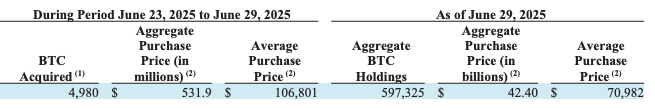

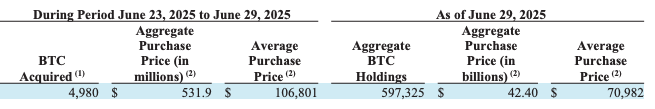

Technique, previously Microstrategy, has introduced the acquisition of an extra 4,980 Bitcoin for about $531.9 million, in keeping with a brand new SEC Kind 8-Ok filed on June 30, 2025. The typical buy worth was $106,801 per Bitcoin, inclusive of charges and bills.

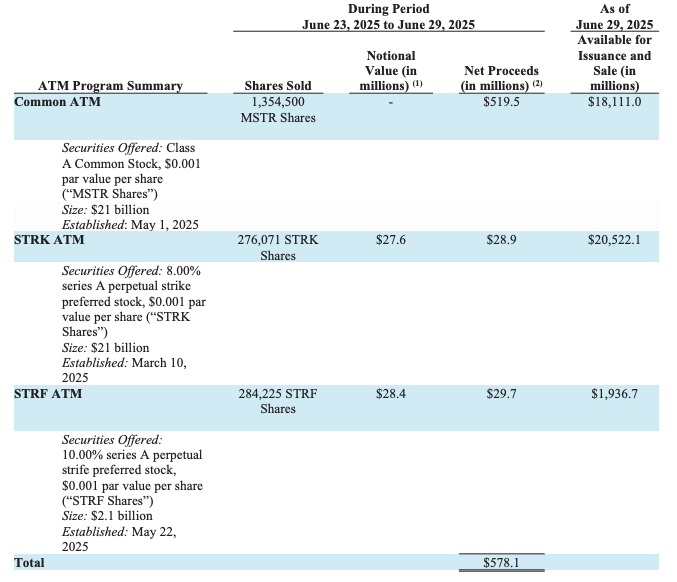

The acquisition was funded by an fairness increase from June 23–29, 2025, throughout its at-the-market (ATM) providing applications. The corporate offered 1,354,500 MSTR shares for $519.5 million in web proceeds, 276,071 STRK shares for $28.9 million, and 284,225 STRF shares for $29.7 million—totaling $578.1 million in funding for the week.

In keeping with the submitting, “The Bitcoin purchases have been made utilizing proceeds from the MSTR ATM, STRK ATM and STRF ATM.”

As of June 29, 2025, Technique now holds 597,325 BTC acquired at a complete value of $42.4 billion, with a median buy worth of $70,982 per Bitcoin.

This acquisition follows final week’s June 23 submitting the place Technique bought 245 BTC for $26 million, bringing its whole holdings to 592,345 BTC on the time. In that report, Technique revealed a Bitcoin yield of 19.2% YTD and signaled a goal of 25% for the yr. With this newest replace, the agency is making measurable progress towards that aim.

The June 30 report additionally confirms that Technique declared quarterly money dividends payable on each its STRK and STRF most popular shares—$2.00 and $2.64 per share, respectively—additional emphasizing the agency’s increasing monetary exercise.

The corporate said it “could proceed to make use of proceeds from future gross sales of shares below its Frequent ATM for common company functions, which can embrace cost of dividends on its most popular inventory.”

This continued Bitcoin accumulation course of by Technique, stays the instance and frontrunner as a number of different firms worldwide proceed to undertake Bitcoin akin to Anthony Pompliano’s ProCap, The Smarter Net Firm, GameStop, and so many extra. Whilst markets face ongoing macroeconomic uncertainty, Technique continues to point out that Bitcoin is the reply and readability to that uncertainty.

The corporate maintains a public dashboard at technique.com for real-time updates on BTC holdings and share exercise.

With BTC hovering round $107,000, Technique’s long-term dedication to Bitcoin as a treasury asset stays some of the bullish in company finance historical past.