It was a light-weight day when it comes to top-tier financial experiences, however that didn’t cease markets from making massive strikes whereas bracing for the upcoming July 9 tariffs deadline.

Geopolitical developments and OPEC+ updates additionally triggered main waves within the power sector, main crude oil to shut almost 3% increased for the day.

Listed below are headlines you’ll have missed within the final buying and selling classes!

Headlines:

- Over the weekend, Israel navy confirmed assaults on a number of terrorist targets in Yemen

- Greek-owned cargo ship in Purple Sea struck by rocket-propelled grenade and gunfire on Sunday, assault linked to Houthi militants

- OPEC+ agreed to extend oil output by 548K bpd vs. 411K bpd anticipated

- China restricted gov’t purchases of medical gadgets from EU in retaliation for final month’s choice barring Chinese language corporations from bidding on public tenders for medical gadgets

- On Sunday, Trump threatened to impose extra 10% tariffs on international locations aligning with “anti-American insurance policies of BRICS”

- U.S. Treasury Secretary Bessent stated tariffs will revert to April 2 ranges by August 1 if no agreements are made

- Japan Common Money Earnings for Might 2025: 1.0% y/y (2.4% y/y forecast; 2.3% y/y earlier)

- Japan Additional time Pay for Might 2025: 1.0% y/y (0.9% y/y forecast; 0.8% y/y earlier)

- Australia ANZ-Certainly Job Advertisements for June 2025: 1.8% m/m (0.2% m/m forecast; -1.2% m/m earlier)

- Japan Main Financial Index for Might 2025: 105.3 (104.5 forecast; 104.2 earlier)

- Germany Industrial Manufacturing for Might 2025: 1.2% m/m (-0.6% m/m forecast; -1.4% m/m earlier)

- U.Ok. Halifax Home Worth Index for June 2025: 0.0% m/m (-0.2% m/m forecast; -0.4% m/m earlier); 2.5% y/y (2.2% y/y forecast; 2.5% y/y earlier)

- Euro space Retail Gross sales for Might 2025: 1.8% y/y (1.7% y/y forecast; 2.3% y/y earlier); -0.7% m/m (-1.0% m/m forecast; 0.1% m/m earlier)

- China’s gold reserves rose for the eighth consecutive month in June at 73.90 million ounces, up from 73.83 million ounces on the finish of Might

- President Trump introduced 25% tariffs on Japan and South Korea by August 1, with Malaysia and South African nations additionally getting extra tariffs

- Tesla shares hit onerous as Trump criticized Elon Musk as “utterly off the rails” following his criticism of the newly-passed tax invoice

Broad Market Worth Motion:

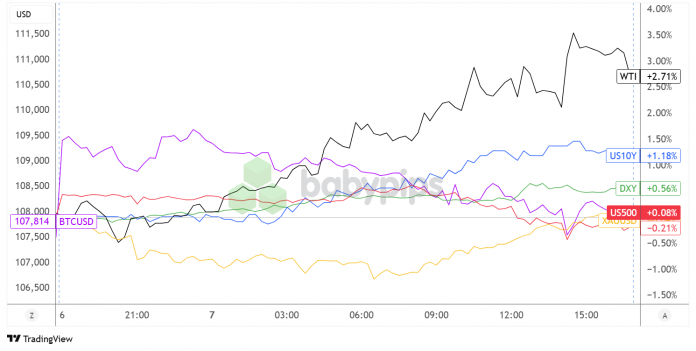

Greenback Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

A number of main headlines greeted market members after the lengthy weekend, as a mixture of flaring Center East tensions and the OPEC+ choice bought power sector merchants off to a roaring begin.

WTI crude oil bulls picked up on experiences of an Houthi-linked assault on a vessel within the Purple Sea, in addition to the Israeli navy’s affirmation that they focused a number of terrorist websites in Yemen. This allowed the power commodity to get well from its transient dip spurred by the OPEC+ announcement of a bigger than anticipated enhance in manufacturing, extending its rally all through the London and U.S. classes to shut 2.71% increased.

Gold, then again, retreated whereas danger urge for food picked up on information that U.S. commerce negotiations might nonetheless be prolonged and that the deadline to bump tariffs again as much as April 2 ranges has been pushed again from July 9 to August 1. Nevertheless, risk-off vibes lifted the valuable metallic again to its open worth later within the day, as Trump threatened a contemporary batch of upper commerce levies.

Fairness futures moved sideways in constructive territory whereas traders retained some optimism that commerce talks might consequence to precise offers within the coming days, though the announcement of 25% tariffs on South Korea and Japan sparked a contemporary spherical of danger aversion that led U.S. inventory indices to shut principally flat.

Treasury yields, which have been already on a gradual climb within the early buying and selling classes, sustained its rally throughout U.S. market hours whereas safe-haven flows appeared to elevate the U.S. greenback.

FX Market Habits: U.S. Greenback vs. Majors:

Overlay of USD vs. Majors Chart by TradingView

The U.S. greenback was off to a strongly bullish begin, though it dipped briefly in opposition to JPY on an uptick in Japan’s main indicators, staging a gentle climb in the course of the Asian session and the early London session whereas markets digested the influence of the U.S. tariffs deadline extension and resurfacing geopolitical tensions.

A little bit of profit-taking and a slight pickup in danger urge for food led higher-yielding commodity currencies and psuedo-risk forex GBP to advance in the course of the latter a part of the London session, as “TACO” expectations got here in play and traders appeared cautiously optimistic that extra commerce offers could possibly be struck in the course of the tariffs delay.

Nevertheless, one other spherical of safe-haven flows kicked in in the course of the U.S. session when Trump declared 25% tariffs on Japan and South Korea whereas U.S. media continued to report on extra tariffs letters being despatched out. USD recovered throughout the board, with USD/JPY sustaining its climb to shut 1.14% increased and NZD/USD and AUD/USD chalking up almost 1% in losses.

Upcoming Potential Catalysts on the Financial Calendar

- Australia RBA Curiosity Fee Choice at 4:30 am GMT

- Japan Eco Watchers Survey Outlook at 5:00 am GMT

- Australia RBA Press Convention at 5:30 am GMT

- Germany Steadiness of Commerce at 6:00 am GMT

- France Steadiness of Commerce at 6:45 am GMT

- U.S. NFIB Enterprise Optimism Index at 10:00 am GMT

- Canada Ivey PMI at 2:00 pm GMT

- U.S. Shopper Inflation Expectations at 3:00 pm GMT

- U.S. Shopper Credit score Change at 7:00 pm GMT

- U.S. API Crude Oil Inventory Change at 8:30 pm GMT

The primary occasion for the day is the Reserve Financial institution of Australia’s (RBA) financial coverage choice, throughout which policymakers are anticipated to chop rates of interest whereas in all probability suggesting a slower tempo of easing down the road.

After that, we’ve bought Canada’s Ivey PMI report lined up for the U.S. buying and selling session, doubtlessly spurring extra volatility for Loonie pairs. As all the time, keep nimble and don’t neglect to take a look at our Foreign exchange Correlation Calculator when taking any trades!