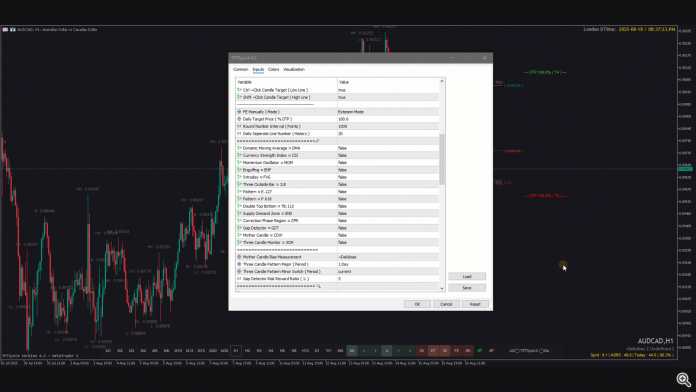

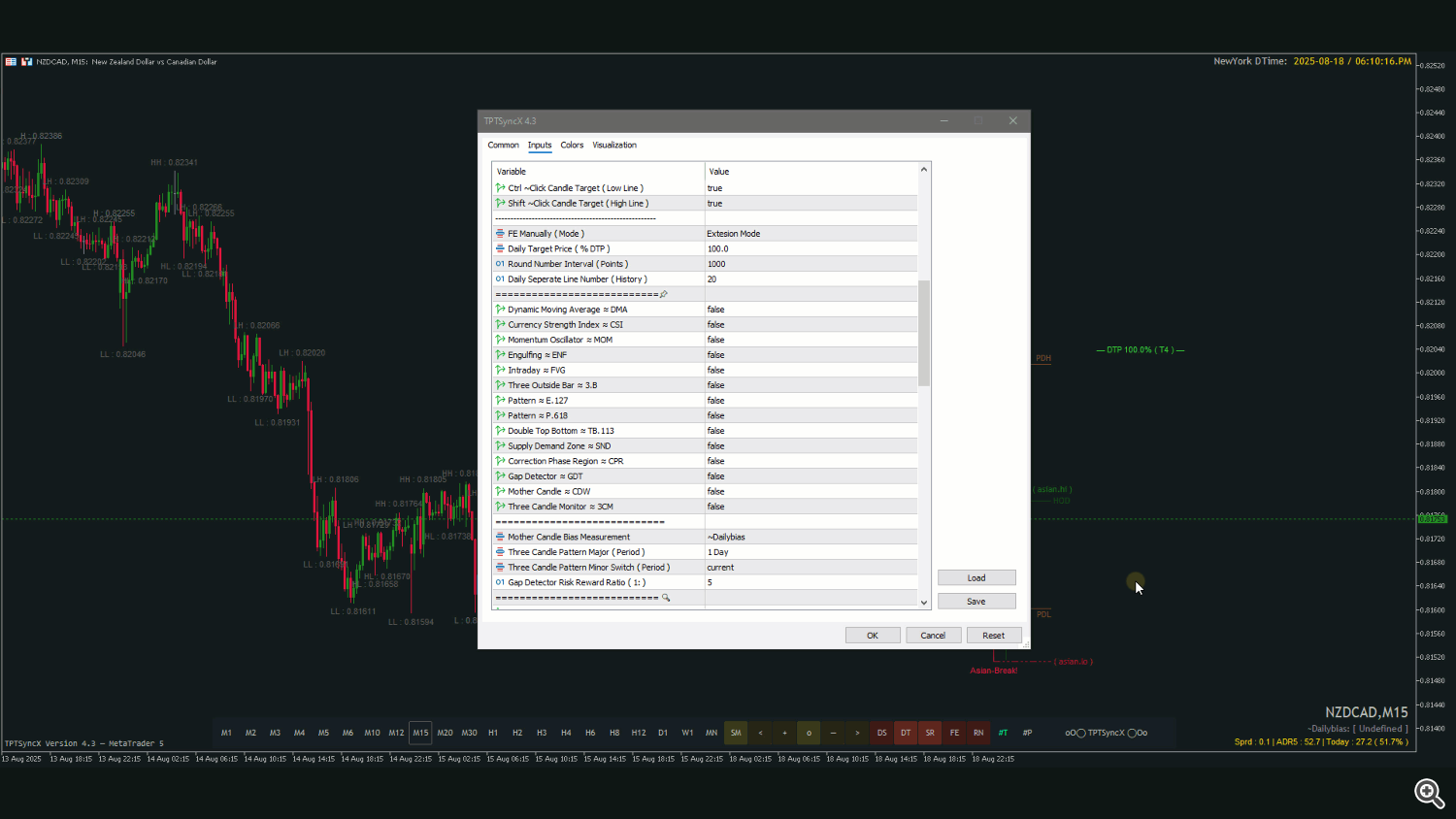

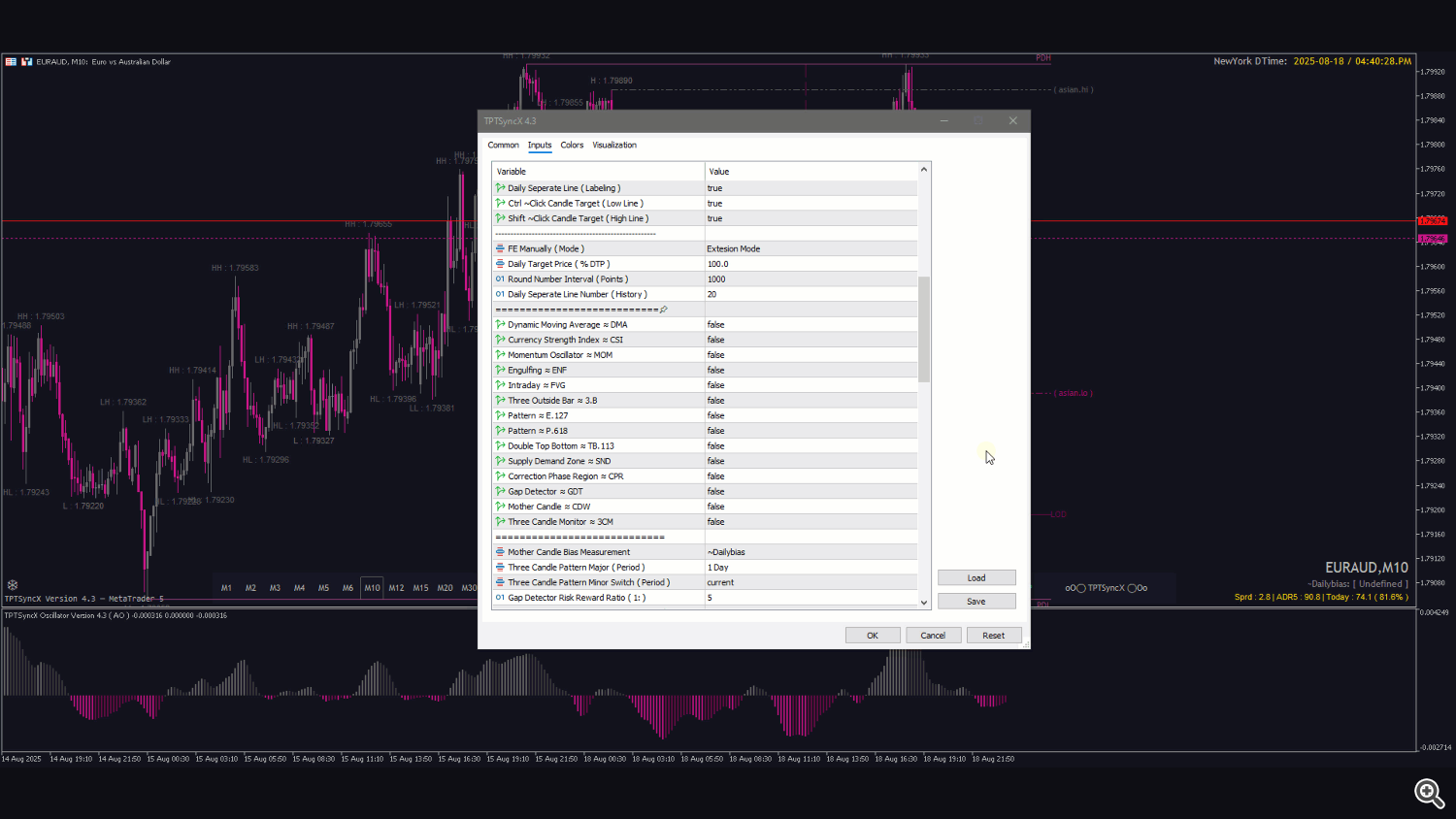

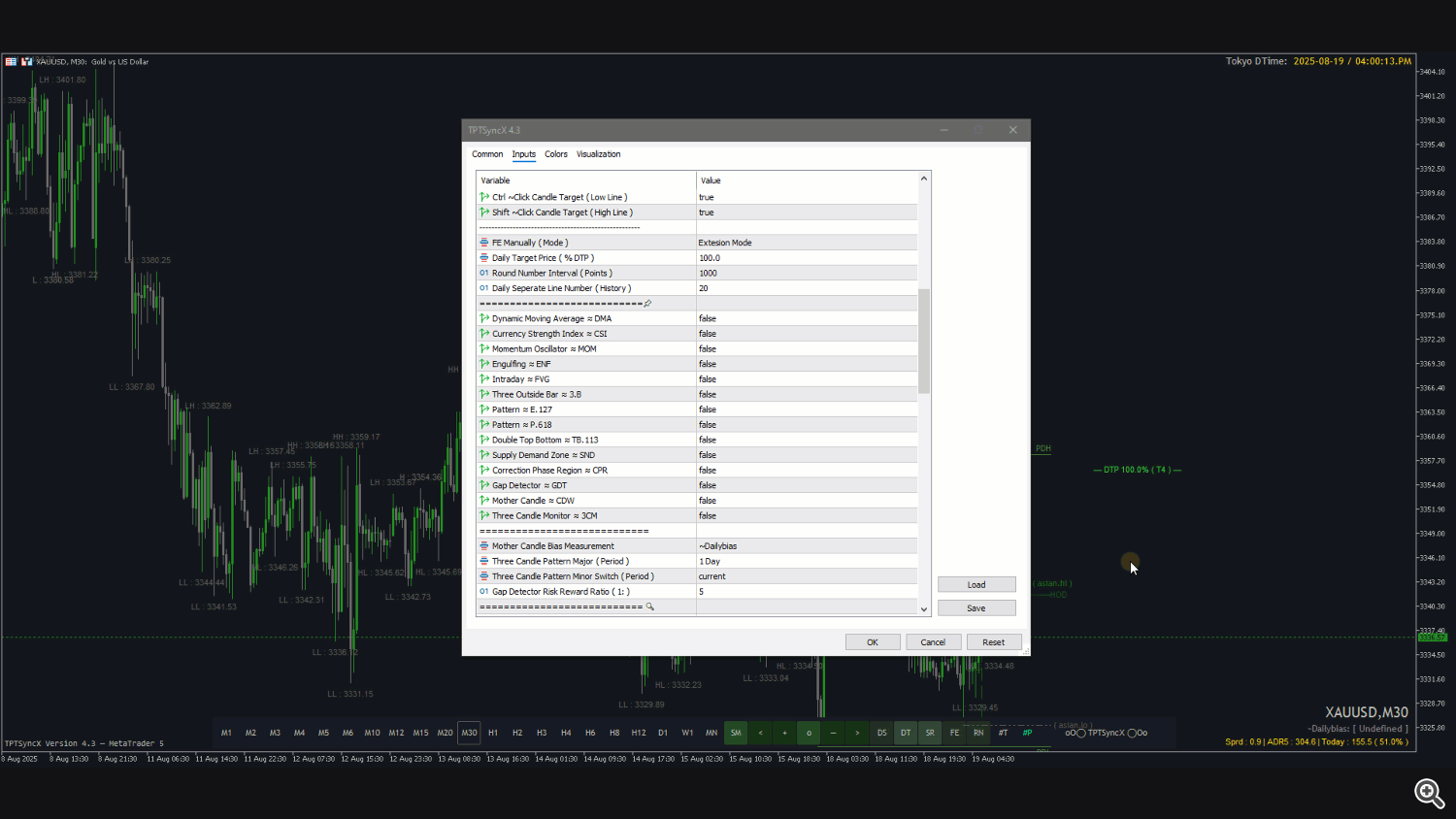

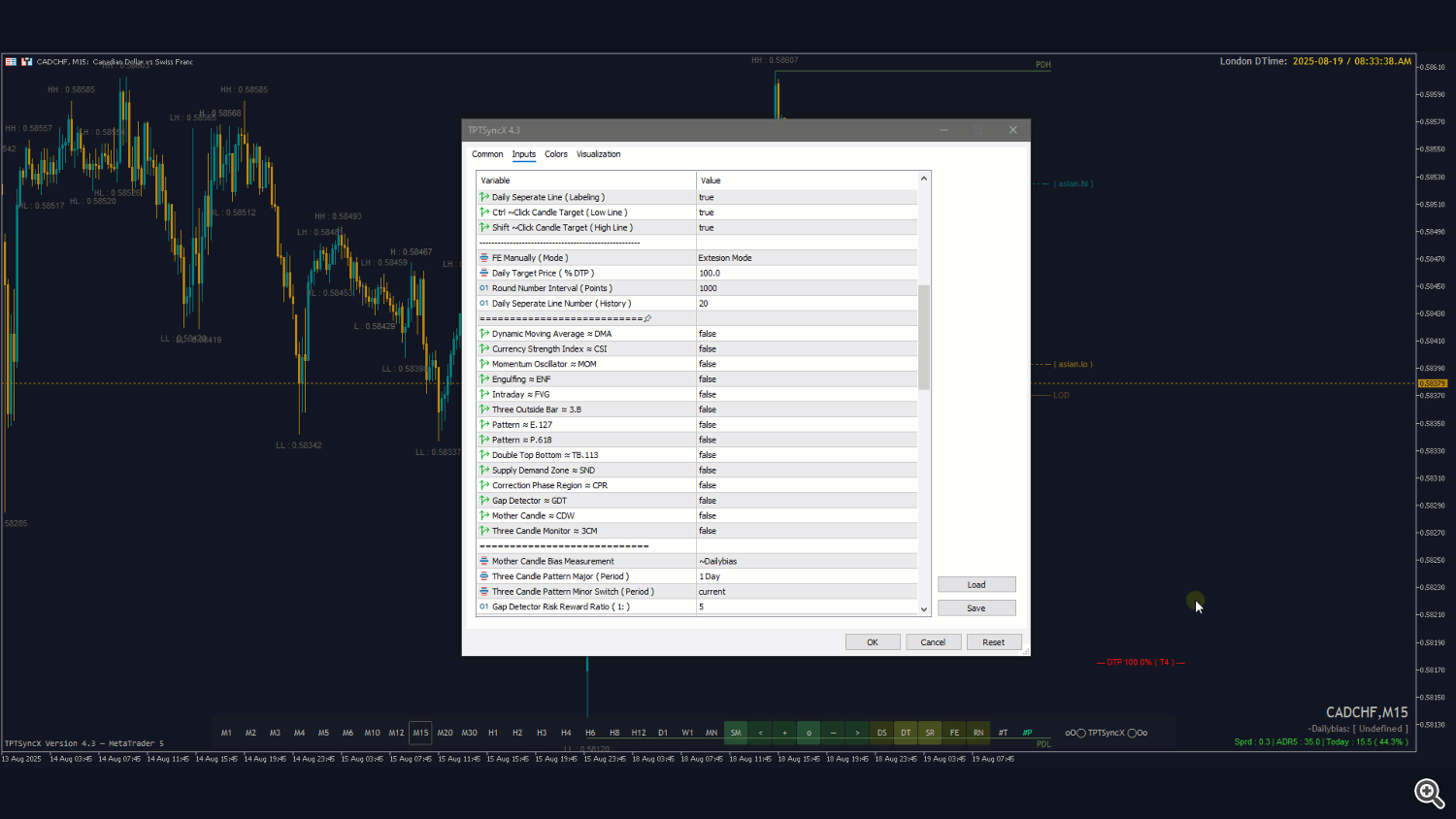

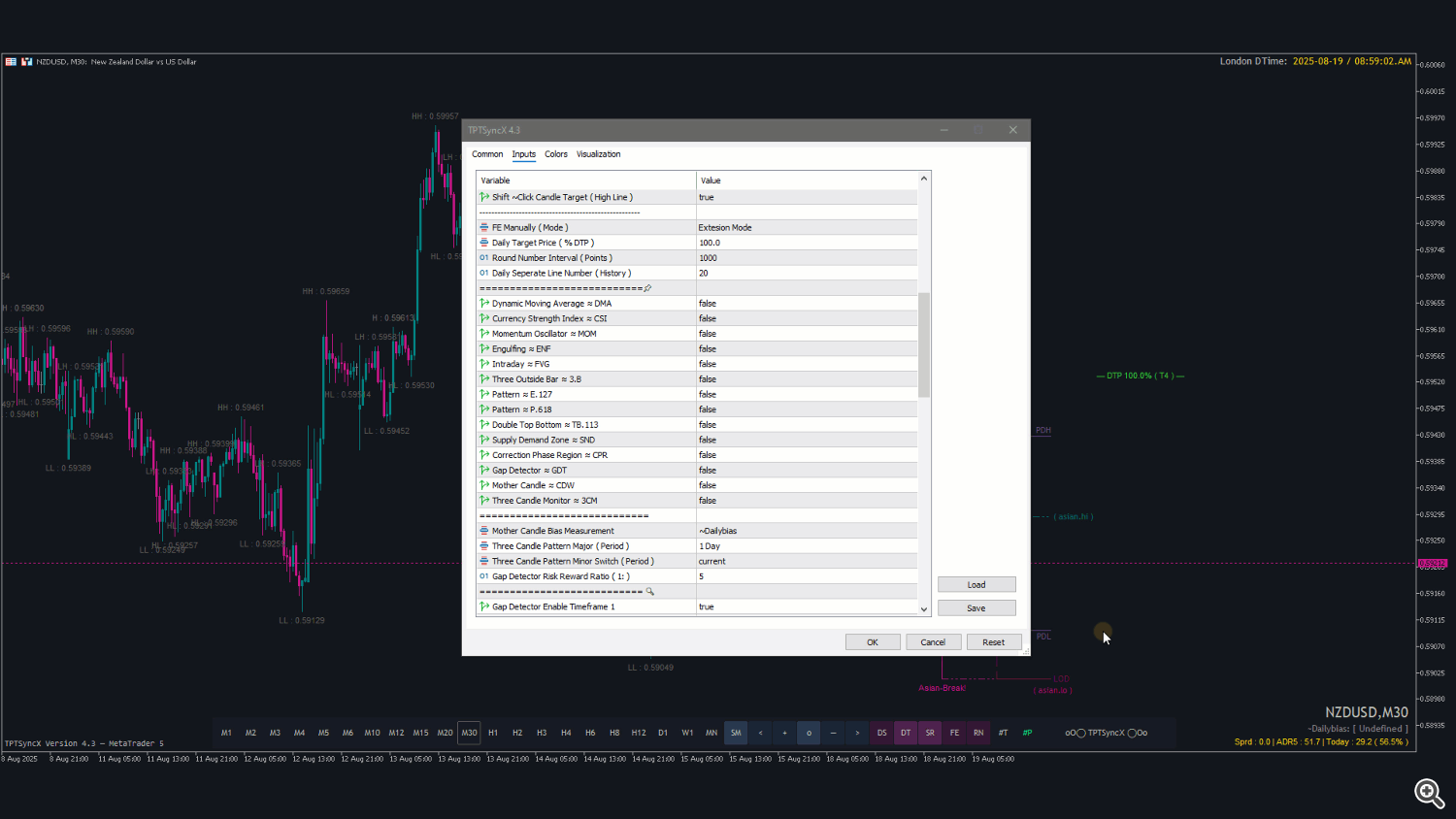

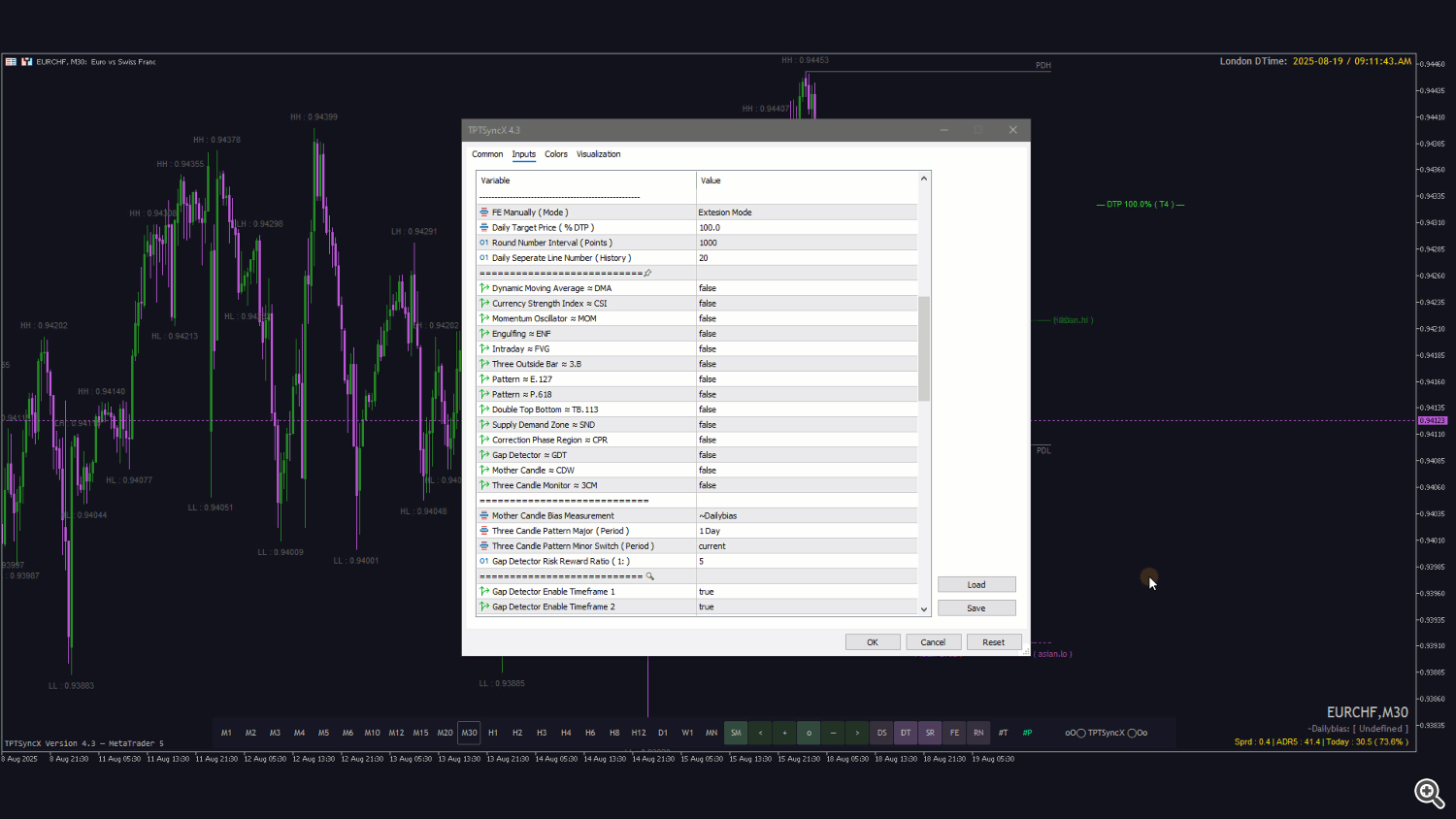

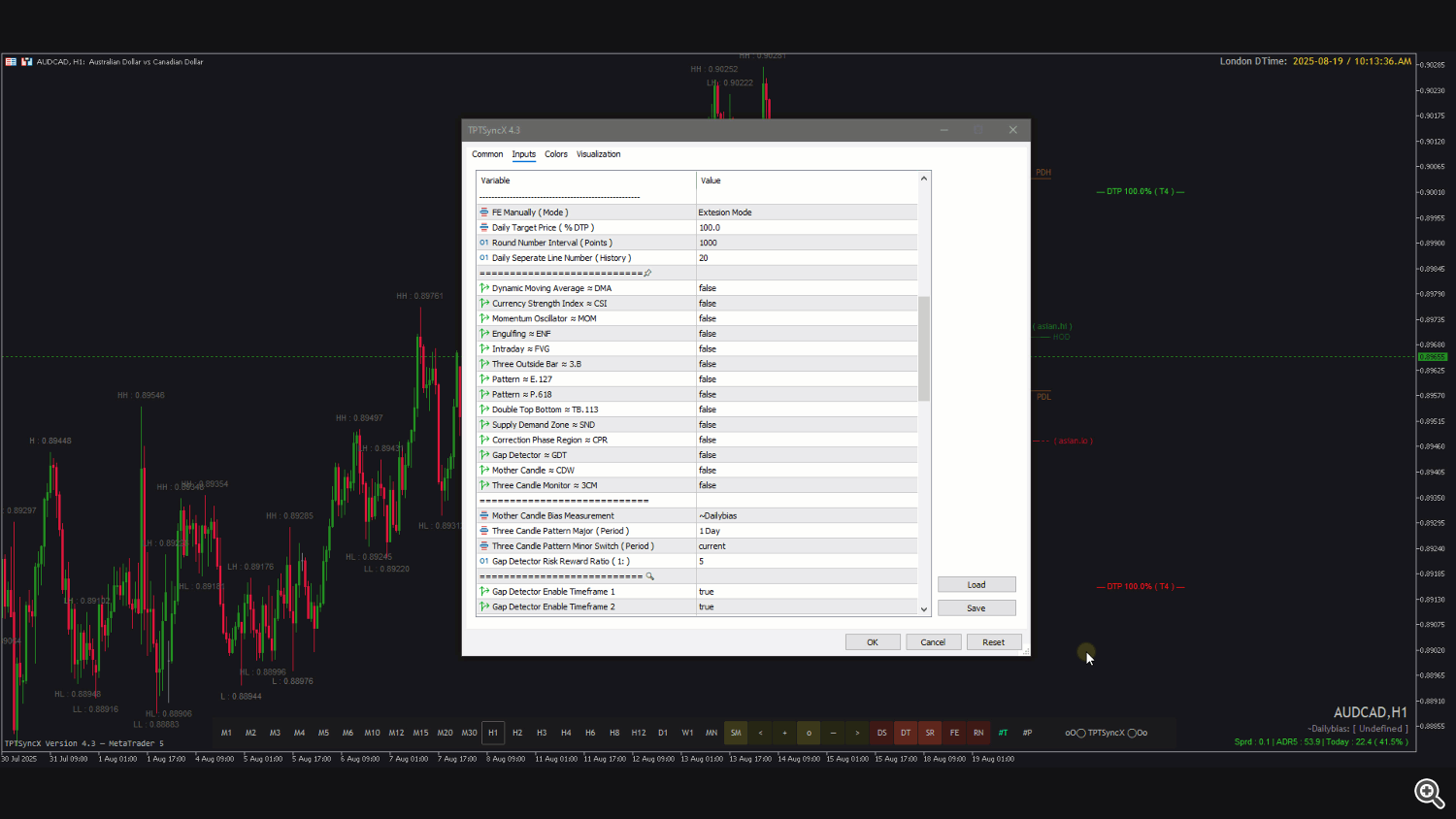

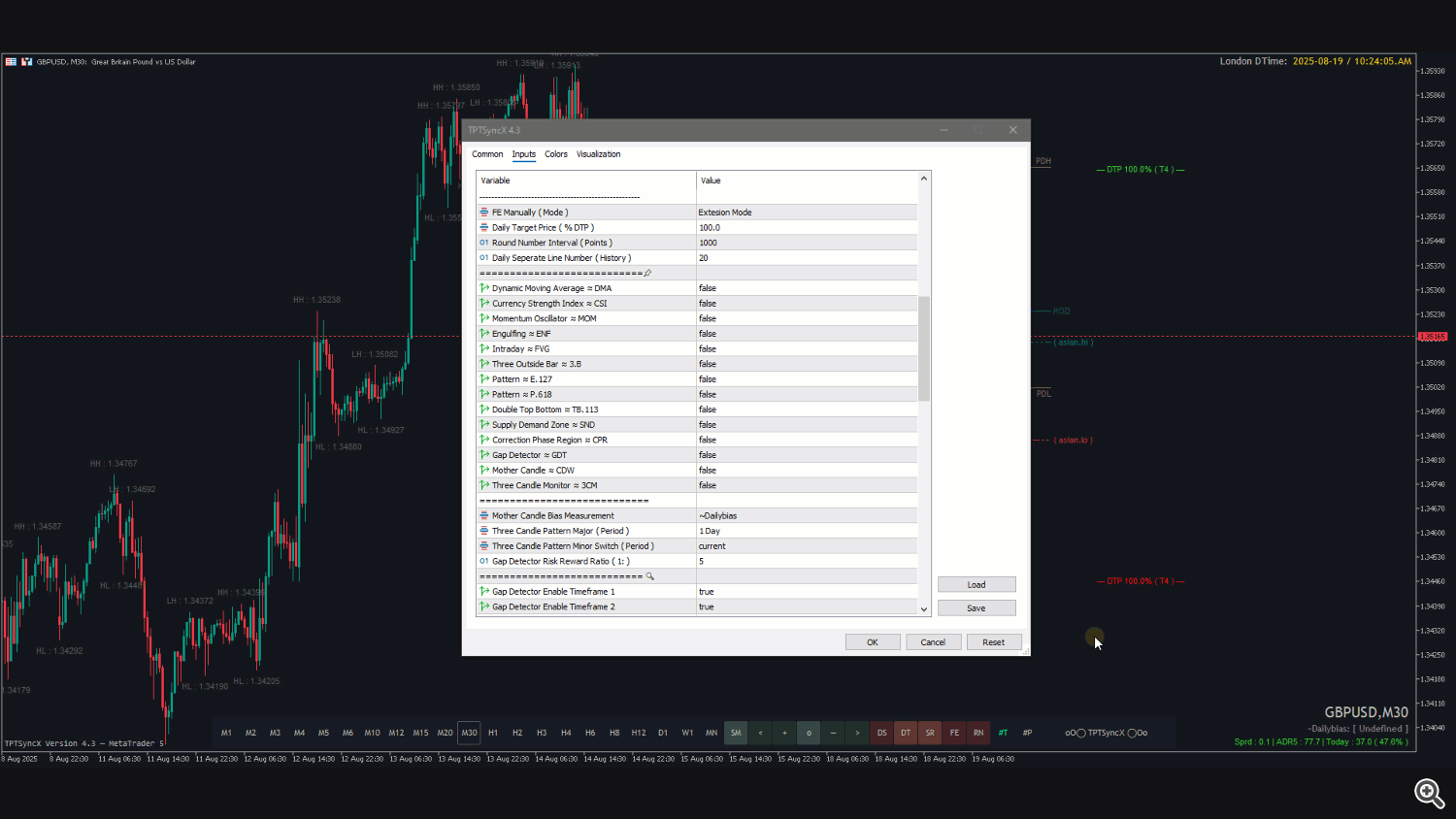

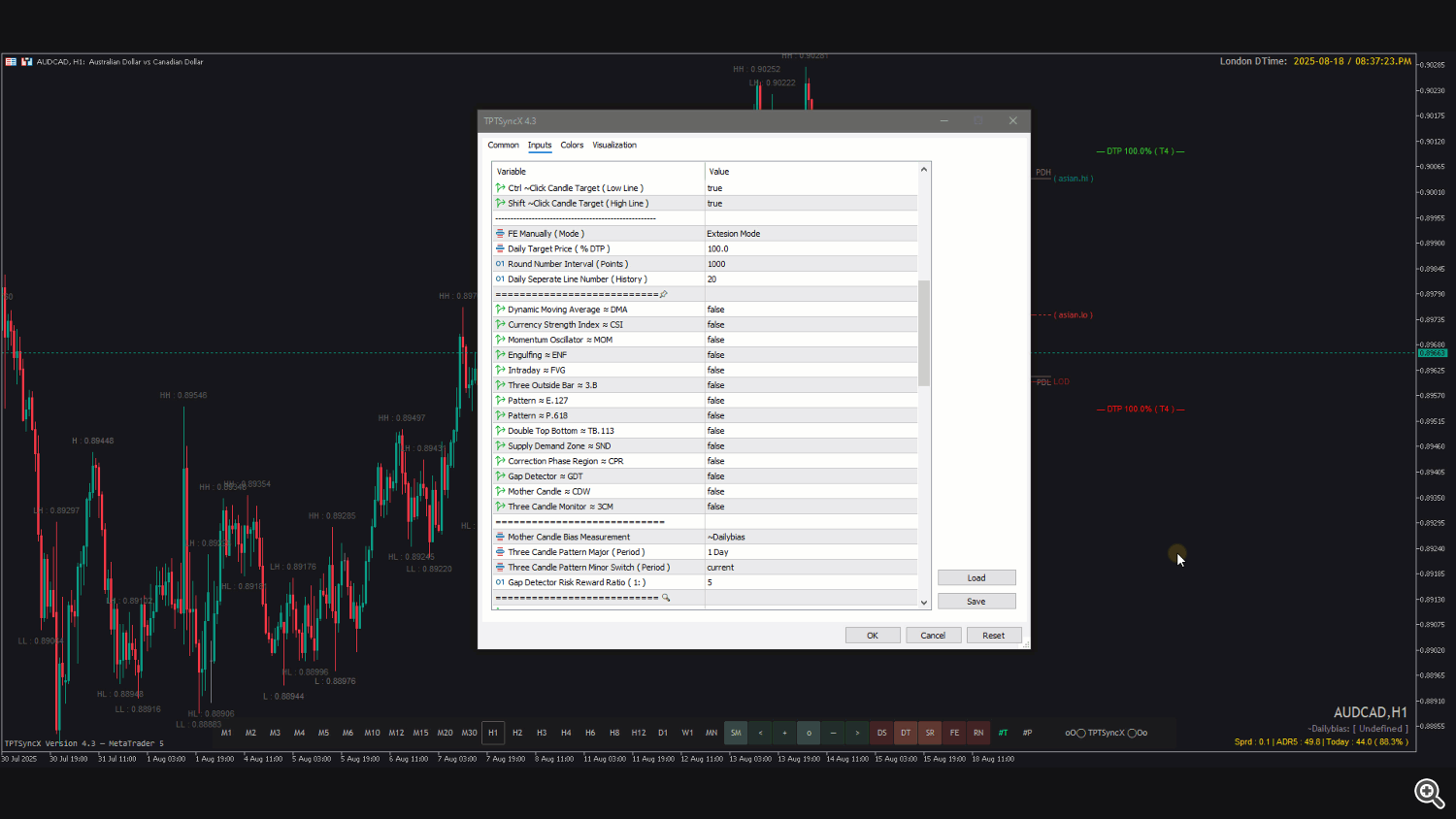

TPTSyncX V4 SERIES – 14 Important Parameters for MetaTrader 5

Introduction

Within the fast-paced world of buying and selling, precision and readability are every part. Profitable merchants know that having the fitting instruments shouldn’t be about including complexity, however about simplifying decision-making and sharpening focus. That’s the place TPTSyncX V4 SERIES steps in—a complicated MetaTrader 5 indicator bundle designed with 14 important parameters that cowl probably the most important features of value motion, momentum, and market construction.

From adaptive pattern evaluation with Dynamic Shifting Common (DMA) to cross-market insights by way of the Forex Energy Index (CSI), TPTSyncX V4 provides a strong set of options tailor-made for merchants who demand accuracy. Whether or not it’s recognizing value imbalances by means of Intraday Truthful Worth Gaps (FVG), confirming reversals with Engulfing patterns, or monitoring structural shifts just like the Double Prime Backside (TB.113), this method equips you with clear, actionable indicators.

