Ever felt like your buying and selling selections make sense in idea, however within the second, one thing simply… takes over?

Possibly you’ve received a transparent setup, a stable plan, and an outlined cease loss.

However as quickly because the commerce is stay, every little thing adjustments.

Your coronary heart races, your thoughts spins, and earlier than it, you’re slicing income early or letting losses run.

Concern and greed, sound acquainted?

Most merchants give attention to discovering the right setup or entry approach, however they overlook the invisible forces that derail execution…

Concern of loss.

Concern of lacking out.

Greed for extra.

These aren’t simply surface-level emotions. They’re hardwired organic responses.

And in the event you don’t be taught to work with them, they’ll quietly sabotage your edge.

That’s precisely what this text is right here to unpack.

Right here’s what you’ll discover:

- How your fight-or-flight system will get triggered even once you’re not in actual hazard

- Why actual cash adjustments the way in which your mind processes selections

- The distinction between being emotional and being irrational

- Sensible instruments to scale back emotional interference

- Actual chart-based examples displaying how concern and greed have an effect on merchants within the second

Whether or not you’re battling hesitation, impulsive exits, or revenge trades, understanding the emotional facet of buying and selling will be the lacking hyperlink to better consistency.

So let’s dive in.

Why Concern and Greed Are So Highly effective

Let’s get one thing straight: concern and greed in buying and selling aren’t simply “emotions.”

And until you perceive what’s occurring behind the scenes, these responses can quietly take over your selections with out you even realizing it.

Struggle-or-Flight in Buying and selling

Everytime you enter a commerce, you’re taking a threat.

You’re placing one thing precious at stake… your cash!

Regardless that you’re bodily protected, your mind doesn’t see it that manner….

Take into consideration what life was like 1000’s of years in the past.

Danger meant dealing with a predator or life-or-death survival conditions.

In entrance of your charts, your mind treats monetary threat the identical manner it handled bodily hazard again then.

When a commerce strikes in opposition to you, your physique begins firing off stress responses:

Your coronary heart price will increase

Respiration turns into extra shallow

And your focus narrows onto the rapid “menace”

Your mind is shouting: Get out! Defend your self!

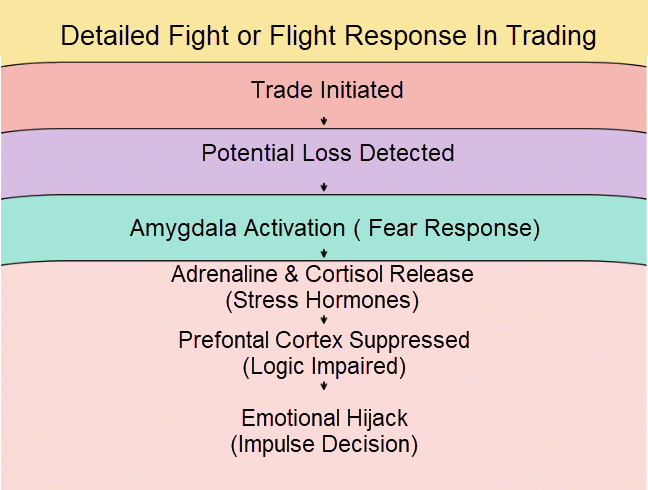

That is the fight-or-flight response as concern and greed settle in, and it kicks in whether or not you’re being chased by a lion or watching your buying and selling account dip into drawdown.

As soon as this historic defence system fires up, there’s a threat it could actually override your logical pondering.

Your prefrontal cortex, the a part of your mind answerable for rational decision-making, takes a backseat to emotional survival mode.

Okay, so how does this relate on to buying and selling?

In buying and selling, this will result in:

Closing good trades too early out of concern

Freezing and refusing to behave out of concern

Over-leveraging after a win on account of greed

Doubling down on unhealthy trades

You’re not making rational selections anymore. You’re reacting to perceived “hazard.”

Cash Adjustments the Mind

It’s not simply historic instincts at work, both.

Trendy analysis exhibits that the presence of actual cash bodily alters how your mind processes selections.

When cash’s on the road, emotional facilities just like the amygdala and striatum grow to be extra energetic, whereas the logical, reasoning a part of the mind, the prefrontal cortex, turns into much less engaged.

Your mind actually begins prioritizing emotion over logic, making it simpler to chase impulsive wins or panic throughout small setbacks.

Neuroscientist Antonio Damasio’s Somatic Marker Speculation helps this too: emotional reactions, formed by previous experiences, closely information decision-making below uncertainty.

Briefly, your previous wins and losses can subtly affect your subsequent buying and selling transfer, even in the event you assume you’re being “rational.”

