The altcoin market simply recorded its most important month-to-month restoration of the 12 months. Whereas most “altcoin season” predictions give attention to crypto indicators, one neglected issue is its correlation with US small-cap shares.

So, what does this correlation recommend? Listed here are some deeper insights.

Altcoin Season Will get Macro Enhance From US Small-Cap Inventory

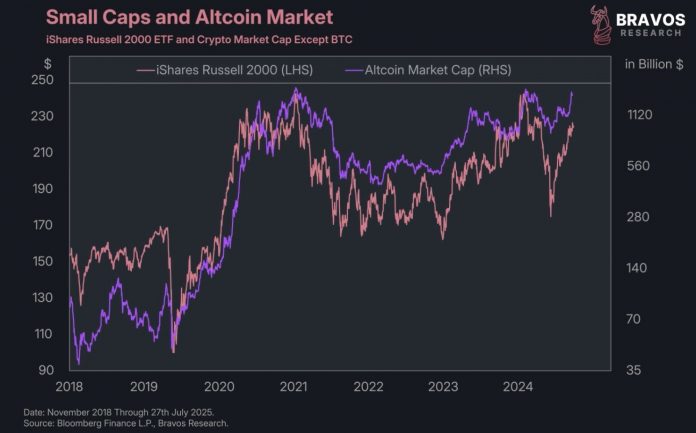

In response to Bravos Analysis’s findings, the altcoin market reveals a powerful correlation with US small-cap shares, as represented by the Russell 2000 Index.

The iShares Russell 2000 is an ETF (Trade-Traded Fund) managed by BlackRock. It’s designed to trace the efficiency of the Russell 2000 Index, which represents 2,000 small-cap corporations within the US.

Knowledge reveals that the altcoin market cap has intently mirrored the motion of US small-cap shares since 2019. This might be as a result of buyers view each asset courses as high-risk, high-reward.

Of their newest video evaluation, Bravos Analysis notes that small companies and altcoins have but to totally get better. In the meantime, buyers are paying extra consideration to large-cap corporations and Bitcoin.

This development displays a slender financial restoration. The restoration isn’t sturdy sufficient to drive capital into riskier belongings.

“And that’s additionally mirrored within the habits of crypto buyers. Throughout these moments the place you’ve gotten a slender financial restoration and inventory market restoration, you even have a slender restoration within the crypto market,” Bravos Analysis reported.

