A launchpad occasion for Wall Avenue’s benchmark index is the best state of affairs for optimistic long-term traders.

It has been nothing wanting a wild journey for traders during the last seven months. In mid-February, the benchmark S&P 500 (^GSPC -0.01%) logged an all-time closing excessive, with the enduring Dow Jones Industrial Common (^DJI -0.32%) and growth-propelled Nasdaq Composite (^IXIC 0.05%) doing the identical in December.

Then the wheels fell off and heightened volatility kicked in.

Through the first week of April (from the closing bell on April 2 to the shut of buying and selling on April 4), the S&P 500 endured its fifth-largest two-day proportion decline in 75 years. This was adopted lower than every week later by the largest single-day level beneficial properties for the S&P 500, Dow Jones, and Nasdaq Composite of their respective histories.

Picture supply: Getty Photos.

When the inventory market’s main indexes swing wildly, it is completely regular for traders to hunt out prior occasions and metrics that correlate with vital directional strikes within the S&P 500, Dow, or Nasdaq Composite. Regardless that no predictive indicator can assure what’s to return, some correlative occasions and metrics have an uncanny observe file of forecasting future inventory returns.

It simply so occurs {that a} just lately accomplished feat by the S&P 500 factors to a sturdy chance of shares skyrocketing over the approaching 12 months.

Heightened volatility will be the near-term norm for Wall Avenue

However earlier than we glance to the longer term, we first have to look at the previous and perceive the variables which have laid the muse for heightened volatility in 2025.

Arguably nothing has prompted shares to gyrate extra this yr than President Donald Trump’s tariff and commerce insurance policies. Following the shut of buying and selling on April 2, Trump unveiled a ten% international tariff, in addition to increased “reciprocal tariff charges” on dozens of nations which have traditionally had adversarial commerce imbalances with America. This unveiling is what despatched the S&P 500 down 10.5% within the following two buying and selling classes.

Per week later, the S&P 500, Dow, and Nasdaq Composite skyrocketed on a 90-day pause of those increased reciprocal tariff charges — which have once more been paused and adjusted for choose international locations by President Trump till Aug. 1.

The priority with tariffs is twofold. First, there’s the potential for tariffs to reignite the home inflation charge and harm commerce relations with our allies. The secondary difficulty is that the president and his administration have recurrently modified tariff implementation dates and responsibility ranges. Wall Avenue calls for predictability, and traders merely do not get it from the present administration.

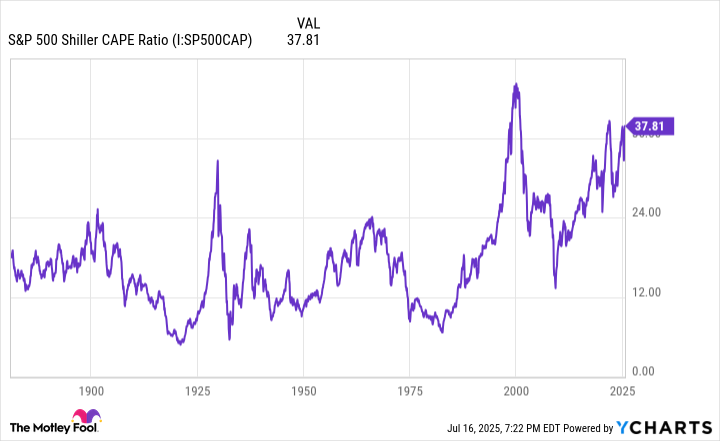

S&P 500 Shiller CAPE Ratio knowledge by YCharts. CAPE = cyclically adjusted price-to-earnings ratio.

Buyers have additionally been tasked with navigating one of many priciest inventory market’s in historical past.

In December, the S&P 500’s Shiller price-to-earnings (P/E) ratio, also called the cyclically adjusted P/E ratio, or CAPE Ratio, hit a a number of of 38.89, which represents the third-priciest studying throughout a steady bull market when back-tested to January 1871. It is nonetheless sitting above 38 on the time of this writing on July 16.