Put cash on the desk, and your mind begins behaving extra prefer it’s in a on line casino than in a calculated decision-making course of.

With out Aware Management, Feelings Override Logic

Right here’s the kicker: none of this occurs slowly.

You don’t get a well mannered warning out of your mind saying,

“Hey, your logical pondering is about to close down, simply so .”

It’s quick. It’s automated.

In the event you don’t consciously intervene, your feelings will quietly take the wheel.

A easy instance?

Think about you’re ravenous and stroll right into a grocery retailer with a easy purchasing checklist, solely to depart with a cartful of unplanned treats.

Starvation overrode your logical plan.

Buying and selling is analogous – concern and greed can really feel so pressing that they make you abandon your well-planned technique.

They aren’t “unhealthy feelings,” however historic survival instruments reacting to fashionable monetary stress.

In the event you can’t acknowledge and construct methods to handle your concern and greed, although, they’ll drive your buying and selling selections straight into the bottom.

Concern and Greed: Chart Examples

To higher illustrate this, let’s check out some actual chart examples so that you get an concept of how greed and concern can unfold in a buying and selling state of affairs.

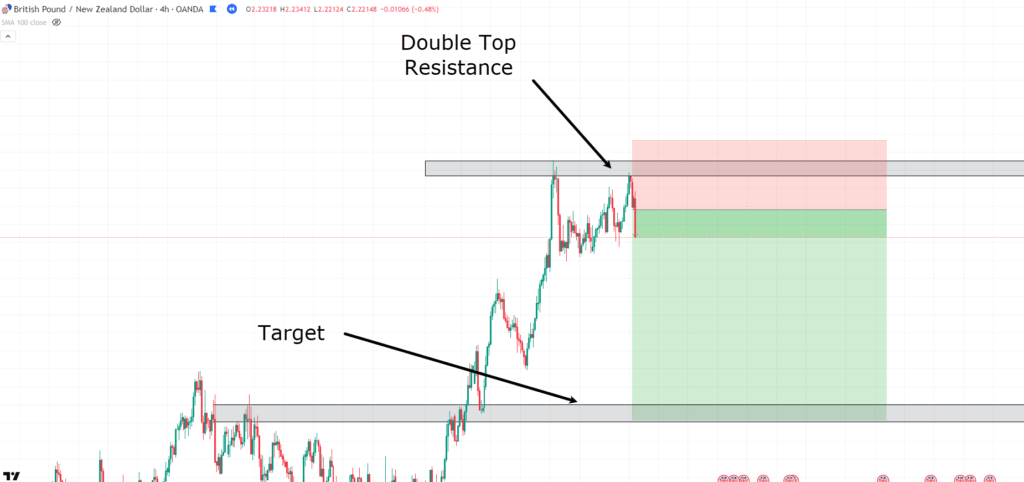

Grasping Sarah

Meet Sarah.

Sarah’s been on a scorching streak, 5 trades, 5 wins.

Feeling untouchable, she decides to take her subsequent commerce with double the danger.

The setup?

The identical as her earlier 5, so what may probably go mistaken?

She’s targeted on rising the account quick as a result of greed tells her this one’s going to be large.

The commerce is entered at a double prime resistance zone, focusing on a powerful assist beneath…

Sarah’s Entry Setup:

Every little thing appears clear on the floor, the goal is cheap, and the entry is smart.

Nevertheless, Sarah’s resolution to extend threat and bypass her guidelines is already setting the stage…

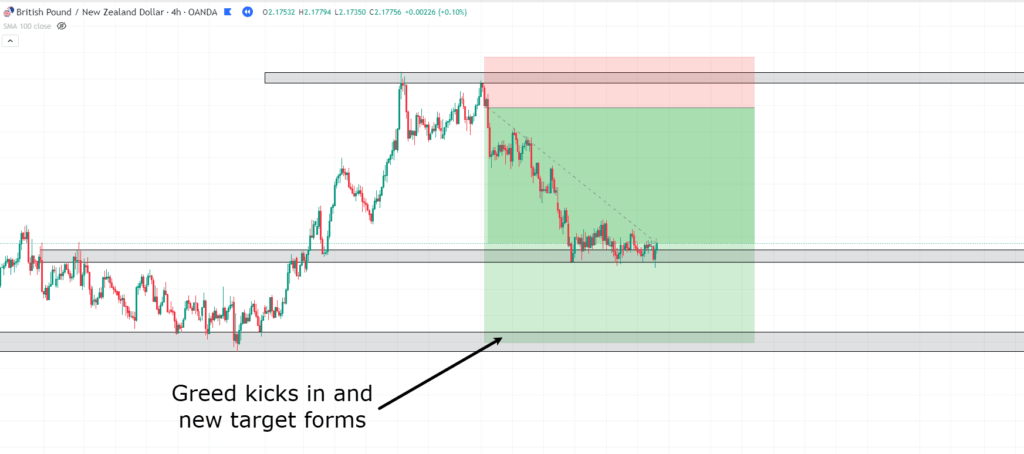

Sarah’s Goal Hit:

As the value strikes in her favor, Sarah’s unique goal will get changed with a extra aggressive one.

