The crypto market capitalization hit a report excessive of $4 trillion in July. On the similar time, Bitcoin Dominance dropped to 61.5%, the bottom since April. These are clear indicators that, based on analysts, verify the official begin of the altcoin season.

The essential query now’s when traders ought to exit the market. Primarily based on insights from skilled merchants, this text outlines a number of key components to look at.

Altcoin Buyers Have Begun to See Earnings in July

Most altcoin traders who began shopping for in June are seemingly seeing earnings by now. That’s as a result of the altcoin market cap (TOTAL2) has risen by 44% since then, reaching $1.5 trillion.

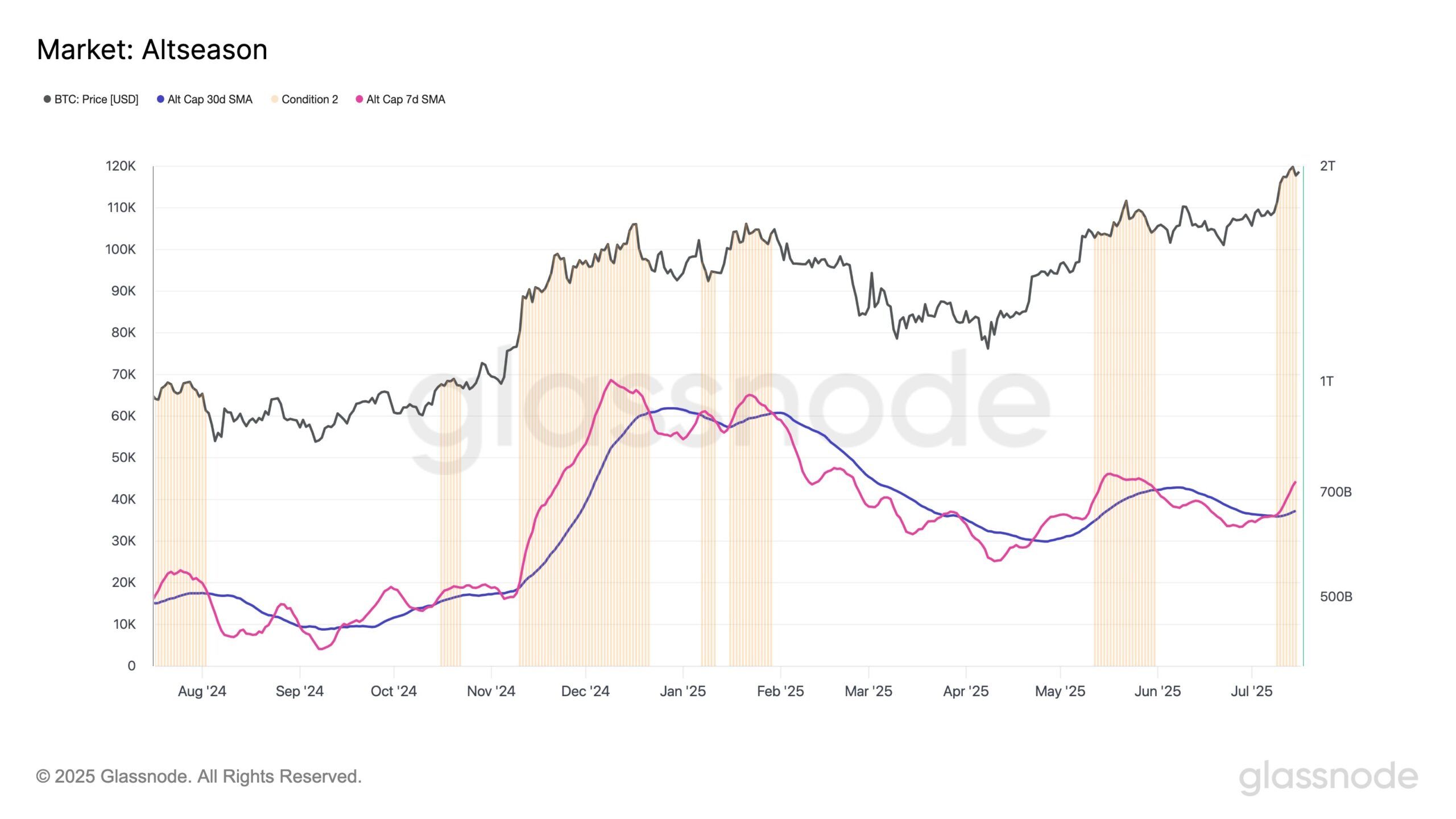

Glassnode’s proprietary indicator confirms capital rotation into altcoins beginning in early July.

