Buyers usually view change reserve information as one of many key indicators for assessing long-term holding demand. When change reserves drop, the obtainable provide for buy turns into scarce, which will help push costs increased.

A number of altcoins have proven a notable decline in change reserves in the course of the first week of August, simply because the altcoin market capitalization regains upward momentum.

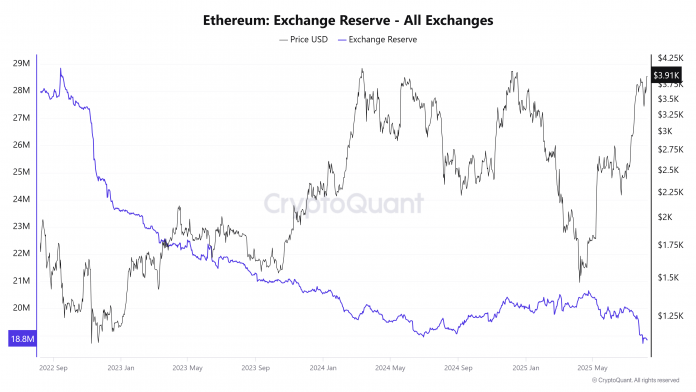

1. Ethereum (ETH)

CryptoQuant information reveals that Ethereum’s change reserves hit a brand new three-year low in early August, falling beneath 19 million ETH.

On August 8, ETH’s worth approached $4,000. But, this worth improve didn’t drive extra buyers to maneuver ETH onto exchanges, suggesting that holders usually are not dashing to take earnings.

ETH’s strongest driver in the intervening time seems to be institutional demand. Strategic ETH Reserve statistics point out that by the top of July, the overall worth of strategic Ethereum reserves had exceeded $10 billion, with 2.7 million ETH. In simply the primary week of August, that determine jumped to $11.8 billion with over 3 million ETH.

This demand has helped ETH stand up to potential promoting pressures corresponding to massive quantities of unstaked ETH and promoting from the Ethereum Basis.

“As ETH worth rises, change reserves are dropping. This reveals extra individuals are holding their ETH off exchanges, which is normally an indication of confidence within the long-term worth,” investor BullishBanter mentioned.