She desires extra.

She believes this commerce is actually the one that can push her account to the following degree.

A brand new goal is positioned on the subsequent logical assist degree.

Are you able to guess what occurs subsequent?…

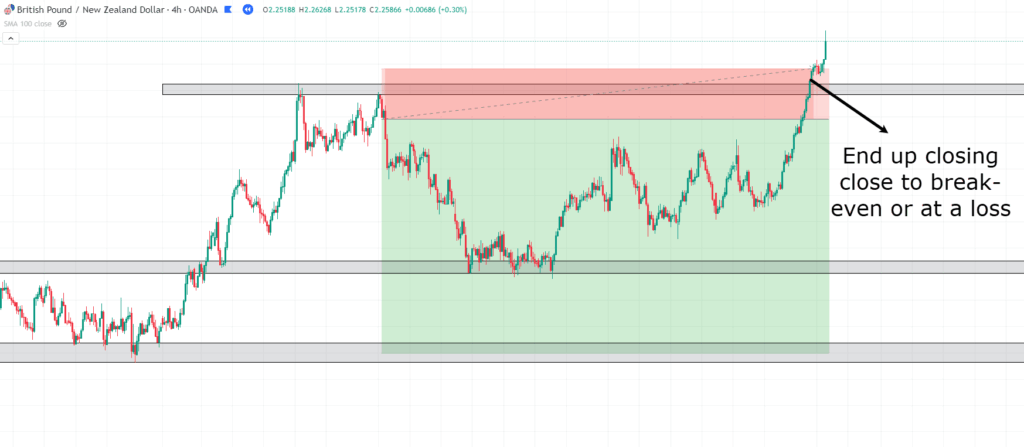

Worth Reversal:

In fact, the value reverses.

Sarah hesitates her concern and greed kicks in.

She holds too lengthy, watching income disappear.

What began as a powerful commerce with nice income ended up closing close to breakeven, and even at a loss, all as a result of she ignored the plan in pursuit of extra.

So, be trustworthy for a second.

Have you ever ever felt like Sarah?

That sense that your current wins meant you have been “due” for one thing large or that you just have been untouchable?

Greed hardly ever declares itself upfront, however it likes to take management the second you let go of your construction.

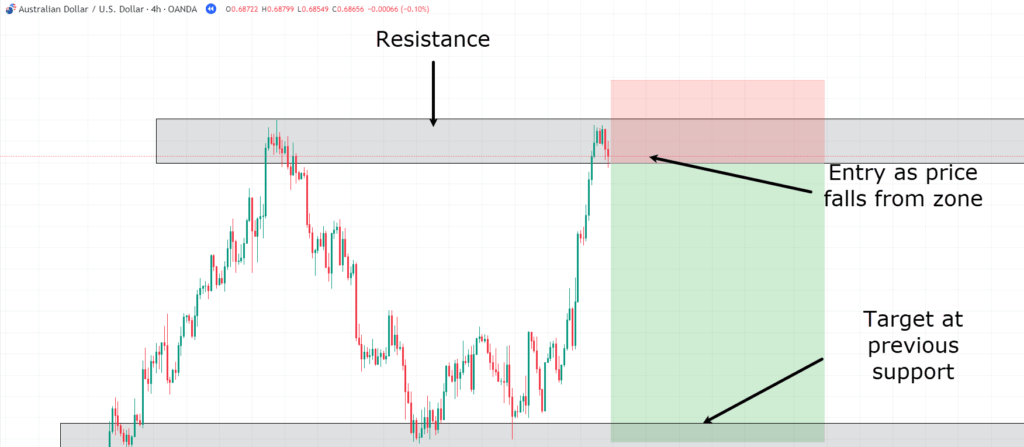

Subsequent, there’s fearful Jack.

Jack Gripped by Concern

Jack’s commerce setup is stable: a clear double prime kinds at resistance…

The Proper Entry:

He follows his guidelines, enters the quick, and units a logical goal on the subsequent assist zone.

A textbook double prime kinds.

His evaluation is sound, and his plan is evident.

