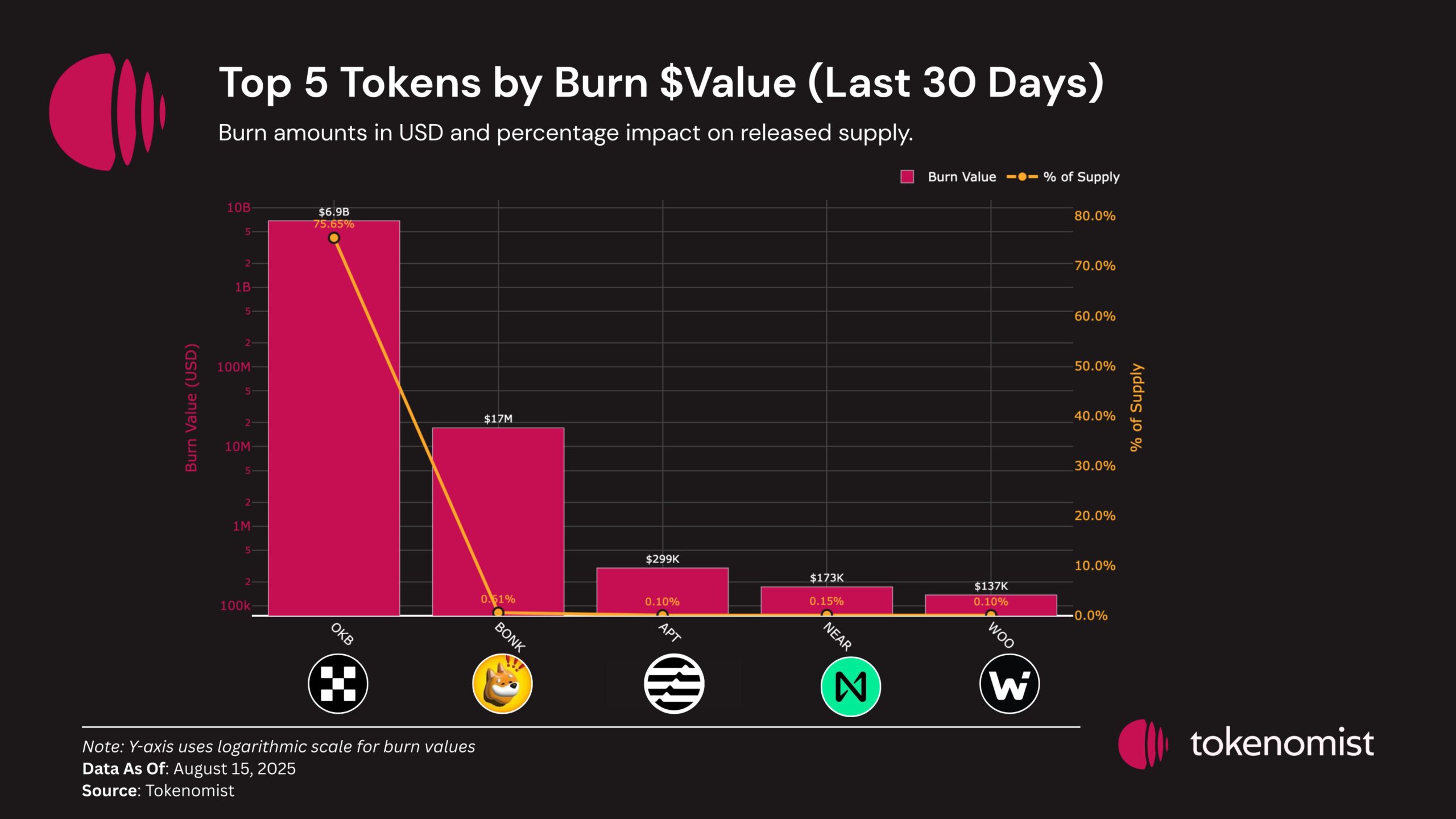

In 2025, token provide administration methods reminiscent of buybacks and burns have turn out to be more and more necessary instruments to reinforce worth and investor enchantment. OKX, one of many main cryptocurrency exchanges, demonstrated this by means of its OKB token burn plan.

The query is why this burn technique enabled OKB to outperform different tokens prior to now month. The next evaluation highlights the core variations.

Key Variations within the OKB Token Burn

Knowledge from CryptoBubble exhibits OKB recorded the very best development amongst altcoins prior to now month.