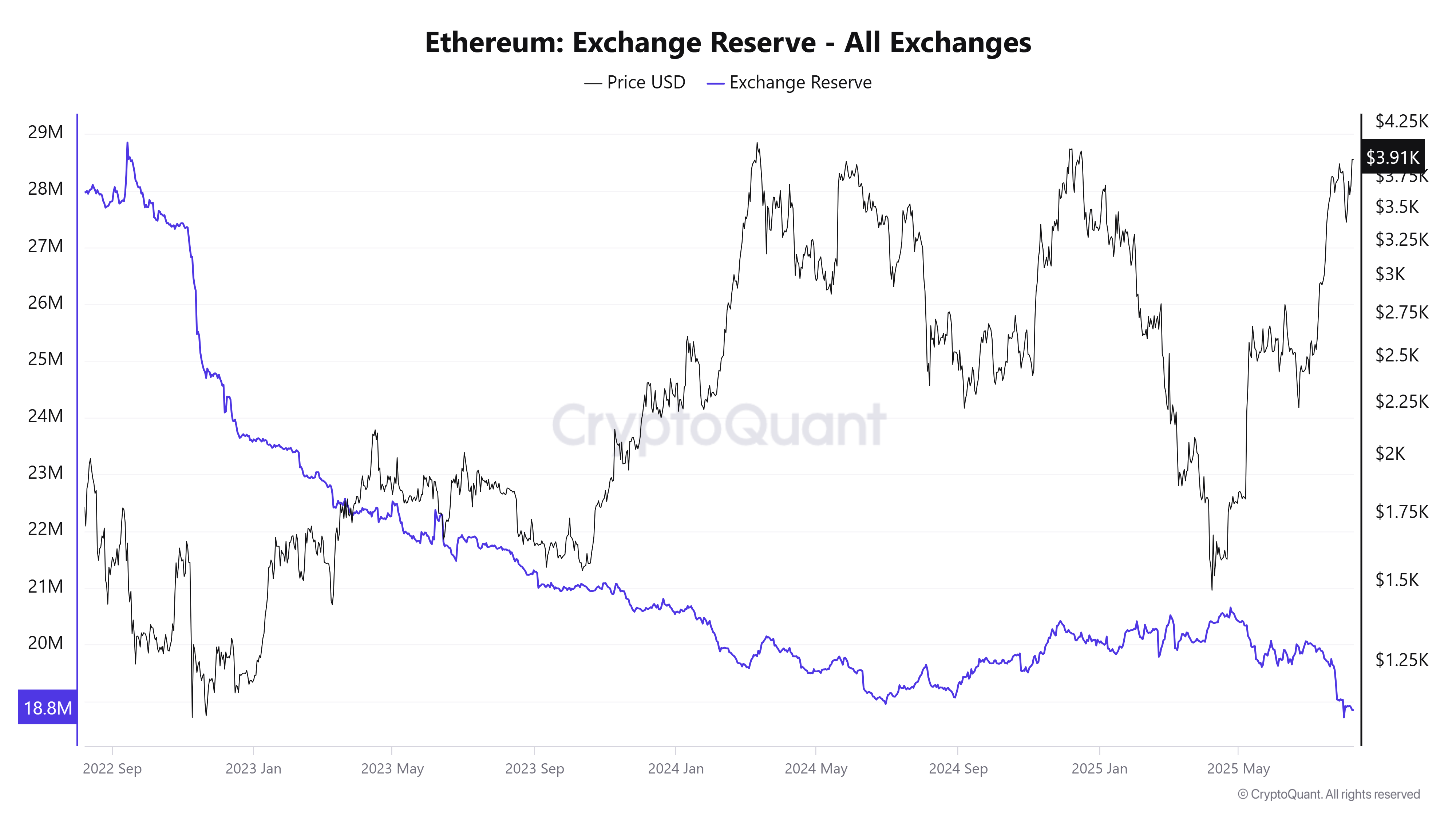

2. Chainlink (LINK)

CryptoQuant information additionally reveals that Chainlink’s (LINK) change reserves hit a brand new low within the first week of August. About 146.2 million LINK can be found on exchanges, down 16% from the start of the yr.

This decline in LINK provide on exchanges got here as its worth rebounded 15%, from $15.5 to over $19. This displays a return of long-term accumulation sentiment for the altcoin.

“Now, take into consideration the Chainlink Reserve. Huge LINK provide shock incoming,” investor Quinten mentioned.

As well as, current Santiment information reveals that when LINK’s worth rose above $18.40, on-chain information recorded a 4.2% improve in wallets holding between $100,000 and $1 million value of LINK. Accrued provide additionally grew by 0.67% in August alone.

This coincided with Chainlink’s launch of Information Streams (real-time US inventory/ETF information) on August 4 and the introduction of the Chainlink Reserve on August 7, which converts protocol income into LINK purchases.