Every little thing goes in keeping with plan…

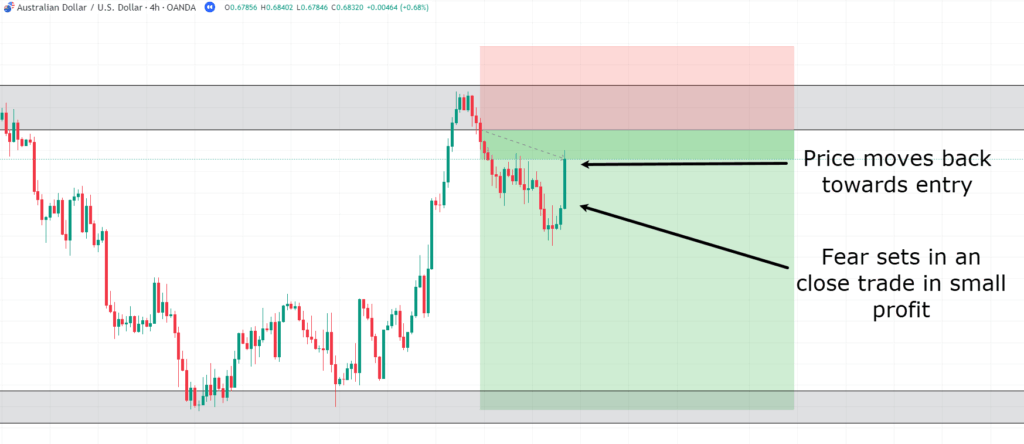

Concern Creeps In:

Worth initially strikes in Jack’s favor, validating the setup.

However then a powerful bullish candle kinds, pulling the value sharply again towards his entry.

Jack panics.

“What if it reverses?”

Reasonably than belief the setup, he exits early, locking in a small revenue…

The Missed Transfer:

Oh no!

Jack watches on in disbelief.

After the momentary pullback, the value resumes its drop, persevering with steadily towards Jack’s unique goal.

Had he stayed in, it will’ve been a fantastic commerce.

However concern of shedding what he’d already gained received in the way in which.

Properly, I’ve been there earlier than – how about you?

Exiting a commerce not as a result of your setup failed, however as a result of your feelings whispered,

“Take the win now, simply in case…”

That is what concern does.

It doesn’t shout, it nudges.

However these nudges can price you greater than you assume, particularly once you’ve gone via a current drawdown or a string of unfortunate trades.

Okay, so you’ll be able to see how this may play out in your buying and selling, however how are you going to actively handle concern and greed to stop them from ruining your buying and selling?

Methods to Handle Concern and Greed

Managing concern and greed isn’t about turning into impassive.

It’s about recognizing these feelings early and having a system in place that protects you after they present up.

In the event you wait till you’re already emotional to determine what to do, it’s normally too late.

It is advisable to construct emotional resilience earlier than you’re within the warmth of the second.

Right here’s begin.

Mindset Shift: Play the Lengthy Recreation

Step one to managing feelings is shifting the way you see buying and selling.

Most individuals naturally decide success by the end result of the following commerce.

Win? Really feel good. Lose? Really feel horrible.

However actual consistency doesn’t come from “profitable the following commerce,” it comes from executing your course of throughout a whole lot of trades, realizing that your edge performs out over time.

You must begin pondering in chances, not outcomes.

You’re not searching for certainty.

You’re enjoying a recreation the place uncertainty is regular and the place the sting solely reveals itself over massive samples.

Whenever you begin pondering like this:

One loss abruptly doesn’t rattle you, however on the similar time, one win doesn’t make you reckless

This results in your emotional reactions from concern and greed shrinking as a result of your focus is larger than “proper now.”

You cease being obsessive about whether or not this commerce wins and begin being obsessive about whether or not you executed your plan appropriately.

This can be a great spot to be.

Concentrate on Course of, Not Final result

In the event you make selections based mostly on outcomes, your feelings will all the time management you.

As a substitute, shift your total success metric to the method.

Ask your self after each commerce:

Did I observe my guidelines?

Did I take the setup that my plan stated to take?

Did I measurement the commerce correctly?

If the reply is sure, it’s a profitable commerce, even when it’s a loss.

Bear in mind, you’ll be able to’t all the time management what the market does.

However you’ll be able to management what you do.

And that’s the place your actual energy is.

