Buyers contemplating which of those two shares to purchase proper now have a simple option to make.

CoreWeave (CRWV -3.65%) and Nebius Group (NBIS -0.90%) have witnessed a fast bounce of their share costs this 12 months. Buyers have been shopping for these shares hand over fist as a result of they’re benefiting huge time from the rising demand for cloud-based synthetic intelligence (AI) infrastructure.

CoreWeave inventory has shot up a exceptional 224% in simply 4 months since going public in March this 12 months, and Nebius has clocked wholesome features of 84% up to now in 2025. Each firms are within the enterprise of renting out knowledge facilities powered by graphics processing items (GPUs), which their clients use to coach AI fashions, construct purposes, and scale up these purposes within the cloud.

But when you need to select certainly one of these two shares to your portfolio proper now, which one ought to it’s? Let’s discover out.

Picture supply: Getty Photographs.

The case for CoreWeave

CoreWeave’s rally since its preliminary public providing (IPO) may be attributed to the terrific progress within the firm’s income and backlog. Its high line jumped by greater than fivefold within the first quarter to $981 million, and it is on observe to maintain its excellent momentum.

That is as a result of the cloud infrastructure-as-a-service market wherein CoreWeave operates is rising at an unbelievable tempo. Grand View Analysis estimates that the cloud AI market might generate $650 billion in annual income in 2030, practically 7.5 occasions the dimensions of this market final 12 months. CoreWeave is capitalizing on this profitable alternative by providing entry to the top-of-the-line GPUs from Nvidia together with server processors from AMD.

The corporate claims that clients utilizing its cloud AI infrastructure take pleasure in important value and efficiency benefits. It says its infrastructure is “purpose-built for compute-intensive workloads, and every thing from our servers to our storage and networking options are designed to ship best-in-class efficiency.”

The demand for the corporate’s AI infrastructure is outpacing provide, so it’s centered on scaling up its capability rapidly to fulfill the robust demand. Administration mentioned on its Could earnings convention name that it has raised over $21 billion to develop infrastructure and knowledge heart capability.

The corporate just lately introduced the upcoming $9 billion acquisition of Core Scientific, which might convey one other 1 gigawatt (GW) of knowledge heart capability and assist decrease its prices from its present leases with Core Scientific.

CoreWeave forecasts a discount of over $10 billion in future lease liabilities as soon as the acquisition is full, adopted by annual run-rate value financial savings of $500 million by the top of 2027. Earlier than this acquisition was introduced, CoreWeave was projecting a fourfold enhance in its knowledge heart capability below its present capability contracts.

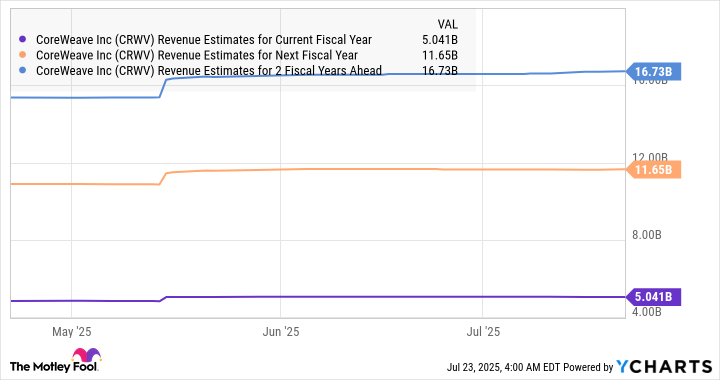

This concentrate on enhancing knowledge heart capability ought to pave the way in which for excellent progress for CoreWeave because it was sitting on a income backlog of just about $26 billion on the finish of the primary quarter — 63% larger from the year-ago interval. As such, analysts predict its income to proceed growing at a robust tempo.

CRWV Income Estimates for Present Fiscal 12 months; knowledge by YCharts.

CoreWeave is prone to stay a high AI inventory since it’s serving a fast-growing market and is investing aggressively to seize a share of it.

The case for Nebius

Nebius shot up impressively final week after Goldman Sachs put a 12-month value goal of $68 on the inventory. The funding financial institution mentioned that the corporate’s full-stack AI infrastructure, which incorporates {hardware} and software program instruments, permits it to profit from the spectacular alternative on this house.

