Synthetic intelligence (AI) investing stays on the forefront of the market as corporations proceed to speculate billions of {dollars} on this rising know-how. We have barely scratched the floor of what an AI-first financial system seems like, and to attain this, we’ll have to construct out considerably extra computing capability.

This can be a bullish signal for a lot of corporations on this house, and I imagine 4 corporations are significantly sensible investments to make proper now. So, if in case you have $1,000 (or some other greenback quantity) out there to deploy, beginning with these 4 is a superb thought.

Picture supply: Getty Photographs.

AI {hardware}: Nvidia and Taiwan Semiconductor Manufacturing

On the {hardware} facet of issues, Nvidia (NVDA -0.42%) has been king of the AI world because the AI race started. Its graphics processing items (GPUs) are extensively deployed in AI functions and have established themselves because the go-to possibility, with a market share of 90%.

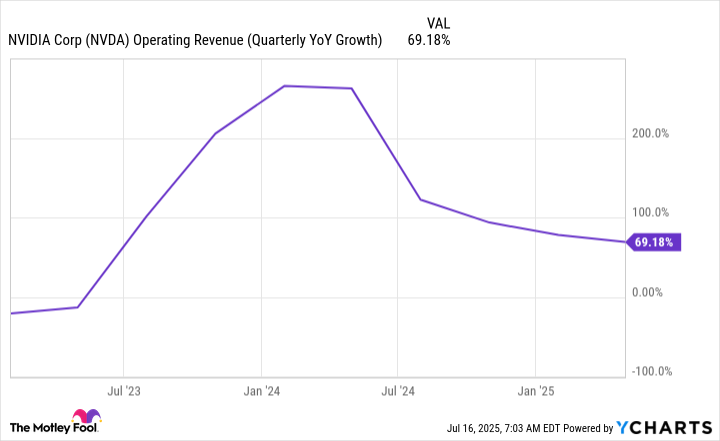

Nvidia has a number of bullish elements brewing, together with the corporate reapplying for an export license to renew delivery GPUs to China, whereas being given assurances by the U.S. authorities that this license will likely be permitted. This can assist reaccelerate Nvidia’s development fee, because it initiatives second quarter income to develop 50% yr over yr; nevertheless, it could have been projected to grown 77% if Nvidia have been allowed to promote into China throughout Q2.

That is an enormous enhance and would permit Nvidia to maintain its jaw-dropping development fee additional into the longer term. This can be a bullish signal for Nvidia’s inventory, underscoring that Nvidia is not going anyplace within the AI world.

NVDA Working Income (Quarterly YoY Progress) knowledge by YCharts

Taiwan Semiconductor Manufacturing (TSM -2.12%) is a key provider to Nvidia, as the corporate cannot produce chips for its GPUs in-house. As an alternative, it purchases them from TSMC, the main chip foundry. Taiwan Semiconductor has risen to the highest by providing cutting-edge know-how alongside best-in-class chip yields, which reduces scrap prices, resulting in elevated revenue for TSMC and higher costs for its prospects.

TSMC expects huge development from AI to proceed for a while. In the beginning of 2025, administration projected that AI-related income would develop at a forty five% compounded annual development fee (CAGR) for 5 years. Chip orders are sometimes positioned years prematurely, so when administration tells buyers that important development is coming, they need to take discover.

Each Nvidia and TSMC are poised for important development within the years to come back, making them glorious shares to purchase now and maintain for the long run.

Cloud computing: Amazon and Alphabet

One other trade that is benefiting from AI deployment is cloud computing. Many corporations cannot afford to construct an costly knowledge middle that is probably not used to its full capability, so it makes extra sense to hire that computing energy from a supplier like Amazon (AMZN 0.97%) by way of Amazon Net Companies (AWS) or Alphabet‘s (GOOG 0.67%) (GOOGL 0.81%) Google Cloud.

Grand View Analysis discovered that the worldwide cloud computing market dimension was round $750 billion in 2024, however that is anticipated to broaden to $2.4 trillion by 2030. That development is powered by each AI and non-AI workloads migrating to the cloud, and firms like Amazon and Alphabet are properly positioned to revenue from this development.

Every can also be a important a part of its mother or father firm’s revenue image. Within the first quarter, AWS accounted for 63% of Amazon’s working income, regardless of comprising solely 19% of complete income. AWS is the revenue driver for Amazon, and with its market-beating development, it is slated to proceed driving Amazon’s inventory increased.

Google Cloud remains to be working towards AWS’ spectacular 39% working margin, because it posted an 18% margin in Q1. Nonetheless, it is rising sooner than AWS (28% development versus 17% development) and will change into a considerable a part of Alphabet’s revenue image within the coming years. Cloud computing suppliers, similar to Amazon and Alphabet, are additionally benefiting from the rise of AI. With the general cloud computing market anticipated to broaden quickly over the following few years, these shares make for sensible buys now.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has positions in and recommends Alphabet, Amazon, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.