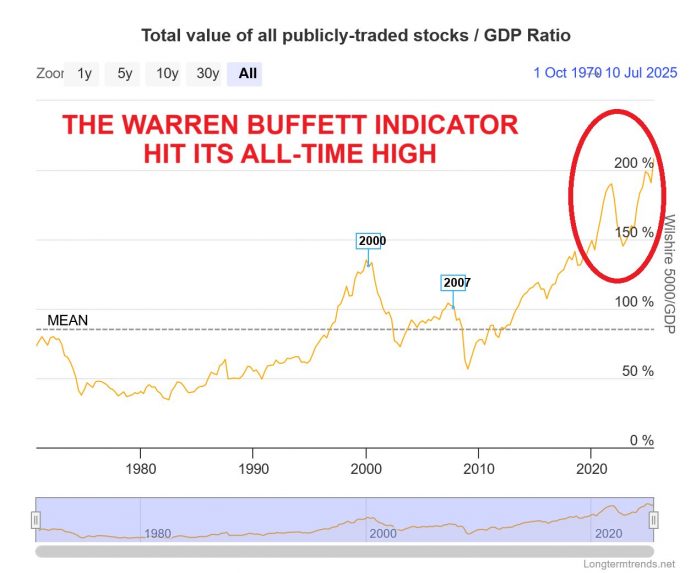

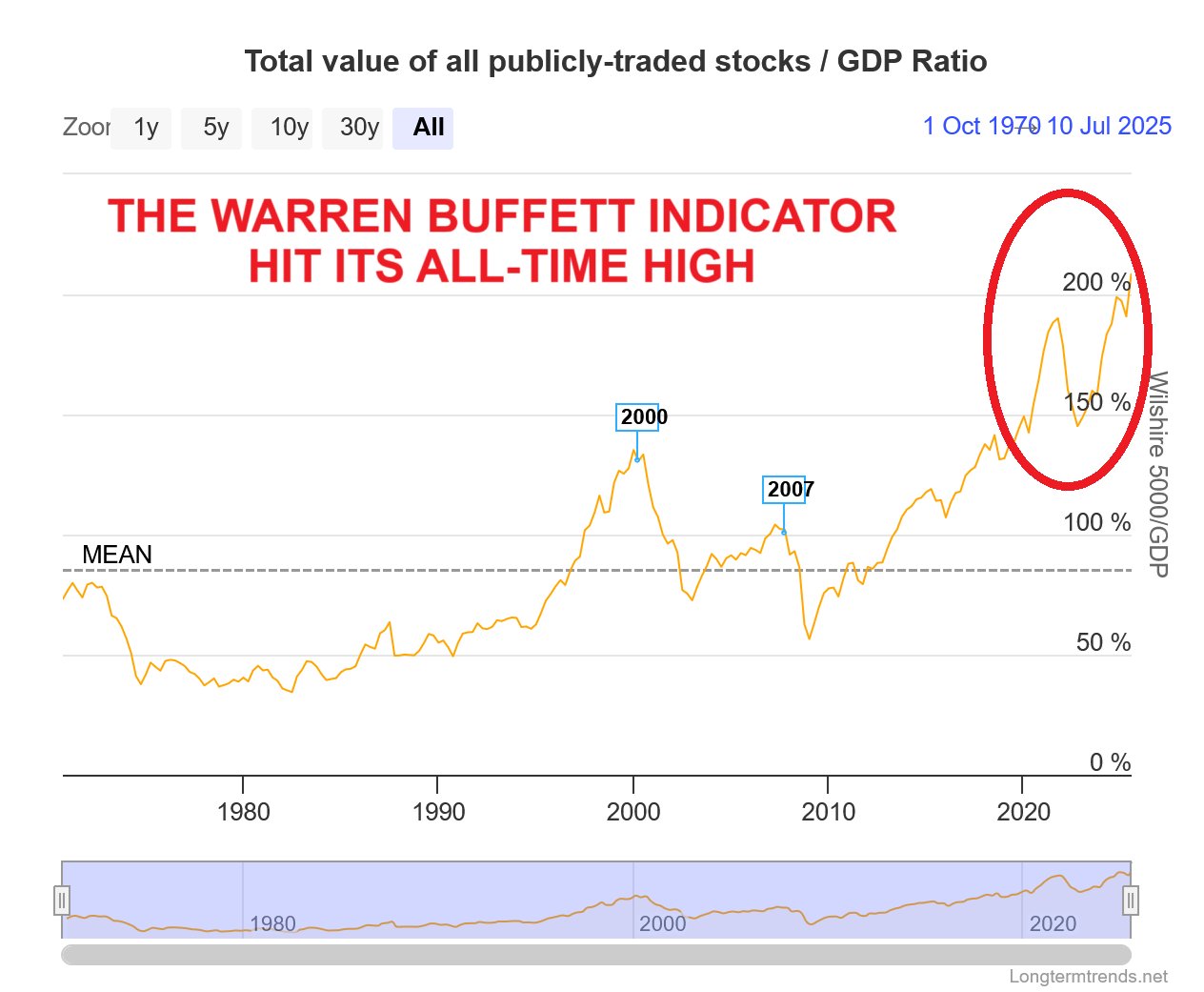

The Warren Buffett indicator has by no means been larger: The US inventory market capitalization to GDP ratio hit a report 210% and rose 45 share factors over the past three months. By comparability, the 2000 Dot-Com Bubble peak was ~144%.

1. The Warren Buffett Indicator: The “Finest Single Measure” of Market Valuation

The Warren Buffett Indicator measures the overall market capitalization of all publicly traded shares relative to a rustic’s Gross Home Product. This easy ratio gained prominence when Warren Buffett described it as “in all probability one of the best single measure” of the place inventory market valuations stand at any given second.

The calculation entails taking the mixed market worth of all publicly traded corporations and dividing it by the nation’s annual GDP, expressed as a share. Buffett endorses this metric as a result of it could possibly seize whether or not inventory costs have turn out to be disconnected from the underlying financial actuality that ought to theoretically assist them.

2. How This Easy Ratio Reveals Market Fact

The financial logic behind this indicator rests on a basic precept. Over the long run, inventory market values ought to roughly correspond to a nation’s productive capability and financial output. When corporations collectively commerce for considerably greater than the economic system produces, it means that market costs have turn out to be indifferent from financial fundamentals.

Excessive readings sometimes point out that shares are costly relative to the underlying financial exercise, whereas decrease readings might sign undervaluation. This relationship offers buyers a broad perspective on whether or not markets are buying and selling at cheap ranges in comparison with the actual economic system, supporting company earnings and progress.

3. A forty five-12 months Journey: From Stability to Hypothesis

The Warren Buffett Indicator’s journey from 1979 to 2025 tells a compelling story of evolving market dynamics. In the course of the early interval from 1979 by means of the Nineteen Nineties, the indicator remained comparatively secure, sometimes ranging between 30% and 60%. This period represented a time when inventory valuations maintained nearer alignment with conventional financial fundamentals and GDP progress.

