTC achieve of €45.2 million YTD. For the present quarter alone, BTC Yield stands at 64.5%, with 399.6 BTC gained.

Earlier this month, the corporate additionally acquired 182 BTC for roughly €17 million, elevating its BTC complete to 1,653 BTC at the moment. The purchases had been funded via convertible bond issuances totaling over €18 million, subscribed by buyers together with UTXO Administration, Moonlight Capital, and TOBAM.

The transactions had been executed through Swissquote Financial institution Europe and Banque Delubac, with safe custody supplied by Swiss digital asset infrastructure agency Taurus. Further funding got here from the conversion of two.98 million share warrants, elevating an extra €1.6 million.