Peloton Interactive‘s (PTON -5.06%) woes have continued thus far this yr because the related health firm remains to be struggling to develop and switch a revenue as it has been unable to beat its post-pandemic collapse.

Whereas some traders proceed to hope for a turnaround, there was little signal of 1 in its two quarterly reviews via the primary half of the yr. The inventory additionally fell in June when the Senate blocked spending from Well being Financial savings Accounts (HSAs) on health club memberships and private health actions.

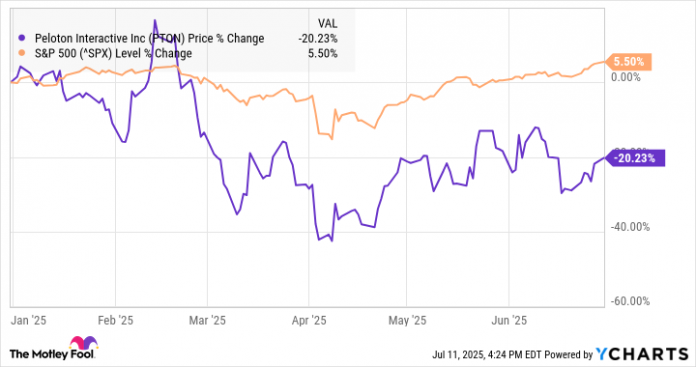

By way of the primary half of the yr, the inventory was down 20% in response to knowledge from S&P International Market Intelligence.

As you may see from the chart beneath, the inventory fell via February and March, and solely managed a modest restoration within the second quarter regardless that the broad market soared.

Peloton remains to be transferring backwards

After asserting final yr that Barry McCarthy would step down as CEO, the corporate started the yr with a brand new chief government, Peter Stern, who’s a co-founder of Apple Health.

Peloton shares had been up briefly in February as traders bid the inventory increased after its Q2 earnings report on Feb. 6 regardless that the enterprise continued to wrestle.

Income fell 9% to $673.9 million, and subscribers and members each fell. The corporate additionally managed to flip a $81.7 million adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) loss from the quarter the yr earlier than to a revenue of $58.4 million.

Later in February and into March, the inventory started to fall at the same time as there was no company-specific information out. As a substitute, the inventory appeared to fall in response to weakening shopper sentiment and the broader decline within the inventory market. As a vendor of high-priced train tools, Peloton is clearly delicate to shopper spending. In April, the corporate introduced a management transition, bringing in Charles Kirol as COO.

In its fiscal Q3 earnings report, income fell once more, declining 13% to $624 million, although its cost-cutting efforts paid off because it continued to slender its usually accepted accounting rules (GAAP) web loss, which improved from $167.3 million to $47.7 million.

On June 17, the inventory fell 12% because the Senate eliminated a provision from a invoice to permit well being financial savings accounts (HSAs) for use for issues like Peloton tools.

Picture supply: Peloton.

What’s subsequent for Peloton

Peloton is making progress on the underside line due to its cost-cutting technique, and it did elevate its income steerage in its most up-to-date report.

Nonetheless, it is arduous to say that its turnaround technique is working till the corporate is ready to exhibit regular progress in each income and subscribers. It might take some time for the corporate to get again there.

Jeremy Bowman has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Peloton Interactive. The Motley Idiot has a disclosure coverage.