The steadiness of those many years contrasts sharply with the dramatic will increase that will observe, marking a transparent shift in how markets started to worth corporations relative to financial output. This baseline interval is crucial for understanding how dramatically market valuations have modified over subsequent many years.

4. The Dot-Com Bubble Warning That Labored

The indicator’s credibility as a warning sign was established through the late Nineteen Nineties expertise growth. As web and expertise shares soared to unprecedented ranges, the Warren Buffett Indicator climbed to roughly 144% by 2000. This excessive studying preceded one in every of fashionable historical past’s most vital market corrections, because the dot-com bubble burst and expertise shares crashed all through 2000 and 2001.

The indicator’s potential to determine this overvaluation earlier than the correction occurred demonstrated its worth as a broad market evaluation software. Following the bubble’s collapse, the ratio declined considerably, confirming that the acute studying had certainly signaled harmful overvaluation.

5. 2007’s Purple Flag: One other Correct Market Sign

The indicator offered one other correct warning sign resulting in the 2008 monetary disaster. In 2007, the ratio once more reached elevated ranges that preceded the following market collapse and the Nice Recession. Whereas not as excessive because the dot-com peak, this studying as soon as once more demonstrated the indicator’s potential to determine durations when market valuations had turn out to be unsustainable relative to financial fundamentals.

The sample of maximum readings adopted by vital market corrections bolstered the metric’s repute as a dependable gauge of broad market overvaluation. The 2007-2008 expertise additional validated Buffett’s evaluation of this ratio as an important market measurement software.

6. Breaking Data: 210% and Climbing Quick

As we speak’s Warren Buffett Indicator studying has reached an unprecedented 210%, considerably shattering all earlier data. This present stage of 210% exceeds the all-time excessive of 144% reached through the dot-com bubble by 46 share factors. By no means earlier than within the indicator’s historical past has the ratio reached such excessive ranges, putting present market situations in uncharted territory.

The magnitude of this studying means that inventory market valuations have turn out to be extra divorced from financial fundamentals than throughout any earlier interval, together with essentially the most infamous speculative bubbles of latest many years.