“Glassnode’s proprietary Altseason Indicator fired on July 9. This implies stablecoin provides are increasing, capital is flowing into BTC and ETH, and, concurrently, the altcoin market cap is rising — a structural atmosphere conducive to capital rotation,” Glassnode reported.

In the present day, knowledge from CryptoBubbles reveals a inexperienced market. Many altcoins are up between 10% and over 20%.

Nonetheless, historical past reveals that the late 2024 altcoin season led to sharp declines. Many altcoins dropped by 50% to 90%. Many traders didn’t act rapidly and watched their portfolios sink deeper into losses.

That’s why figuring out when to take earnings is as essential as figuring out when altcoin season begins.

Analysts Advocate 4 Components to Decide Exit Timing

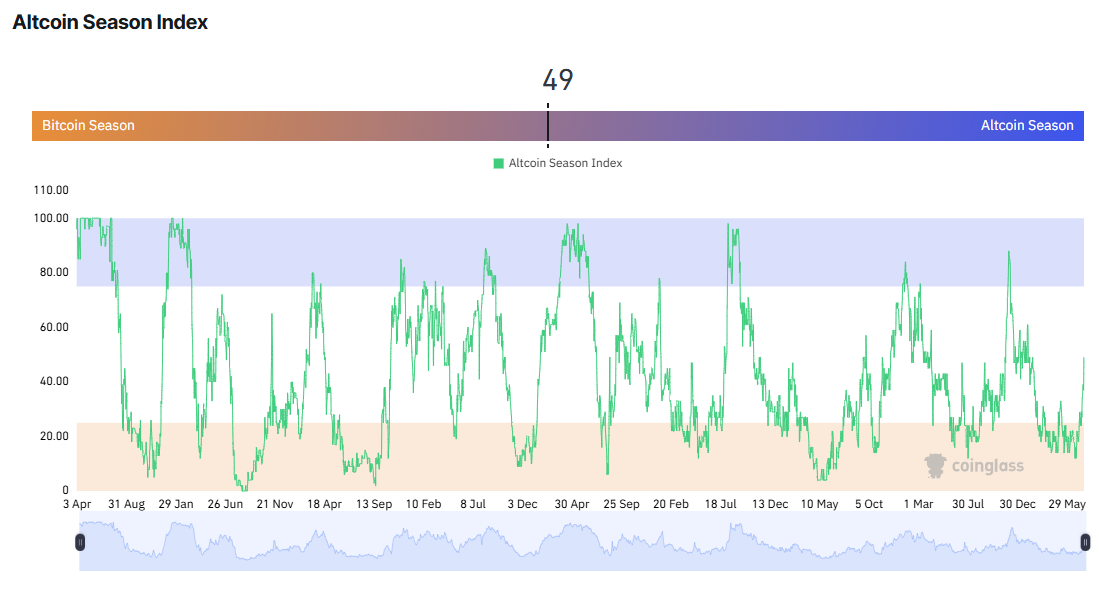

The only and most generally used sign is the Altcoin Season Index. This index is usually used to establish entry factors. However when it hits its higher restrict, it additionally acts as a warning to the broader market.

As of this writing, Coinglass experiences that the index is at 49. When it reaches 70 to 100 factors, traders are suggested to take earnings.

“The Altcoin Season Index is rising, and the altcoin market cap has surged considerably in latest days. When the index reaches above 70, it’s time to promote your altcoins. Proper?” — Coinglass reported.