Widening the lens a bit additional, there have solely been six situations in 154 years the place the Shiller P/E has surpassed and held a a number of of 30 for not less than two months, together with the current. All 5 prior occurrences resulted in the S&P 500, Dow, and/or Nasdaq Composite dropping not less than 20% of their worth.

The opposite prime catalyst that is prompted Wall Avenue to wobble is Moody’s downgrade of the US’ credit standing to AA1 from AAA. Moody’s was the third and closing main credit-rating company to downgrade the U.S. from the best attainable score.

Whereas the U.S. economic system continues to fireplace on all cylinders, this downgrade serves as a reminder that America’s quickly rising nationwide debt is anticipated to, someday, turn into unsustainable. That is one other occasion of uncertainty creeping into the minds of traders.

Picture supply: Getty Photos.

We simply noticed the S&P 500 do one thing exceptionally uncommon — and it bodes properly for optimists

With a greater understanding of why inventory market volatility has been heightened in 2025 (and may proceed for the foreseeable future), let’s circle again to the extremely distinctive feat just lately accomplished by the S&P 500 that, traditionally talking, factors to vital future upside in shares.

When Wall Avenue’s main inventory indexes take the elevator decrease, it is not unusual for traders’ feelings and worry to return into play. However one of many extra attention-grabbing quirks in regards to the inventory market is that the most effective funding alternatives usually happen when issues appear their most dire.

As identified earlier, the S&P 500 shed 10.5% between the closing bells on April 2 and April 4 and inched near a bear market by the closing bell on April 8. As for the Nasdaq Composite, it did fall right into a bear market on April 8 — its first since 2022.

However starting on April 9, all three main indexes started to rally in an enormous method, they usually have not regarded again. For under the sixth time for the reason that begin of 1950, the broad-based S&P 500 has gained greater than 25% over a three-month interval.

The S&P 500 is up 26% the previous three months, one of many biggest three month returns ever.

On the floor this may sound like weak point is coming, however that is not essentially true. By no means decrease 3, 6, and 12 months later with above avg returns throughout the board as properly. pic.twitter.com/YZM1Q76Seu

— Ryan Detrick, CMT (@RyanDetrick) July 13, 2025

As you may see within the desk above from Carson Group Chief Market Strategist Ryan Detrick, Wall Avenue’s most-encompassing index has tallied a 26% three-month acquire. Though forecasting returns within the S&P 500 a month after one in every of these outsize return intervals has been a little bit of a crapshoot, there’s been no mistaking how properly the S&P 500 has carried out one yr after these phenomenal three-month beneficial properties.

Following the 5 earlier situations the place the S&P 500 rallied not less than 25% in three months, the index was up by a median of 21.4% one yr later. As compared, the S&P 500 has averaged a 9.2% annualized return since 1950. In different phrases, the S&P 500 has, traditionally, greater than doubled its common annual return following one in every of these uncommon launchpad moments.

What Detrick’s knowledge set speaks to is the nonlinearity of funding cycles, which overwhelmingly favors optimistic long-term traders.

In June 2023, researchers at Bespoke Funding Group in contrast the calendar-day size of each bull and bear market within the benchmark index relationship again to the beginning of the Nice Despair (September 1929). What they discovered was a night-and-day distinction.

Whereas the typical S&P 500 bear market has resolved in 286 calendar days (about 9.5 months) over a virtually 94-year interval, the everyday bull market endures for roughly 3.5 instances as lengthy — 1,011 calendar days (roughly two years and 9 months).

Irrespective of how worrisome elevator-down strikes within the S&P 500, Dow Jones Industrial Common, and Nasdaq Composite could appear, they’re traditionally short-lived and provides technique to a few of Wall Avenue’s greatest funding alternatives.