The US Greenback Index (DXY) plunged to 97.2 on Thursday, marking its lowest since 2022. This has intensified market expectations for a serious shift in capital flows towards Bitcoin (BTC) and crypto.

This prolonged weak point within the greenback comes as traders digest macroeconomic uncertainty and put together for what some analysts name a generational rotation into digital belongings.

Analysts Wager Large on Crypto As DXY Collapse Triggers Hunt for Progress

In response to Barchart, the greenback misplaced greater than 10% of its worth in 2025. This marks its worst first half in virtually 40 years.

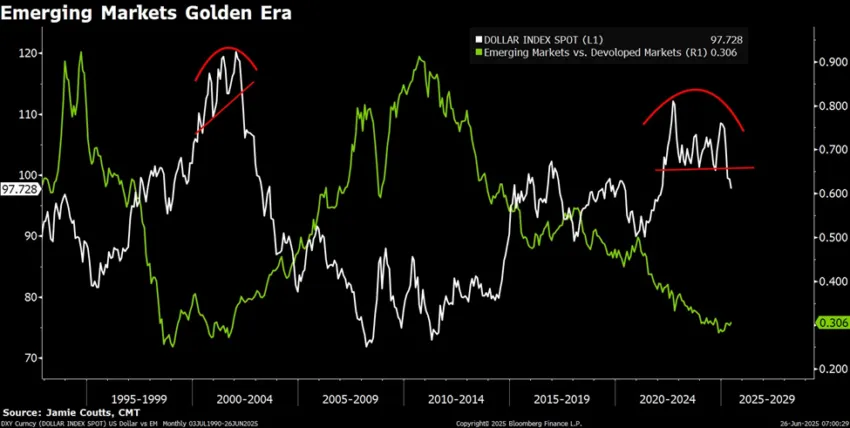

The fast depreciation is sparking comparisons to previous market cycles, when a falling greenback triggered highly effective rallies elsewhere. Jamie Coutts, lead crypto analyst at Actual Imaginative and prescient, attracts a historic parallel that’s catching consideration.

“Should you bear in mind 2002–2008, the final main greenback depreciation lit a hearth beneath EM [emerging markets] equities and commodities. EM outperformed DM [developed markets] by 3x as capital chased high-growth, younger economies — giving rise to BRICS. Crypto is at present’s EM,” he stated.

Coutts argues that at present’s crypto market is just like rising markets 20 years in the past, attracting inflows from traders searching for greater returns amid structural change.

With fiat currencies weakening globally, digital belongings are more and more seen as the subsequent frontier for progress.

In the identical tone, crypto analysts like Mister Crypto level to the falling greenback and plateauing Bitcoin dominance as alerts that altcoin season might be close to.

Chainbull echoed this view, noting that greenback weak point and rising Bitcoin dominance sign a pivotal shift.

Nevertheless, whereas capital could rotate into crypto, Bitcoin is the principle beneficiary relative to altcoins. BeInCrypto reported that Bitcoin dominance not too long ago hit a brand new yearly excessive, main some to consider that enthusiasm for altcoins could also be untimely.

Nevertheless, which will change quick as merchants more and more anticipate a dollar-driven rotation into smaller-cap tokens.

The broader crypto market tends to reply inversely to the greenback’s energy. A weaker DXY usually lowers the price of borrowing, boosts liquidity, and encourages risk-taking, that are splendid circumstances for digital belongings to outperform.

If the present development holds, capital may flood into crypto simply because it did with rising markets in the course of the early 2000s.

With macro forces, historic analogs, and real-time on-chain alerts aligning, the stage could also be set for a serious crypto rally.

“Capital is shifting the place the power is. Fiat is fading,” Coutts added.

Whether or not this implies a sustained rise for altcoins or renewed energy for Bitcoin, the greenback’s decline is reshaping investor danger, and crypto could profit.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.