AMCOR PLC – AMC Elliott Wave technical evaluation

As we speak’s Elliott Wave evaluation from TradingLounge focuses on AMCOR PLC (ASX:AMC). We determine important upward potential within the AMC inventory. The chart suggests the start of a 3rd wave. On this breakdown, we element the projected worth targets and the invalidation degree that defines the validity of this wave forecast.

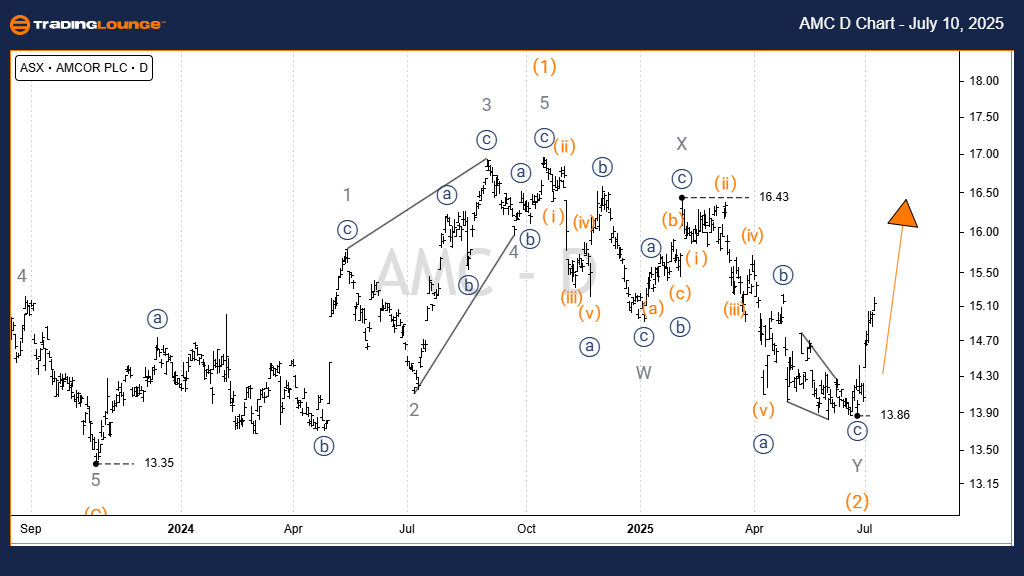

AMCOR PLC – AMC one-day chart (semilog scale) evaluation

-

Operate: Main pattern (Intermediate diploma, Orange).

-

Mode: Motive.

-

Construction: Impulse.

-

Place: Wave 3) – orange.

Particulars:

Wave 3) – orange might now be progressing upward. From the 13.35 low, wave 3)) – navy is advancing and seems prolonged. It breaks down additional into wave 1),2) – orange, which appears to have concluded. Following the 13.82 low, wave 3) – orange is shifting increased, aiming at a goal between 17.56 and 20.37.

Worth should maintain above 13.82 to assist the continuation towards 5)) – navy.

Invalidation level: 13.86

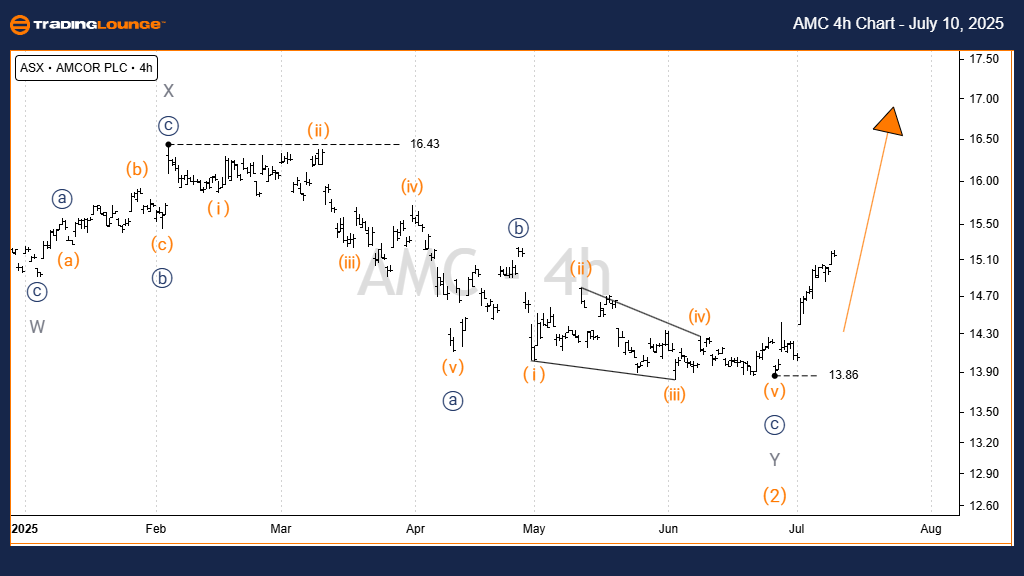

AMCOR PLC – AMC 4-hour chart evaluation

-

Operate: Main pattern (Intermediate diploma, orange).

-

Mode: Motive.

-

Construction: Impulse.

-

Place: Wave 3) – orange.

Particulars:

The wave construction continues upward. The inventory is approaching the earlier excessive at 16.43 and prone to pursue increased ranges. To take care of this outlook, the worth should keep above 13.86.

Invalidation level: 13.86

Conclusion

This technical forecast on AMCOR PLC (AMC) presents insights into each the broader market course and short-term actions. Particular validation and invalidation worth ranges assist the boldness on this Elliott Wave rely. By means of exact wave monitoring and disciplined evaluation, we intention to offer knowledgeable and goal perspective for knowledgeable buying and selling.

![AMCOR PLC – AMC Elliott Wave technical forecast [Video]](https://www.cryptojunks.uk/wp-content/uploads/2025/07/AMCOR-PLC-–-AMC-Elliott-Wave-technical-forecast-Video-696x392.png)