7. 45 Factors in 3 Months: When Markets Lose Contact with Actuality

The indicator’s speedy acceleration over simply three months stands out, with the ratio climbing 45 share factors on this temporary timeframe. Such dramatic will increase sometimes sign speculative exercise quite than gradual appreciation based mostly on bettering financial fundamentals or company earnings progress.

This tempo of enhance means that market costs have turn out to be more and more indifferent from the underlying financial actuality that ought to theoretically assist inventory valuations. The pace of this rise distinguishes it from extra gradual market appreciations that may mirror real financial enchancment or company efficiency enhancement.

8. Why This Makes the Dot-Com Bubble Look Tame

The present 210% studying makes the notorious dot-com bubble seem modest by comparability. At 46% larger than the earlier report of 144%, as we speak’s market valuation represents a stage of disconnection from financial fundamentals that exceeds even essentially the most infamous speculative interval in latest reminiscence.

This comparability offers an important perspective on the present scenario’s unprecedented nature. The dot-com period, broadly thought to be one in every of historical past’s most excessive examples of market hypothesis, has been considerably surpassed by present valuation ranges. This improvement locations the current market surroundings in a completely totally different class.

9. What Modified? Expertise, Globalization, and Trendy Markets

A number of structural modifications within the world economic system might assist clarify why the indicator has reached such excessive ranges. The rise of asset-light expertise corporations has essentially altered how companies create worth, doubtlessly justifying larger market capitalizations relative to conventional GDP measures.

Moreover, many giant US firms generate substantial income from worldwide operations, that means their market values might mirror world quite than purely home financial exercise. Modifications in financial coverage over latest many years, together with prolonged durations of low rates of interest, have additionally influenced how buyers worth future money flows and progress prospects.

10. The Focus Downside: When a Few Giants Skew All the pieces

The extraordinary focus of market worth in a handful of mega-capitalization expertise corporations considerably influences the general ratio. When a number of corporations command huge market capitalizations, their collective impression on the overall market-to-GDP calculation turns into substantial.

This focus impact implies that the valuations of those dominant corporations can drive the whole indicator to excessive ranges, even when the broader market stays extra moderately valued. The mathematical impression of this focus creates a scenario the place conventional valuation metrics might not absolutely seize the nuanced actuality of recent market construction.

11. Historical past’s Monitor Report: What Occurred After Earlier Peaks

Historic proof demonstrates a transparent sample of great market corrections following excessive Warren Buffett Indicator readings. The 2000 and 2007 peaks have been adopted by substantial bear markets that introduced valuations again towards extra sustainable ranges.

The post-2000 expertise crash and the 2008 monetary disaster confirmed the indicator’s potential to determine unsustainable market situations earlier than main corrections occurred. Whereas previous efficiency can’t predict future outcomes, this historic monitor report establishes the indicator’s credibility as a broad market evaluation software and highlights the importance of maximum readings.

12. The Timing Dilemma: Being Proper vs. Being Early

Whereas the Warren Buffett Indicator has confirmed efficient at figuring out overvalued market situations, it offers restricted steering on the timing of potential corrections. Markets can stay elevated for prolonged durations, significantly in environments characterised by accommodative financial coverage or sturdy investor sentiment.

The indicator’s power lies in figuring out when valuations have turn out to be excessive relative to financial fundamentals, quite than predicting precisely when market corrections would possibly happen. This limitation implies that whereas the metric can sign warning, it shouldn’t be used as a short-term market timing software.

13. Uncharted Territory: Are We within the Largest Bubble Ever?

The present 210% studying locations markets in uncharted territory, elevating basic questions on whether or not we’re witnessing the most important speculative bubble in fashionable monetary historical past or structural financial modifications have created a brand new regular for market valuations.

The indicator now stands at roughly thrice its long-term historic common, representing a deviation stage with no historic precedent. This excessive studying forces consideration of two prospects: both present situations characterize essentially the most vital market bubble ever recorded, or basic financial modifications require a whole recalibration of what constitutes regular valuation ranges.

Conclusion

The Warren Buffett Indicator’s record-breaking 210% studying delivers an unmistakable message about present market situations. This unprecedented stage, far exceeding even the dot-com bubble’s peak, calls for severe consideration from buyers, policymakers, and market contributors.

Whereas structural modifications within the fashionable economic system might present some justification for larger baseline valuations, the acute nature of the present studying means that warning is warranted.

The indicator’s historic monitor report of previous main market corrections, mixed with its unprecedented stage, creates a scenario that deserves cautious monitoring and considerate consideration in any funding technique or market evaluation.