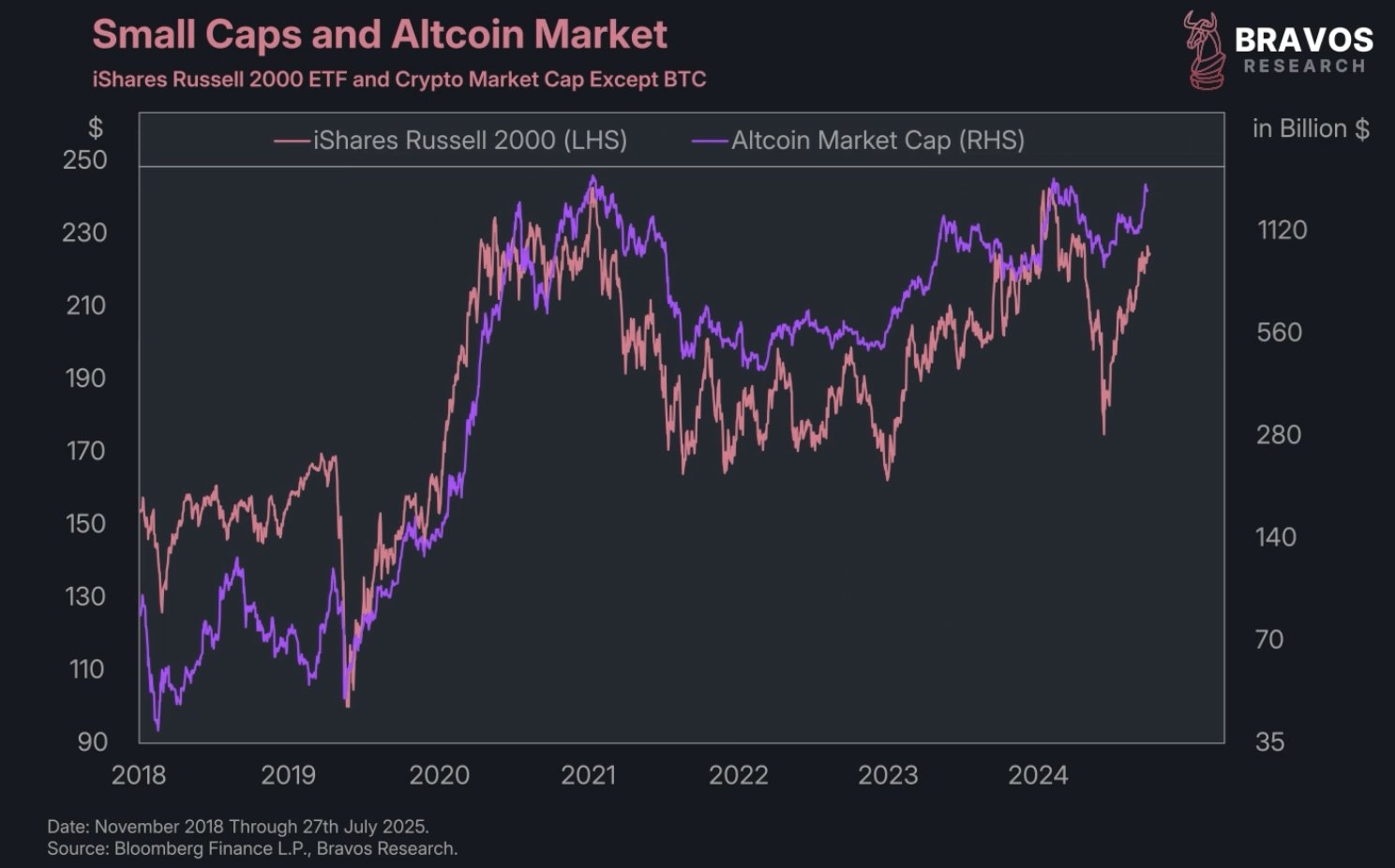

Nonetheless, the evaluation additionally factors out a current uptick in small enterprise optimism. The Small Enterprise Sentiment Index is now rising—much like 2016, 2020, and 2021 tendencies—signaling bettering financial circumstances. If this development continues, small-cap shares could surge.

Mixed with its correlation to the crypto market, the optimistic sentiment in low-cap shares could point out that the altcoin season nonetheless has extra room to develop.

