The bitcoin value presently seems to be on the verge of getting into a euphoric part of value motion after an already sturdy bull market. Nevertheless, has this cycle actually been as spectacular because the USD value chart suggests, or might Bitcoin really be underperforming when in comparison with different belongings and historic cycles? This evaluation digs into the numbers, compares a number of cycles, and examines Bitcoin’s efficiency not simply in opposition to the US greenback, but in addition versus belongings like Gold and US tech shares, to offer a clearer image of the place we actually stand.

Earlier Bitcoin Value Cycles

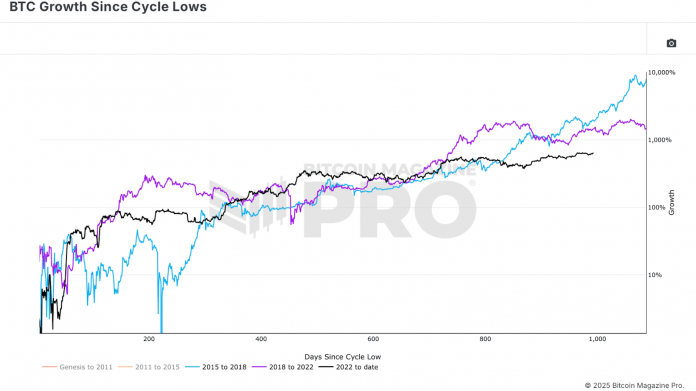

Wanting on the Bitcoin Progress Since Cycle Lows chart, the info initially appears to be like promising. From the lows on the tail finish of the final bear market, Bitcoin has delivered returns of round 634% on the time of writing. These are important positive factors, supported not solely by value motion but in addition by sturdy fundamentals. Institutional accumulation by way of ETFs and Bitcoin treasury holdings has been sturdy, and on-chain knowledge exhibits a big proportion of long-term holders refusing to take income. Traditionally, that is the sort of backdrop that precedes a robust run-up part late within the bull cycle, much like what we noticed in prior cycles.