Greater than only a assortment of instruments, TPTSyncX V4 is a complete buying and selling framework. It integrates sample detection (E.127, P.618), provide and demand mapping (SND), hole monitoring (GDT), and even higher-level affirmation strategies such because the Mom Candle (CDW) and Three Candle Monitor (3CM). Every parameter works independently, but collectively they kind a unified ecosystem that adapts seamlessly to totally different buying and selling types—scalpers, swing merchants, and place merchants alike.

This weblog will information you thru these 14 important parameters, explaining their goal, how they work together with market conduct, and how one can combine them into your buying and selling technique. Whether or not you’re refining entries, filtering noise, or constructing a disciplined buying and selling system, the TPTSyncX V4 SERIES offers the structured edge you’ve been on the lookout for.

1.Dynamic Interval Shifting Common ≈ DMA

A versatile shifting common that robotically adapts to market volatility and pattern circumstances. In contrast to conventional shifting averages with fastened durations, the DMA dynamically adjusts its smoothing issue based mostly on value motion, permitting it to reply sooner throughout sturdy tendencies whereas filtering out noise in ranging markets. This makes it helpful for figuring out pattern course, recognizing potential reversals, and aligning entries with the dominant market bias.

2.Forex Energy Index ≈ CSI

The Forex Energy Index (CSI) is designed to disclose the true steadiness of energy between currencies. As an alternative of specializing in a single chart, the CSI compares a number of pairs concurrently, displaying which currencies are gaining energy and that are dropping momentum.In TPTSyncX V4, the CSI is calculated based mostly on the typical of RSI values throughout chosen pairs. This strategy combines the reliability of the Relative Energy Index with a broader market perspective. By averaging RSI readings, the CSI smooths out particular person value fluctuations and highlights constant forex efficiency tendencies.This makes it simpler to identify high-probability alternatives, equivalent to strong-versus-weak forex setups, whereas avoiding pairs which might be equally matched and more likely to transfer sideways. With CSI as a part of your toolkit, you’ll be able to align entries with the dominant market circulate and commerce with better confidence.

3.Momentum Oscillator ≈ MOM

The Momentum Oscillator (MOM) in TPTSyncX V4 is constructed based mostly on the Superior Oscillator, offering a transparent visible of market acceleration and deceleration. By monitoring the energy of bullish and bearish momentum, it provides merchants an intuitive method to anticipate shifts in value dynamics.When utilized with Buying and selling Chaos Idea, this oscillator turns into much more highly effective. Its wave-like patterns can be