For different traders, technical evaluation of the altcoin market cap (TOTAL3) is a information. Analysts like Peter Brandt and Greeny consider TOTAL3 is forming a cup-and-handle sample.

Utilizing the measurement principle of that sample, TOTAL3 might attain a goal of $2 trillion. That could be a key level the place altcoin holders ought to contemplate exiting.

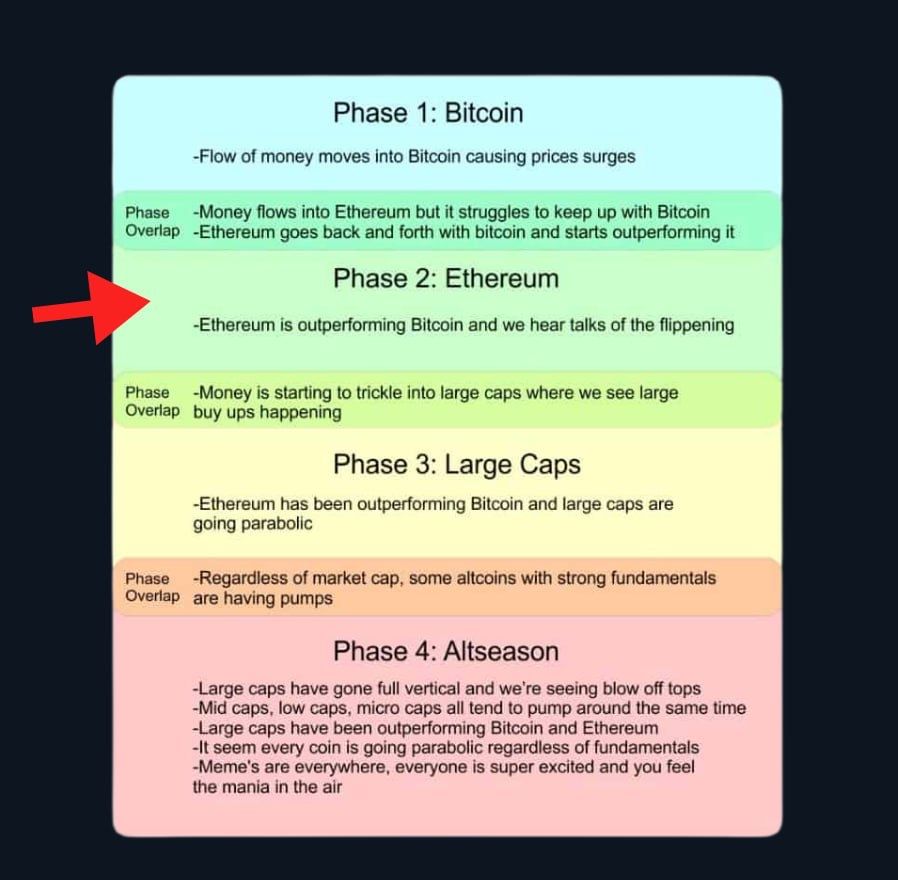

Some traders monitor the capital movement cycle to establish when the season would possibly finish. For instance, investor NekoZ believes the market is now getting into the second part of a four-phase cycle.

“ETH has began to outperform BTC when it comes to returns, which implies we now have moved into the second part of the altcoin season,” NekoZ stated.

On this framework:

- Part 1 is Bitcoin outperforming.

- Part 2 is Ethereum outperforming Bitcoin.

- Part 3 sees large-cap altcoins rally.

- Part 4 is when small-cap altcoins and meme cash pump, usually signaling the ultimate stage of the altcoin season.

Many observers intently monitor this development.