Present Bitcoin Value Cycle

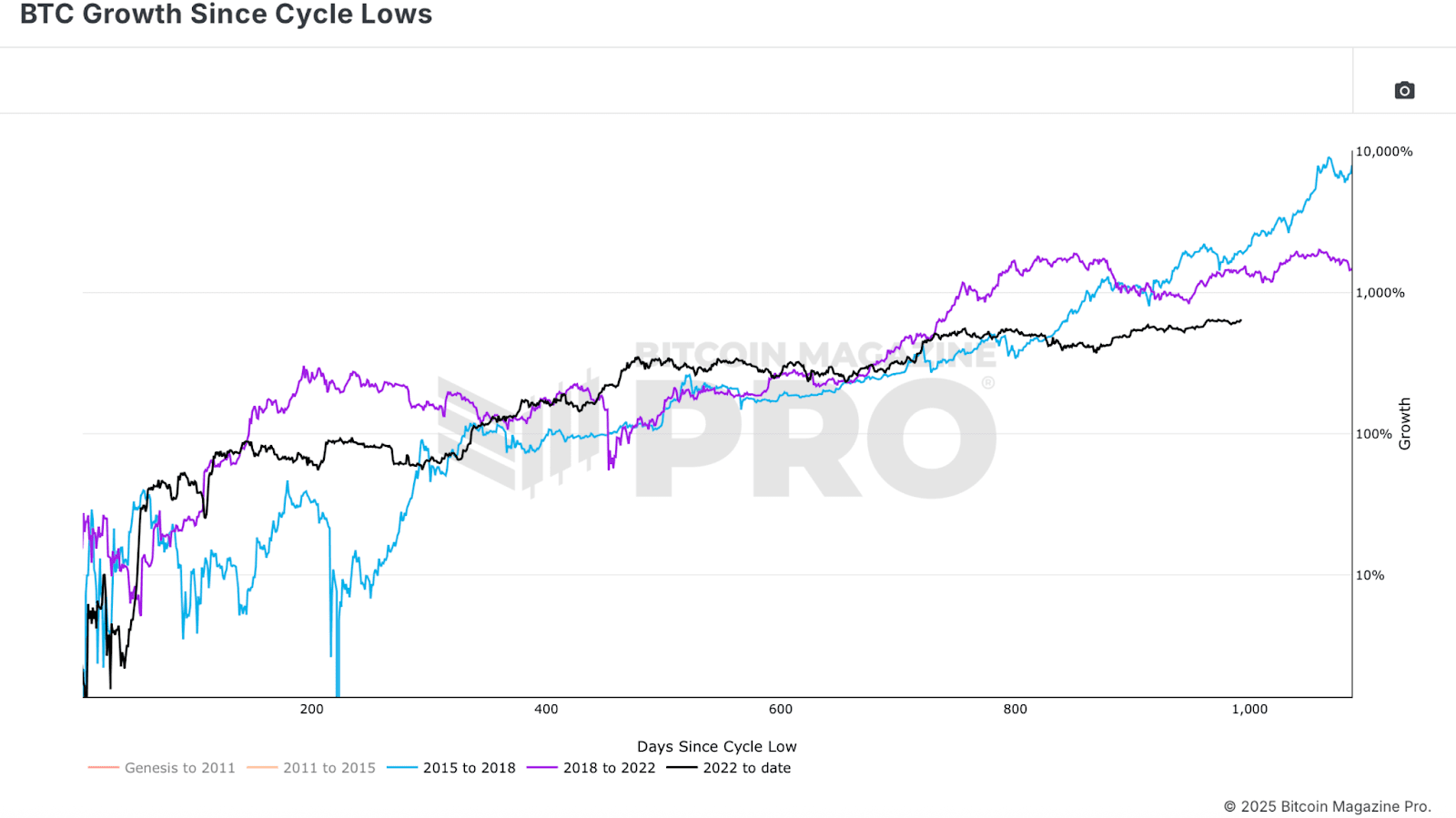

Turning to the USD value chart on TradingView, the present bitcoin value cycle doesn’t look unhealthy in any respect, particularly when it comes to stability. The deepest retracement this cycle has been round 32%, which occurred after surpassing $100,000 and pulling again to roughly $74,000–$75,000. That is far milder than the 50% or higher drawdowns seen in previous cycles. Decreased volatility might imply decreased upside potential, but it surely additionally makes the market much less treacherous for traders. The worth construction has adopted a “step-up” sample, sharp rallies adopted by uneven consolidation, then one other rally, repeatedly pushing towards new all-time highs. From a basic standpoint, the market stays sturdy.