utilized to measure and validate Elliott Wave constructions, serving to merchants determine the place the market at present sits throughout the broader cycle. This mix permits for exact timing—recognizing continuation waves early and detecting potential reversal factors earlier than they unfold.With MOM, merchants not solely see momentum in movement but in addition achieve a structured framework to map market psychology by means of Elliott Wave.

4.Engulfing ≈ ENF

The Engulfing sample (ENF) is among the most dependable candlestick formations for signaling potential market reversals or sturdy continuation strikes. It happens when a candle’s physique utterly engulfs the physique of the earlier candle, reflecting a decisive shift in management between patrons and sellers. the Engulfing detection is totally automated throughout a number of timeframes, permitting merchants to identify these high-probability setups with out manually scanning charts. A bullish engulfing suggests renewed shopping for energy after a down transfer, whereas a bearish engulfing signifies contemporary promoting strain after an up transfer.

5.Intraday ≈ FVG

The Intraday Truthful Worth Hole (FVG) highlights areas of value imbalance created when the market strikes too aggressively, leaving untested zones between candles. These gaps typically function liquidity swimming pools the place value is drawn again to revive steadiness.With automated detection in TPTSyncX V4, merchants can immediately determine intraday imbalances and use them as exact reference factors for retracements, continuation entries, or potential reversals. This offers a strategic benefit in timing trades round zones the place institutional exercise is most certainly concentrated.

6.Three Exterior Bar ≈ 3.B

A 3-candle reversal sample detetion in multi-timeframes that confirms a decisive shift in market momentum. It types when the second candle totally sturdy response, and the third closes additional in the identical course, validating the change. This construction strengthens reversal indicators and offers merchants with larger confidence for timing entries after a pattern shift.

7.Sample ≈ E.127

A projection sample constructed across the 127% extension degree, generally utilized by means of the AB=CD 1.27 projection. On this setup, the CD leg extends 1.27 instances the AB leg, making a exact reference level for anticipating value reactions. In TPTSyncX V4, this sample could be detected throughout a number of timeframes and forex pairs concurrently, making it simpler to align intraday indicators with higher-timeframe bias. By projecting value conduct past the prior swing, merchants can determine whether or not the market is approaching an exhaustion zone or making ready for a powerful continuation. This mix of projection accuracy, multi-timeframe context, and cross-currency evaluation offers a sharper edge in recognizing high-probability continuation alternatives.