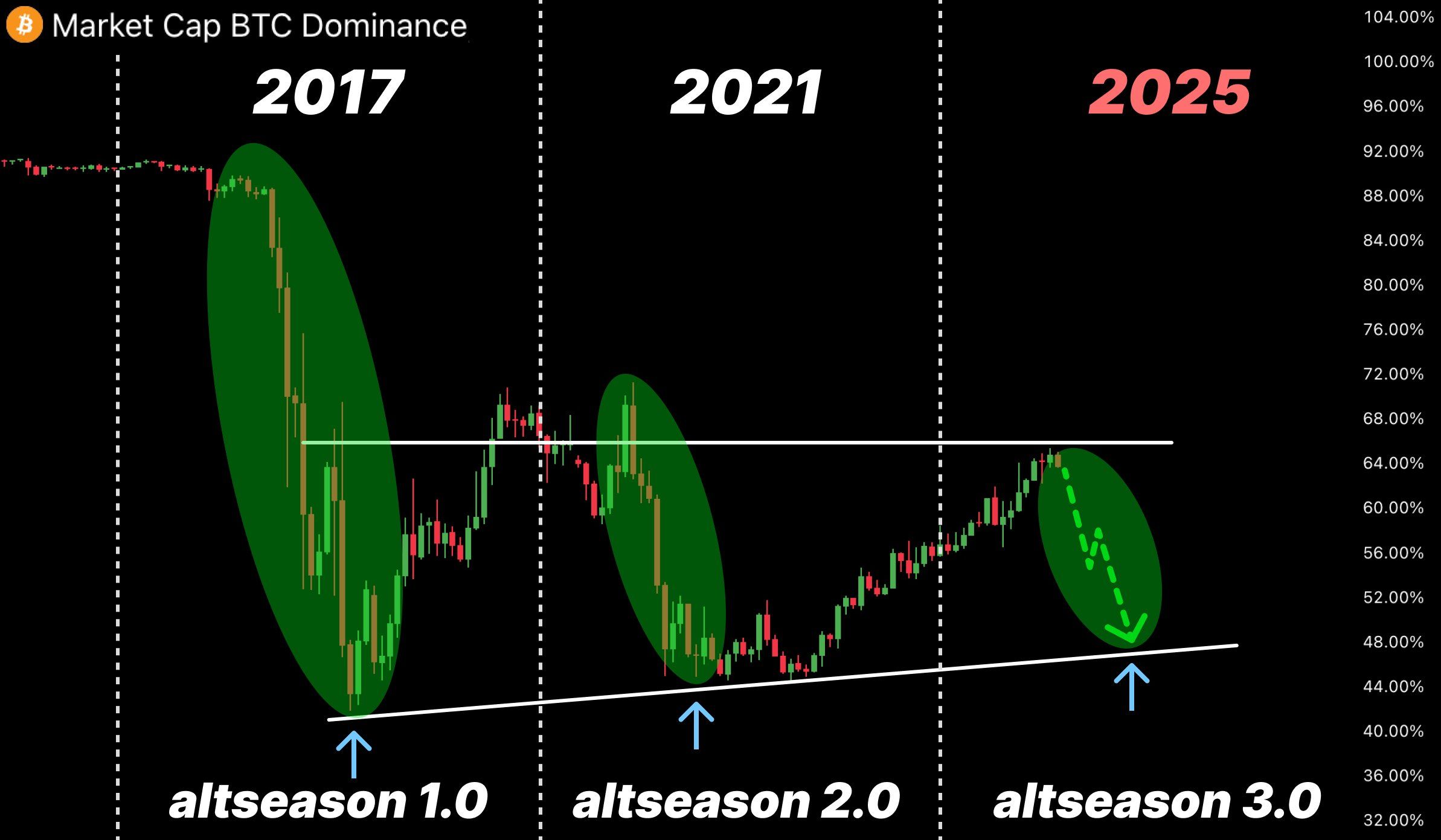

The final issue to contemplate is Bitcoin Dominance (BTC.D). In July, BTC.D decreased from 65.5% to 61%, marking the most important month-to-month drop since November 2024. Analysts, taking a look at trendlines from earlier cycles, consider that the altcoin season could proceed till BTC.D falls to 48% to 50%.

Each investor seemingly has their technique. Nonetheless, historic expertise reveals that holding altcoins for too lengthy usually results in losses, not like Bitcoin, which tends to recuperate higher. Because the market overheats, the dangers develop even increased.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.