Bitcoin Value vs Different Belongings

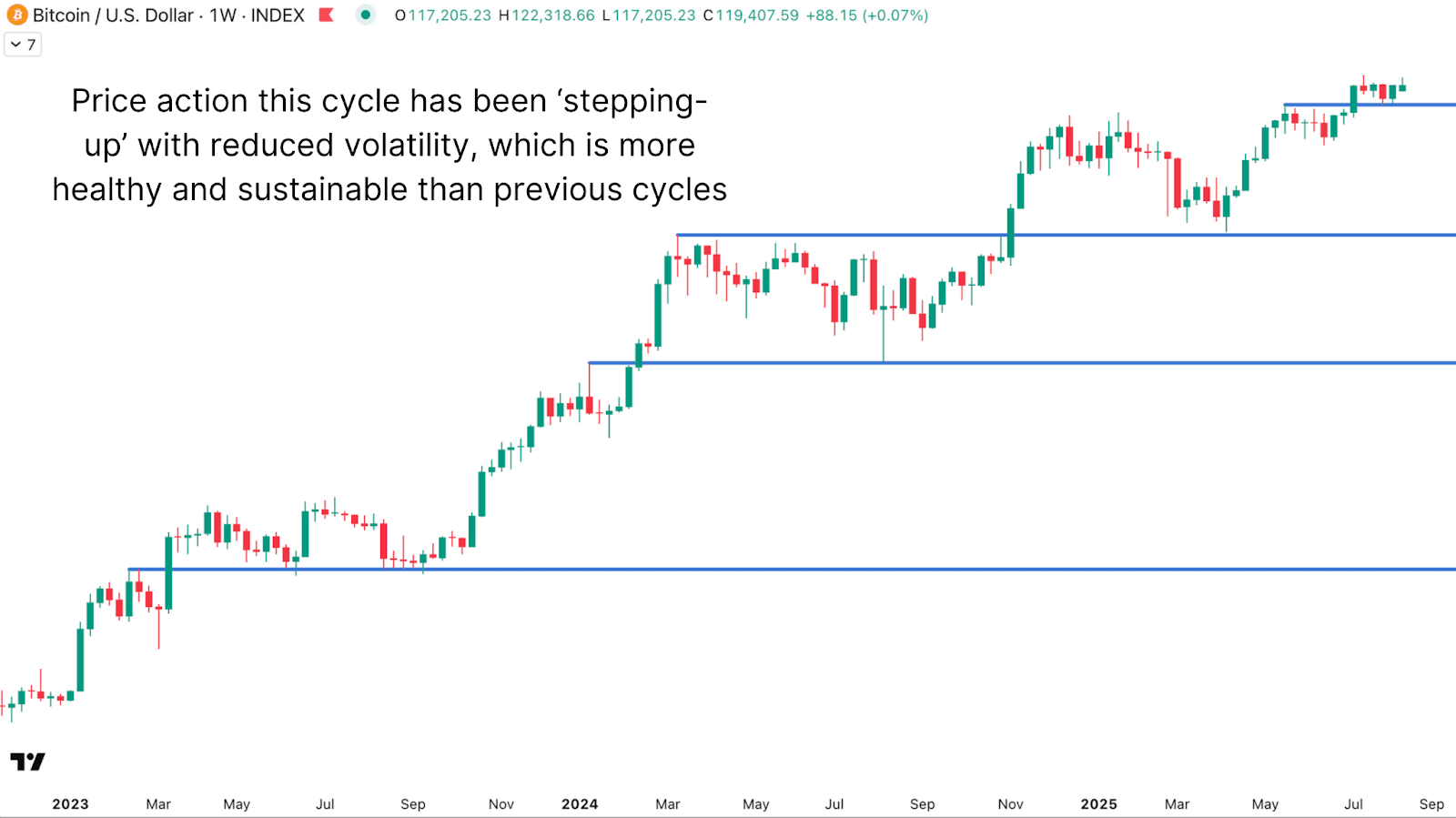

When measuring Bitcoin in opposition to one thing extra steady than the US greenback, such because the NASDAQ or different US tech shares, a distinct image emerges. US tech shares are additionally high-growth, speculative belongings, so this comparability is a extra direct comparability than BTC vs USD. Right here, Bitcoin’s efficiency appears to be like much less spectacular. On this present cycle, the climb past the earlier excessive has been minimal. Nevertheless, the chart exhibits Bitcoin presently turning prior resistance into assist, which can set the inspiration for a extra sustained transfer greater. What we are able to additionally see, trying on the earlier double-top cycle, is a second peak at a significantly decrease degree, suggesting that Bitcoin’s second peak within the final cycle might have been pushed extra by international liquidity growth and fiat forex debasement than by real outperformance.