8.Sample ≈ P.618

A projection sample centered on the 61.8% retracement–projection degree, typically considered the golden ratio for reversals. When value reaches this zone, it incessantly indicators exhaustion of the present transfer and the potential begin of an reverse leg. In TPTSyncX V4, the P.618 is tracked throughout a number of timeframes and forex pairs, permitting merchants to detect alignment between short-term pullbacks and higher-timeframe reversal zones. This makes it a strong filter for figuring out turning factors, refining entries, and decreasing publicity to false breakouts by specializing in probably the most important Fibonacci projection degree.

9.Double Prime Backside ≈ TB.113

A traditional reversal formation the place value fails to interrupt past the identical resistance or help degree twice. The Double Prime signifies promoting strain at a repeated excessive, whereas the Double Backside displays shopping for energy at a repeated low. TB.113 robotically tracks these setups throughout a number of timeframes, forex pairs, and with particular deal with intraday value motion, permitting merchants to catch early indicators of exhaustion throughout the buying and selling day. This makes it an efficient device for recognizing intraday turning factors, tightening threat management, and aligning short-term reversals with broader market context.

10.Provide Demand Zone ≈ SND

An computerized zone detector that maps provide and demand on the present chart utilizing liquidity cues—speedy displacement, unfilled impulse strikes, wick absorption, and clustered order-flow footprints—to disclose the place giant resting orders doubtless sit. By studying these liquidity signatures in actual time, SND highlights high-probability response areas for exact entries, protecting stops simply past the zone, and measured targets as value rebalances into obtainable liquidity.

11.Correction Section Area ≈ CPR

A structural mapping that identifies the market’s corrective phases inside a pattern. As an alternative of chasing each swing, CPR highlights zones the place value is briefly consolidating, retracing, or absorbing liquidity earlier than the subsequent enlargement. this detection is automated on the present chart with multi-timeframe and multi-paris consciousness, permitting merchants to tell apart between wholesome pullbacks and potential reversals. By specializing in correction phases, merchants can higher time entries in step with pattern continuation or put together for shifts when corrective constructions fail.

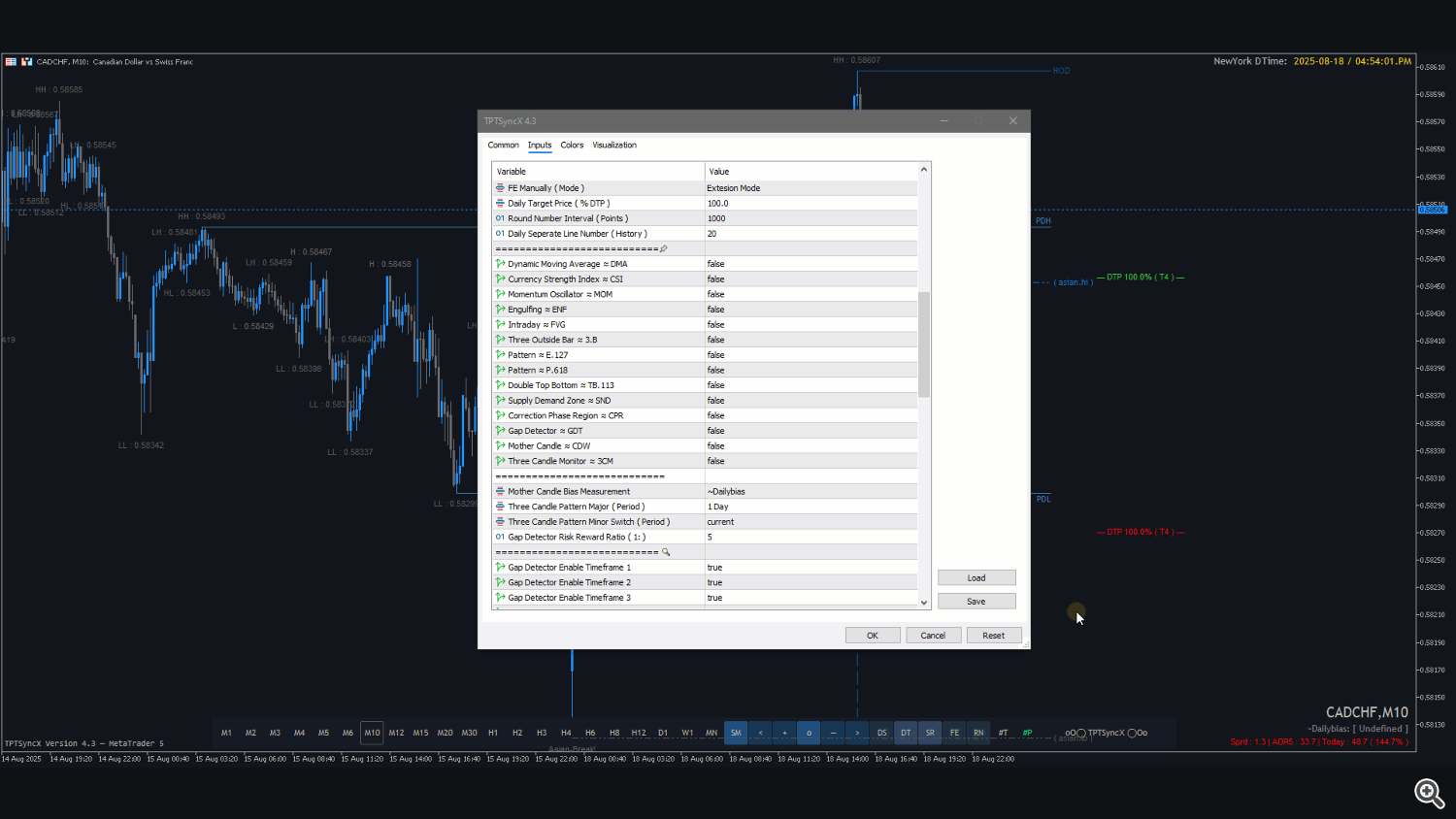

12.Hole Detector ≈ GDT

A specialised device that scans for value gaps within the present time, throughout a number of pairs and a number of timeframes concurrently. It robotically highlights imbalance zones the place liquidity was skipped, giving merchants clear references for potential retracements or continuations. GDT can be introduced within the type of a dashboard on the present chart, permitting on the spot monitoring and comparability with out switching symbols or timeframes, making it extremely environment friendly for each intraday and swing methods.

13.Mom Candle ≈ CDW

A candlestick-based reference that focuses on a single present candle within the every day and weekly timeframe. The Mom Candle defines the dominant excessive–low vary that accommodates subsequent value motion, performing as a boundary for breakout or continuation setups. By monitoring this candle in actual time, merchants achieve a transparent map of the market’s fast construction, utilizing its vary as a information for intraday positioning, breakout affirmation, and higher-timeframe bias alignment.

14.Three Candle Monitor ≈ 3CM

A formation tracker that displays sequences of three candles on each minor and main timeframes, with the pliability to swap views immediately. This function permits merchants to check short-term momentum shifts whereas aligning them with broader structural strikes, making it simpler to validate setups, verify bias, and synchronize entries throughout totally different buying and selling horizons.

