Invoice Ackman has 70% of his hedge fund’s portfolio in these 5 massive shares.

Billionaire Invoice Ackman based Pershing Sq. Capital Administration with $54 million in 2004. Right this moment, Ackman’s web price exceeds $9 billion, whereas the hedge fund’s belongings beneath administration exceed $18 billion.

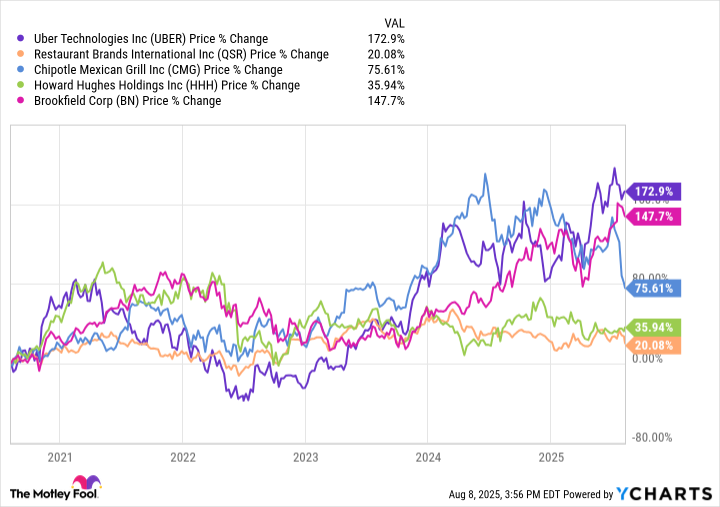

Pershing Sq. holds shares in solely 10 publicly traded firms, however 70.1% of its portfolio is concentrated in 5 shares as per the newest 13-F submitting. Listed below are Ackman’s 5 largest inventory holdings.

Picture supply: Getty Photographs.

1. Uber Applied sciences (18.5%)

Uber Applied sciences (UBER -3.30%) is the world’s largest ride-sharing firm and in addition gives meals supply and freight transport providers. Uber enjoys the advantages of community results and a big international footprint and sees large potential in autonomous autos. Ackman believes Uber inventory may even double over the subsequent three to 4 years.

2. Brookfield Corp (18.01%)

Brookfield Corp (BN -0.34%) owns a 73% stake in Brookfield Asset Administration. The choice asset supervisor invests in renewable vitality, actual property, infrastructure, and enterprise and industrial providers. Ackman is worked up about Brookfield’s targets to develop annual earnings per share by 20% and generate $47 billion in free money move over the subsequent 5 years.

3. Restaurant Manufacturers Worldwide (12.85%)

Restaurant Manufacturers (QSR -0.81%) owns Burger King, Tim Hortons, Popeyes, and Firehouse Subs. It operates over 32,000 eating places worldwide, primarily by way of franchisees. Ackman sees robust long-term progress potential in Restaurant Manufacturers, which goals to develop same-store gross sales and systemwide gross sales by over 3% and eight%, respectively, between 2024 and 2028.

4. Howard Hughes Holdings (11.71%)

Ackman has been concerned with Howard Hughes (HHH 1.20%) since its formation in 2010 after a spin-off and now owns a 46.9% stake in the true property developer. Ackman now needs to transform Howard Hughes right into a diversified holding firm akin to Warren Buffett’s Berkshire Hathaway.

5. Chipotle Mexican Grill (9.07%)

Chipotle Mexican Grill (CMG -2.87%), recognized for its burritos and tacos, owns over 3,800 eating places. Chipotle is now increasing globally and rolling out new applied sciences. Though Brian Niccol, who was monumental in Chipotle’s progress, give up because the CEO in 2024, Ackman believes the current administration beneath new CEO Scott Boatwright will proceed to ship.

Neha Chamaria has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway, Brookfield, Brookfield Company, Chipotle Mexican Grill, Howard Hughes, and Uber Applied sciences. The Motley Idiot recommends Brookfield Asset Administration and Restaurant Manufacturers Worldwide and recommends the next choices: quick September 2025 $60 calls on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.