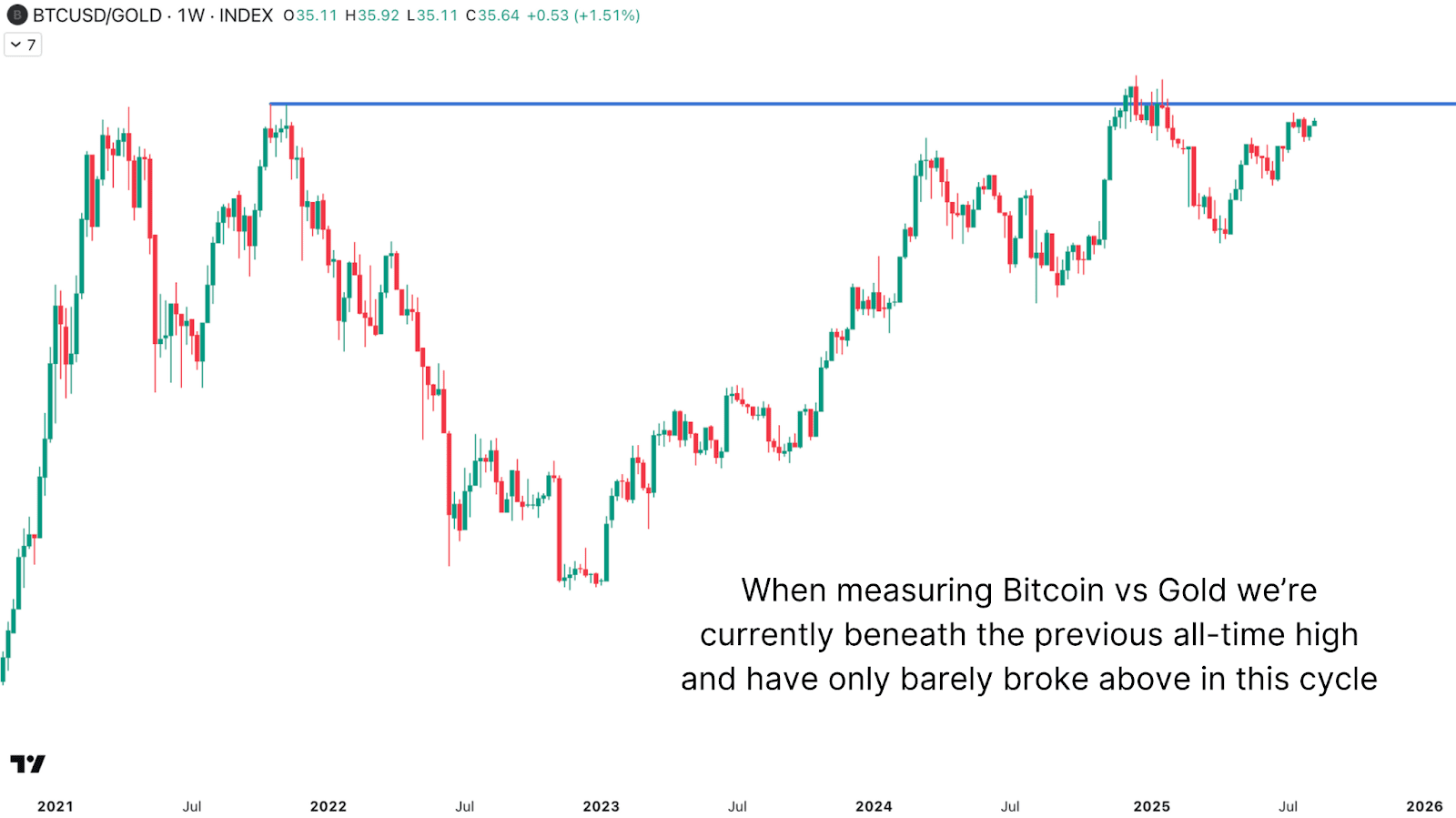

The “digital gold” narrative invitations one other vital comparability, taking a look at BTC vs Gold. Bitcoin has nonetheless not surpassed its earlier all-time excessive from the 2021 peak when measured in Gold. Meaning an investor who purchased BTC on the 2021 peak and held till now would have underperformed in comparison with merely holding Gold. For the reason that final cycle lows, Bitcoin vs Gold has returned over 300%, however Gold itself has been in a robust bull run. Measuring in Gold phrases strips away fiat debasement results and exhibits the “true” buying energy of BTC.