Goldman’s value goal requires a 31% bounce within the inventory within the coming 12 months. And there’s a good probability that the corporate might surpass that given its 385% income bounce 12 months over 12 months within the first quarter to $55 million. Extra importantly, the expansion in its annual income run fee was a lot sooner at 684% 12 months over 12 months to $249 million.

That improved to $310 million in April, and the corporate forecasts an annual income run fee of $750 million to $1 billion by the top of the 12 months, pushed by the brand new knowledge heart capability it’s planning. In a letter to shareholders, CEO Arkady Volozh mentioned:

We’re quickly increasing our capability footprint. In simply three quarters, we have gone from one location in Finland to 5 areas throughout Europe, the U.S., and now the Center East. We’re actively exploring new websites within the U.S. and around the globe, and we anticipate to offer extra information on this quickly.

Not like CoreWeave, Nebius offers extra than simply AI {hardware} infrastructure to clients. Its cloud platform additionally affords developer instruments and companies that clients can make use of to refine their AI fashions, run inference duties, and develop customized options. For this reason Goldman believes that Nebius might be a pacesetter within the cloud AI house.

The corporate’s stability sheet — with $1.45 billion in money and $188 million in debt — permits it to proceed placing extra money into its cloud infrastructure. This explains the wholesome top-line progress it’s projected to ship.

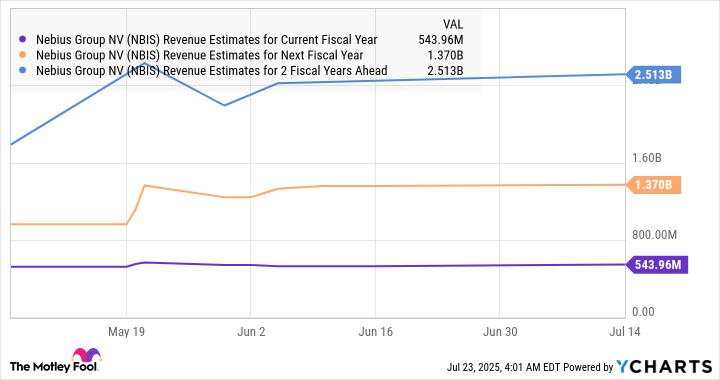

NBIS Income Estimates for Present Fiscal 12 months; knowledge by YCharts.

So, like CoreWeave, Nebius is prone to stay a high-growth firm. However is it a greater purchase than its bigger peer at this level?

The decision

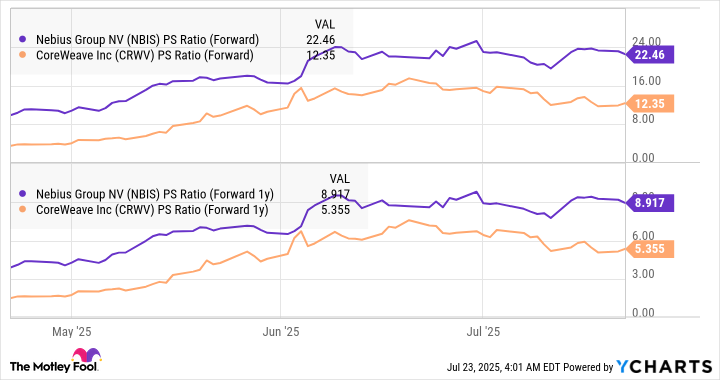

Each CoreWeave and Nebius are rising at wholesome charges and are anticipated to maintain that. So, traders ought to have a look at their valuations to determine which is the higher purchase.

The 2 firms aren’t worthwhile proper now contemplating their aggressive infrastructure investments, so we have to evaluate their price-to-sales ratios (P/S).

NBIS PS Ratio (Ahead); knowledge by YCharts.

Nebius inventory is far more costly than CoreWeave when evaluating gross sales multiples, indicating that the latter is a greater purchase even after its robust rally this 12 months. Furthermore, CoreWeave is rising sooner, has an enormous backlog, and is sitting on ample assets to proceed increasing its knowledge heart footprint, making it the straightforward alternative for traders contemplating which of those two AI shares is price including to their portfolios proper now.