A number of shares within the quantum computing realm are buying and selling at traditionally excessive valuations.

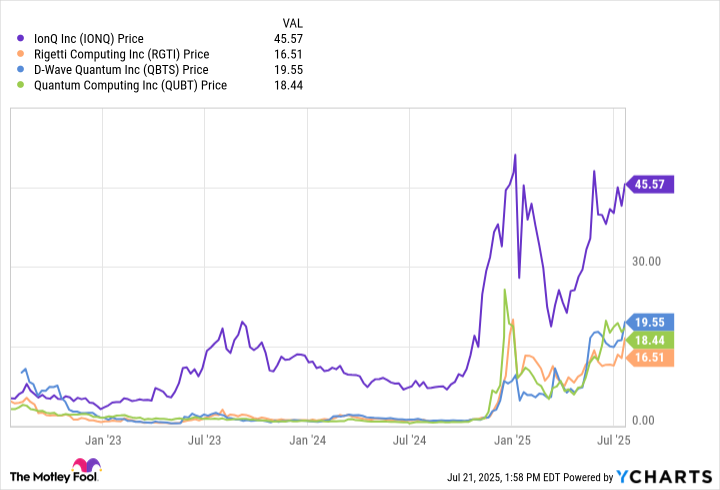

Final summer season, firms similar to IonQ (IONQ -1.80%), Rigetti Computing (RGTI -3.29%), D-Wave Quantum (QBTS -4.45%), and Quantum Computing (QUBT -1.42%) had been unknown penny shares.

Nonetheless, as quantum computing steadily made its method towards heart stage within the synthetic intelligence (AI) realm, every of those firms witnessed meteoric rises of their share costs. Over the past 12 months, IonQ inventory has blasted increased by 517%, whereas Rigetti, D-Wave, and Quantum Computing have skilled surges of no less than 1,500% as of this writing (July 21).

With valuations reaching traditionally excessive ranges, may buyers be on the verge of witnessing a quantum computing bubble bursting?

Is quantum computing in a bubble?

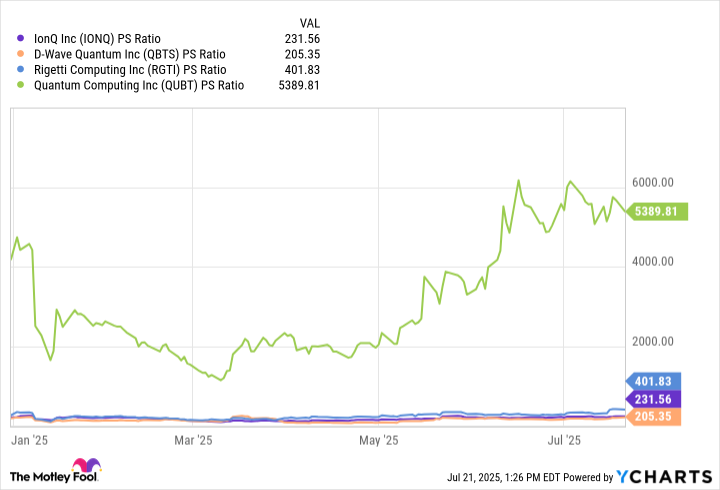

The chart beneath illustrates valuation developments amongst common quantum computing shares on a price-to-sales (P/S) foundation.

IONQ PS Ratio knowledge by YCharts.

As I outlined in a previous article, the quantum computing shares above are buying and selling at far increased P/S multiples in comparison with ranges seen through the dot-com and COVID-19 inventory bubbles.

For instance, through the web growth within the late Nineties, shares similar to Amazon, Cisco, and Microsoft skilled peak P/S ratios within the vary of 30x and 40x. Taking this a step additional, common COVID shares similar to Zoom Communications and Peloton noticed P/S multiples high out at 124x and 20x, respectively.

The massive theme right here is that IonQ, Rigetti, D-Wave, and Quantum Computing are every buying and selling for valuation multiples that could possibly be seen as traditionally excessive, even when in comparison with prior bubble occasions.

With that stated, different AI firms which might be additionally exploring quantum computing — similar to Nvidia, Amazon, Alphabet, and Microsoft — at present commerce for rather more cheap valuation multiples when in comparison with the businesses within the chart above.

For that reason, I don’t assume the whole quantum computing panorama is prone to experiencing a bubble-bursting occasion. Nonetheless, IonQ and its friends have been dropping some breadcrumbs in latest months that lead me to assume the smaller quantum computing gamers could possibly be on the verge of a harsh sell-off.

Picture supply: Getty Photos.

What is going on on underneath the hood with quantum computing shares?

After some digging into sure filings with the Securities and Trade Fee (SEC), I feel IonQ, Rigetti, D-Wave, and Quantum Computing could also be making an attempt to sign some vital issues to buyers:

What’s actually happening right here? With every of those quantum computing shares buying and selling close to all-time highs, it seems to me that administration is seeking to reap the benefits of frothy market situations.

Quantum computing is a research-heavy, capital-intensive trade. Administration at IonQ and its friends absolutely perceive this, and so I see these capital raises as a calculated transfer to capitalize on inflated, overstretched valuations.

Do you have to spend money on quantum computing shares?

To me, any trace of a bubble surrounding IonQ and its smaller friends might already be within the strategy of bursting. Beneath the floor, the assorted inventory issuances and fairness choices annotated above may recommend that administration doesn’t consider present value ranges are sustainable.

Through the use of the dot-com and COVID bubbles as benchmarks, historical past would recommend {that a} main correction could possibly be on the horizon for these small quantum computing shares. Issuing inventory to boost funds isn’t sustainable in the long term. Moreover, persistently diluting shareholders via these choices may name into query how these firms are allocating capital.

In my eyes, if buyers are in search of publicity to the quantum computing trade, they’re greatest off exploring extra diversified alternatives in huge tech versus the smaller, extra speculative gamers analyzed on this piece.

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Cisco Programs, Microsoft, Nvidia, Peloton Interactive, and Zoom Communications. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.