True Buying Energy

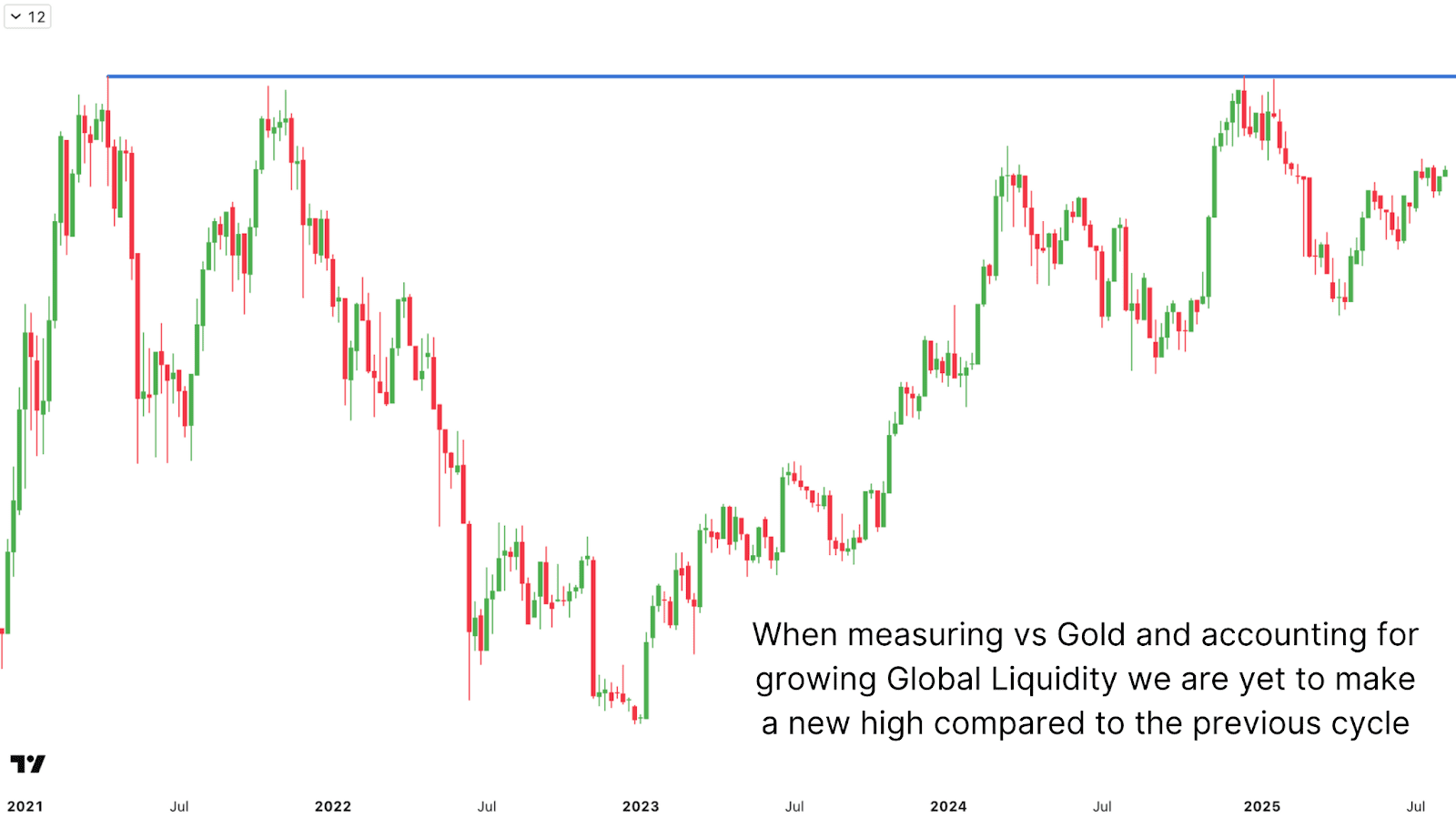

To take this a step additional, adjusting the Bitcoin vs Gold chart for World M2 cash provide growth paints an much more sobering image. When accounting for the massive liquidity injections into the worldwide financial system in recent times, Bitcoin’s cycle peak value in “liquidity-adjusted Gold” phrases remains to be under the prior peak. This helps clarify the shortage of retail pleasure, as there’s no new excessive in actual buying energy phrases.

Conclusion

Thus far, Bitcoin’s bull market has been spectacular in greenback phrases, with over 600% positive factors from the lows and a comparatively low-volatility climb. But, when measured in opposition to belongings like US tech shares or Gold, and particularly when adjusted for World Liquidity growth, the efficiency is way much less extraordinary. The info suggests a lot of this cycle’s rally might have been fueled by fiat debasement relatively than pure outperformance. Whereas there’s nonetheless room for important upside, particularly if Bitcoin can break by means of the liquidity-adjusted resistance and push to even greater highs, traders must also pay shut consideration to those ratio charts. They provide a clearer perspective on relative efficiency and will present priceless clues about the place the bitcoin value may go subsequent.

Beloved this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to knowledgeable evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.