Extra Supporting Capabilities

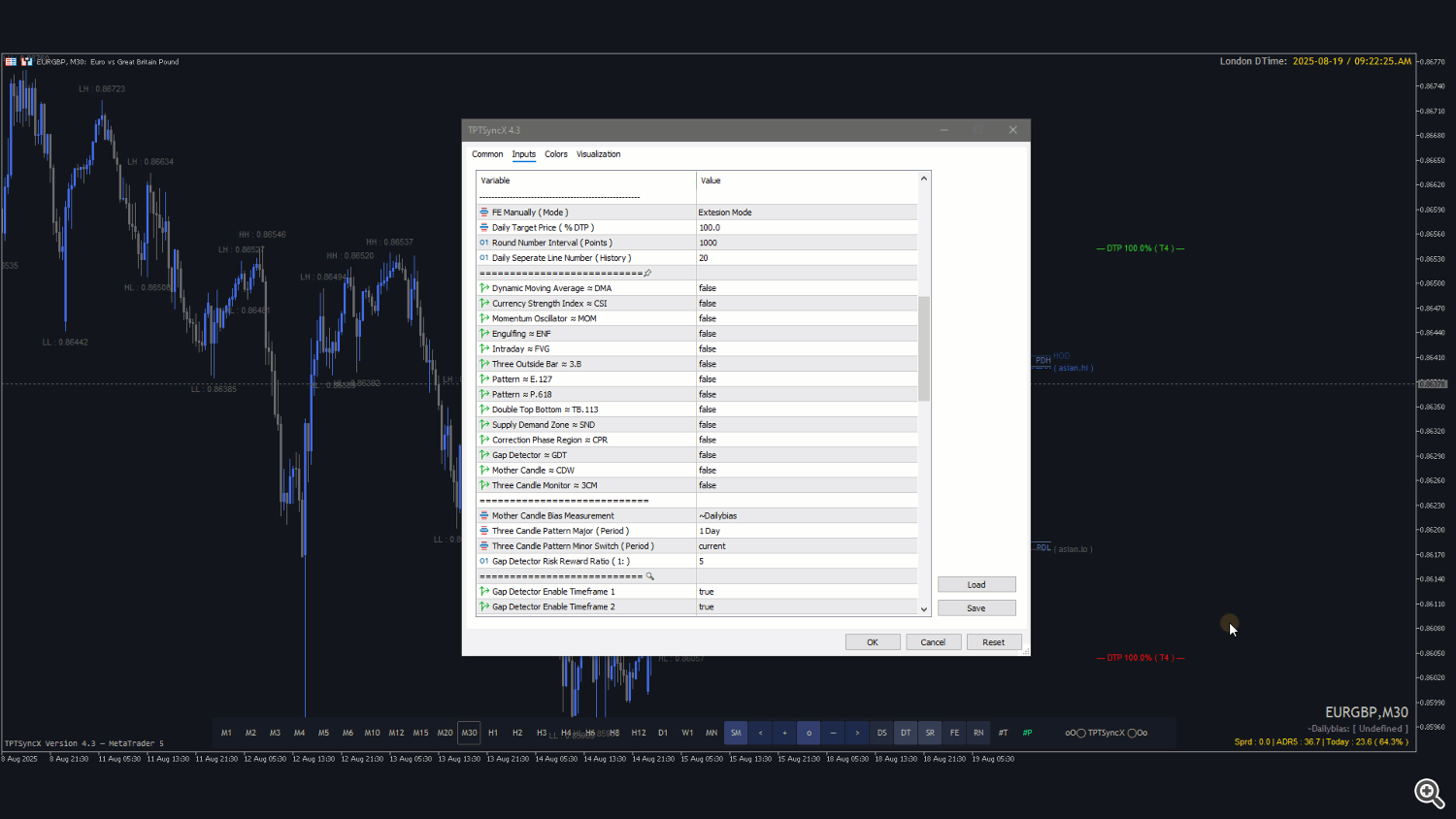

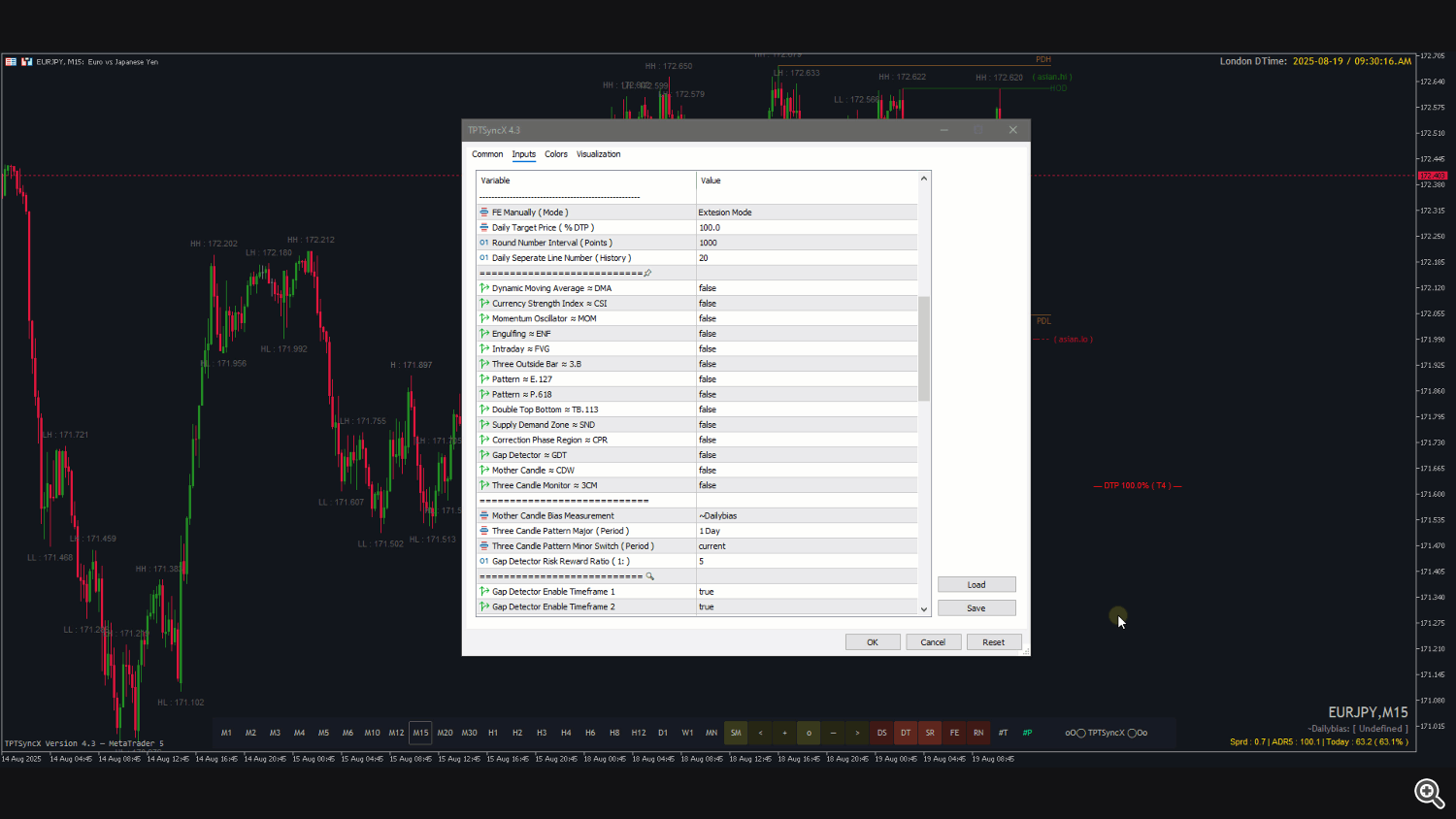

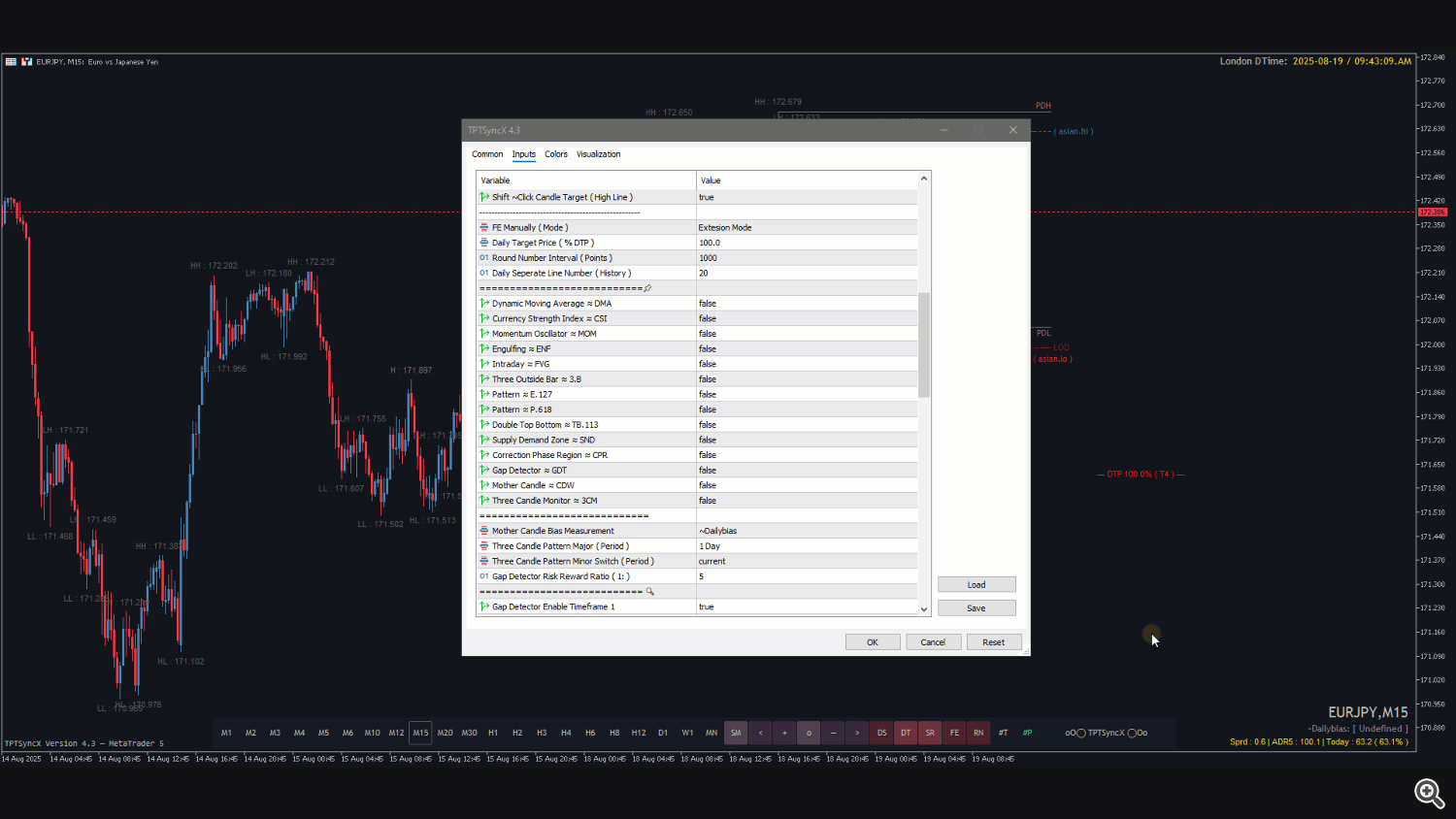

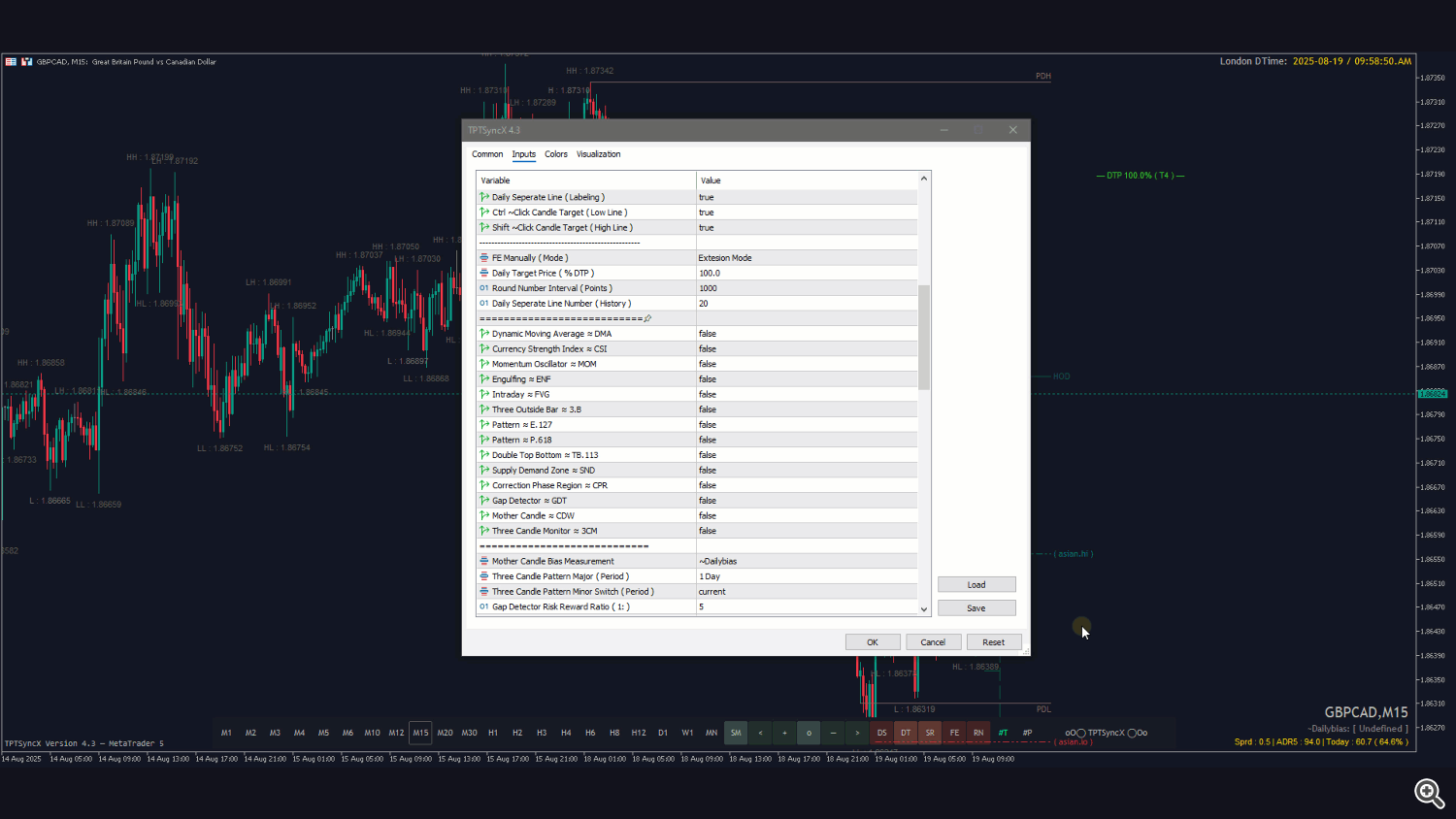

A group of sensible enhancements designed to simplify and streamline the buying and selling course of. Core options embody every day reference traces for readability, guide Fibonacci extension instruments for projection, spherical quantity markers to identify psychological value ranges, every day goal value indicators for measured aims, and time session guides to trace market openings and overlaps. These supporting features present merchants with a cleaner workflow, decreasing chart litter whereas enhancing decision-making. And with many extra utilities built-in, they collectively function a complete toolkit to help consistency, precision, and effectivity in on a regular basis buying and selling.

Get it now — TPTSyncX for MetaTrader 5, obtainable solely on the official web site https://www.mql5.com/en/market/product/136185

Expertise the market with TPTSyncX Full Chart + AUX — Zero compromise.

🎁 FREE AUX MT5 Indicator & EA Bundle — Requires TPTSyncX

Improve your MetaTrader 5 buying and selling setup with this unique FREE obtain of superior auxiliary instruments — designed to enrich and lengthen the capabilities of the TPTSyncX indicator.

⚠️ Word: This bundle requires the TPTSyncX indicator as the first device. AUX instruments are designed to work alongside it for full performance

What’s Included within the AUX Bundle:

🔹 AUX Oscillator Indicator for Elliott Wave Counting ( FREE )

An clever oscillator that helps Elliott Wave evaluation (Primarily based on Buying and selling Chaos Idea), serving to you visually determine wave constructions and potential reversal zones with ease. simply double click on goal on the indicator window and the zone will seem.

🔹 EA Commerce Supervisor for Danger Administration ( FREE )

Automate your threat management with this good EA — together with dynamic lot dimension calculation, auto SL/TP placement or manually performance, all aligned with skilled cash administration ideas.

🔹 EA to Shut All Positions Primarily based on Goal Fairness ( FREE )

Set your every day, weekly, or customized fairness targets, and let this EA robotically shut all positions as soon as your revenue purpose is reached — serving to you safe features and stick with your buying and selling self-discipline.

✅ Requires the TPTSyncX indicator (not included on this obtain)

📥 Obtain the AUX TPTSyncX information beneath