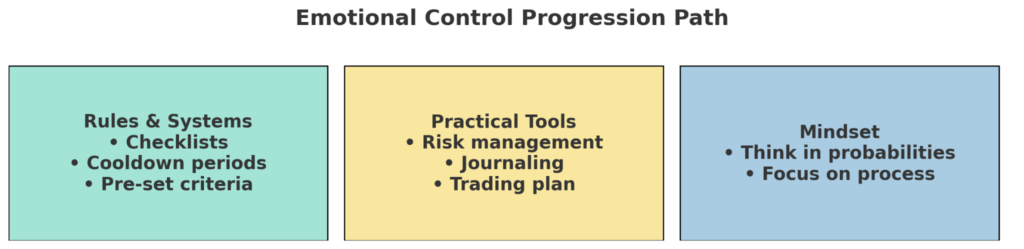

Sensible Instruments to Handle Feelings

Mindset is crucial, however instruments may also help you again it up when the stress is on.

No 1 is:

Danger Administration (Cease Losses, Correct Sizing)

Setting clear threat parameters earlier than getting into a commerce protects you from panic selections later.

This implies all the time use cease losses based mostly on construction, not feelings.

It additionally means you’re risking a small, constant proportion of your account (like 1% or much less per commerce).

This shouldn’t wildly change from commerce to commerce.

Final however not least, go into each commerce accepting the total threat earlier than you enter; it will assure there aren’t any surprises.

If precisely what you’re keen to lose earlier than you click on the button, concern shrinks dramatically.

The following sensible device is a Buying and selling Plan and Journaling

A written buying and selling plan retains you grounded.

It tells you precisely when to enter, exit, and modify threat, eradicating decision-making from the warmth of the second.

Nevertheless it’s not simply technical.

Journaling your emotional states throughout and after trades is equally essential.

Whenever you begin monitoring, the way you felt earlier than, throughout, and after trades, what ideas or impulses you seen, and what feelings triggered good or unhealthy selections…

…you start to see emotional patterns, and from there, patterns will be managed when you’re conscious of them.

Lastly, checklists and cool-off intervals are important

Earlier than you enter a commerce, run via a easy guidelines:

Does this commerce meet my plan standards?

Is my threat measurement appropriate?

Am I buying and selling from logic or emotion?

After an enormous win or a troublesome loss streak, construct in necessary cool-off intervals:

Step away for the remainder of the day or a number of hours…

Permit your self to reassess solely after feelings cool…

And naturally, by no means revenge commerce or rush again into the market with out aware evaluate.

Generally the perfect commerce you’ll ever make… is taking no commerce in any respect!

Managing concern and greed isn’t about being excellent.

It’s about establishing methods that maintain you constant when feelings inevitably present up.

As a result of the market isn’t your greatest enemy…

…your unmanaged reactions are.

You Can’t Get rid of Concern and Greed — And That’s Okay

One of many greatest myths in buying and selling is that the perfect merchants are these chilly, mechanical robots who really feel nothing as they threat 1000’s of {dollars}.

Nevertheless it’s not true.

Feelings are a part of being human.

You’re speculated to really feel one thing when cash is on the road.

In the event you didn’t, you wouldn’t be absolutely engaged with the method.

The true secret of profitable merchants is that their methods, their plans, threat administration, and self-discipline act as a buffer between these feelings and their actions.

Selections Should Be Backed by Logic

You possibly can and can really feel emotional at occasions in buying and selling.

When a commerce goes in opposition to you and concern rises…

When an enormous win tempts you to double your threat…

When boredom makes you need to “simply take one thing” out of impatience…

That’s when it is advisable to cease and ask:

“Am I making this resolution based mostly on my system… or based mostly on how I really feel proper now?”

If it’s based mostly on emotion, pause.

Reset.

If it’s based mostly in your pre-planned logic, you execute.

Over time, it’s going to grow to be second nature.

You gained’t must “battle” feelings; you’ll merely acknowledge them with out obeying them.

Conclusion

By now, it needs to be clear that buying and selling success isn’t nearly discovering the right setup or mastering a brand new technique; it’s about managing the emotional swings that include placing actual cash on the road.

Concern and greed aren’t weaknesses, they’re a part of being human.

However when left unchecked, they’ll push even probably the most ready dealer astray.

You may exit too early, leap in too late, transfer a cease, overleverage, or skip a commerce solely… not as a result of your system stated so, however as a result of your feelings did.

As you’ve seen via Sarah and Jack’s tales, the distinction usually isn’t within the setup, it’s within the response.

The dealer who can handle their emotional state will usually outperform the one who’s continually reacting to it.

Buying and selling with readability doesn’t imply you gained’t really feel concern or pleasure.

It means you’ll act in alignment together with your plan anyway.

Now I’d love to listen to from you:

Have you ever ever had a “Jack second” the place concern made you shut a commerce too early?

Or possibly a “Sarah second” the place you turned overconfident due to earlier success

Drop your story within the feedback, let’s be taught from one another.