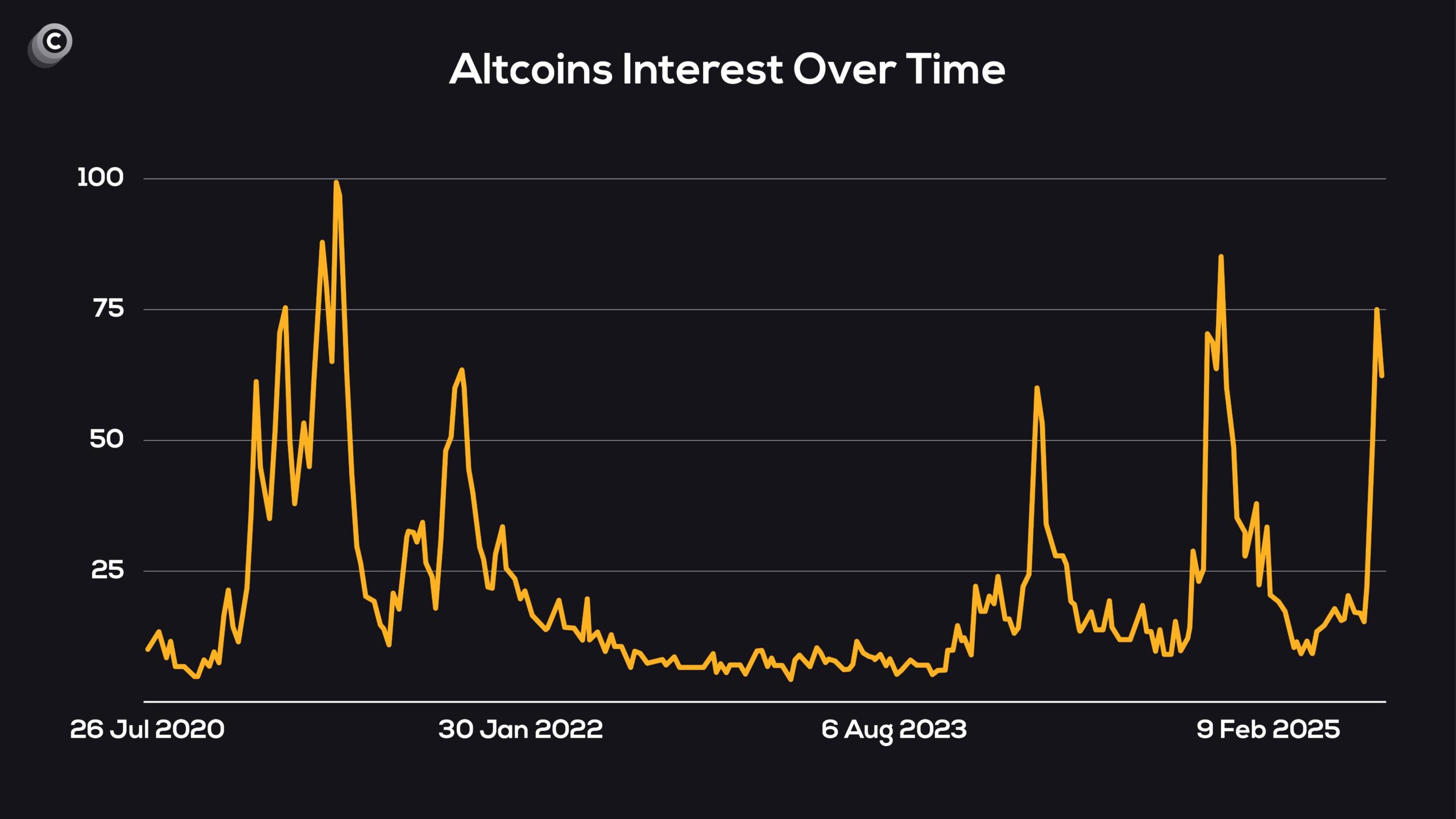

Altcoin Market Pulls Again in Early August, However Sentiment Stays Robust

The altcoin market turned purple in early August following a powerful July rally. TOTAL3’s market cap (excluding BTC and ETH) dropped from a July excessive of $1.09 trillion to round $965 billion—a virtually 12% decline.

Nonetheless, this decline doesn’t appear to have shaken investor sentiment. The Crypto Worry & Greed Index stays within the “Greed” zone.

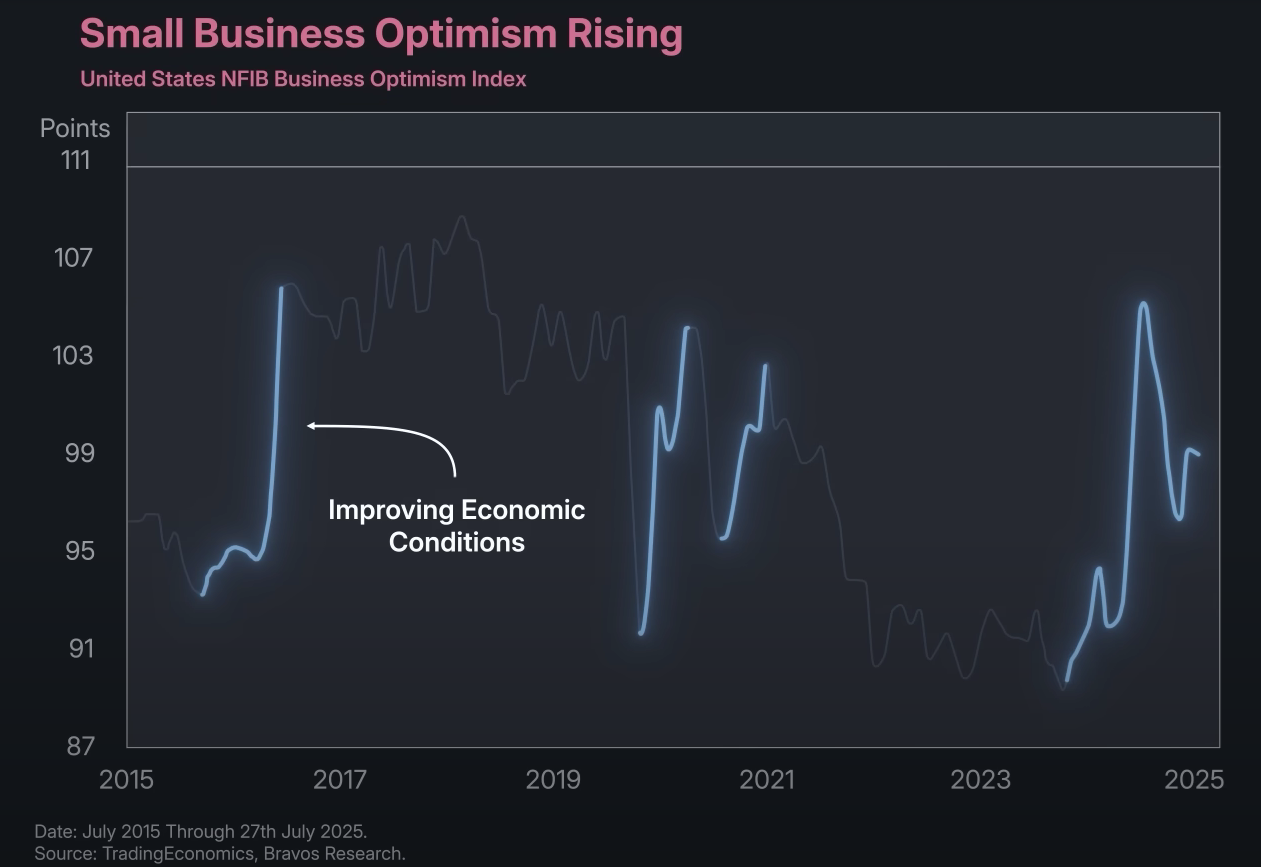

Moreover, Coinvo’s Altcoin Curiosity indicator has sharply elevated because the begin of the 12 months, reflecting renewed enthusiasm amongst retail buyers.

“Retail is totally again in motion and Altcoin Season is lastly right here,” Coinvo reported.

A current report from BeInCrypto additionally highlights the drop in Bitcoin Dominance and Ethereum’s outperformance over Bitcoin. These are each sturdy indicators of an ongoing altcoin season.

The submit A Stunning US Shares Correlation Suggests Altcoin Season Is Far From Over appeared first on BeInCrypto.