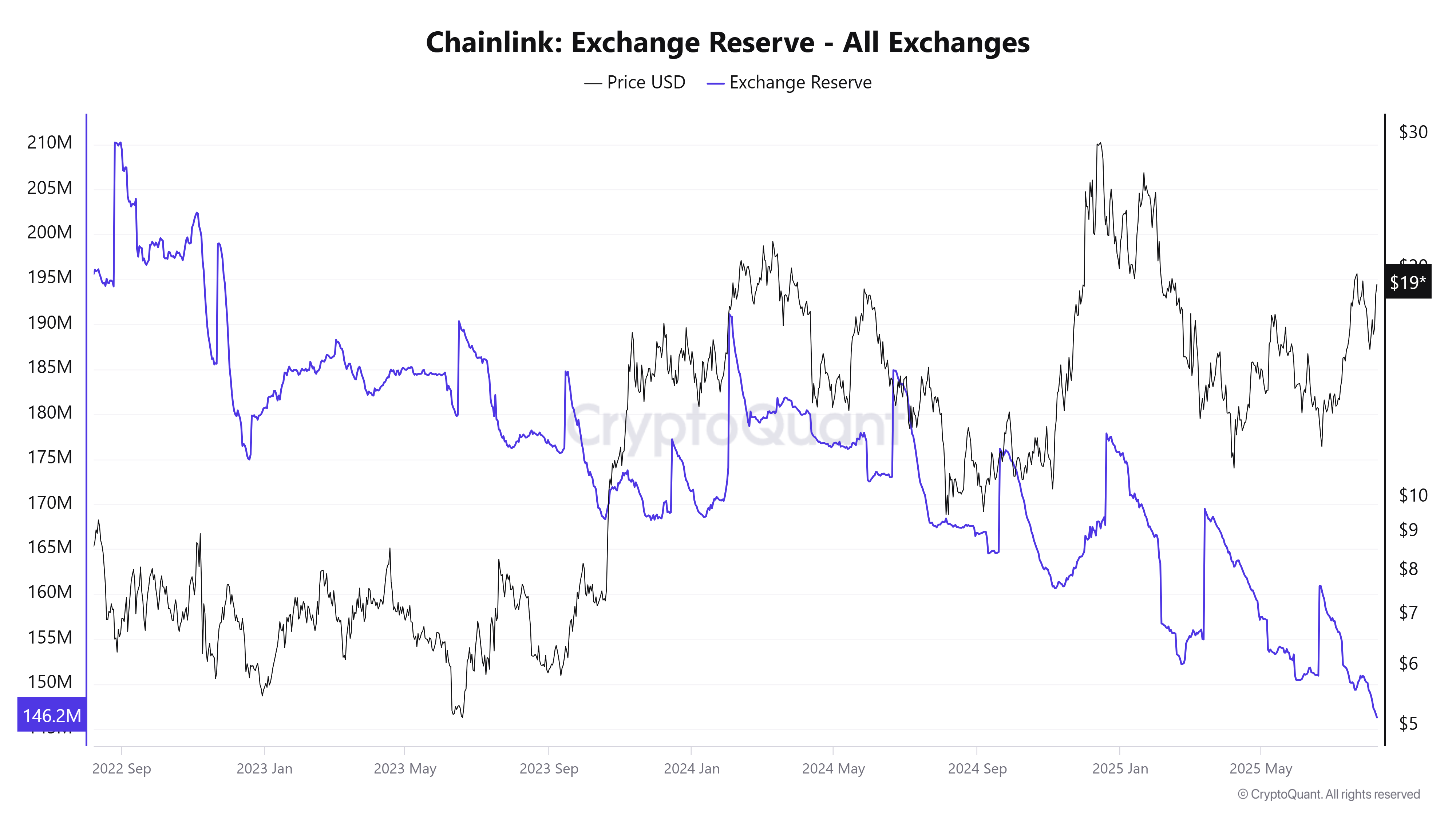

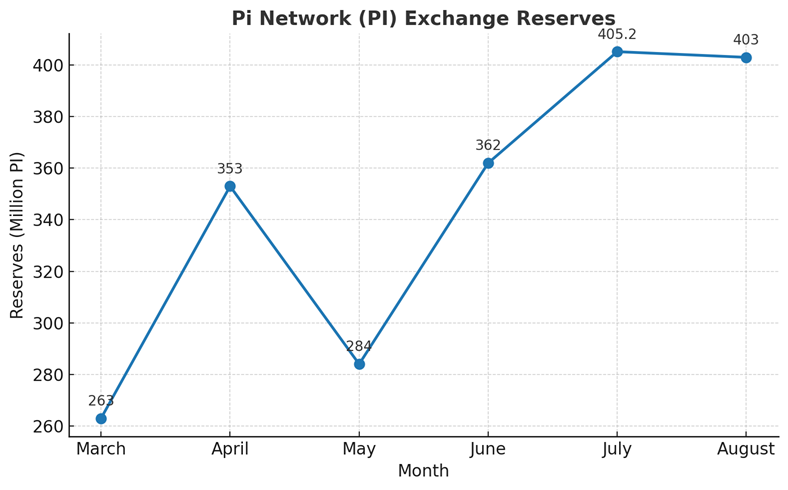

3. Pi Community (PI)

A late-July report from BeInCrypto warned that Pi Community (PI) holdings on exchanges had climbed above 405 million PI. Nevertheless, based on Piscan information, that determine dipped barely to 403 million PI after the primary week of August.

Though the drop is small, it’s nonetheless a optimistic signal after months of steady will increase in Pi’s change provide.

Notably, this early-August decline in Pi on exchanges occurred whereas its worth fell sharply by 10% to $0.366 within the first week of August. This means that Pi accumulation could return, as buyers begin seeing a possibility to purchase at considerably decrease costs than in the course of the open community part.

Nevertheless, change information needs to be monitored carefully, because the decline will not be robust sufficient to attract agency conclusions.

The put up 3 Altcoins See Declining Change Reserves within the First Week of August appeared first on BeInCrypto.