The token gained practically 300%, surpassing different sturdy performers reminiscent of LINK, MNT, and AERO.

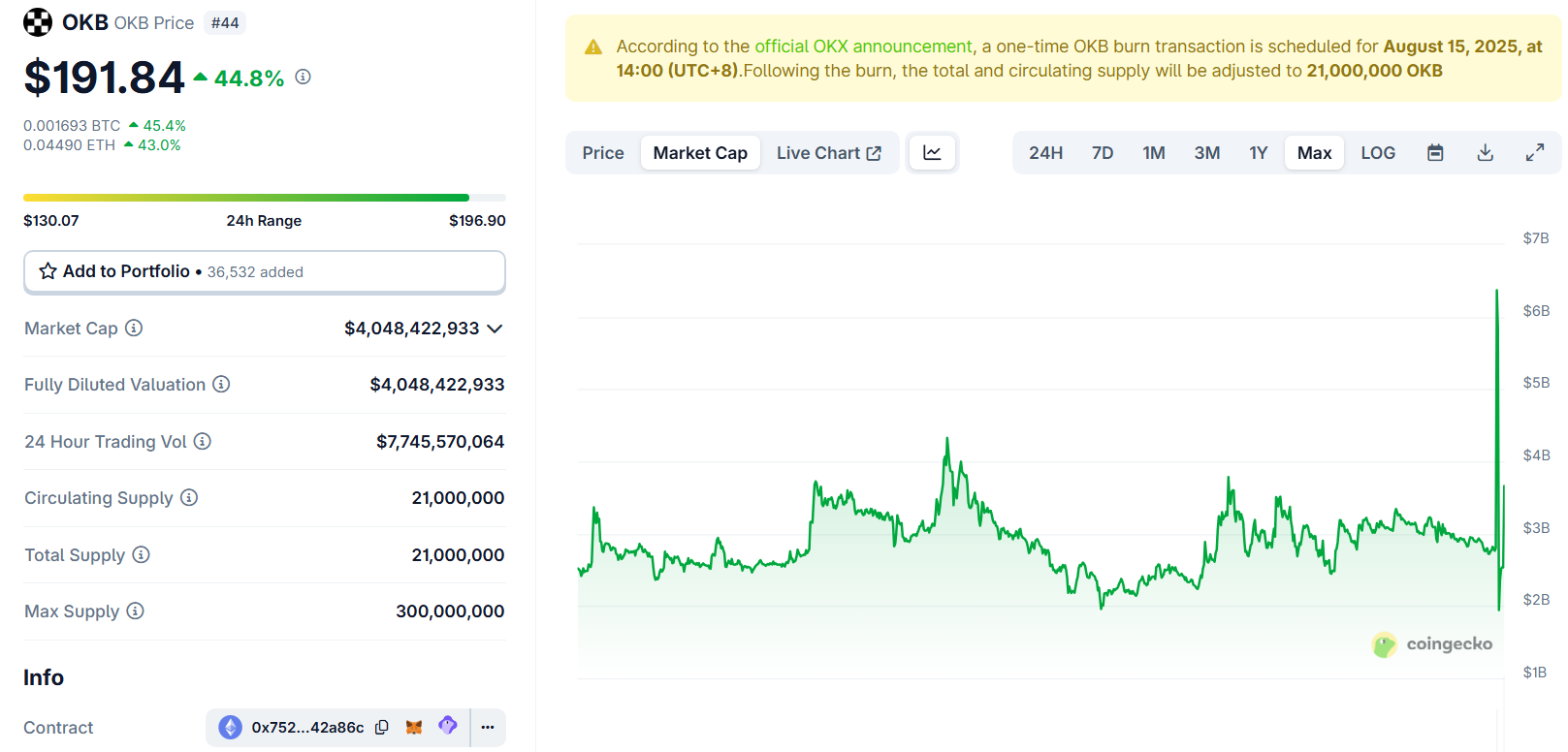

In contrast to routine burns, the OKB burn was positioned as a close to redefinition of tokenomics. OKX carried out its largest-ever burn, completely eradicating 65,256,712 OKB—together with beforehand repurchased and reserved tokens—lowering the mounted provide to 21 million.

This provide adjustment allowed the market to reprice the token’s capitalization. The timing proved vital, because it coincided with a constructive interval in August when analysts held excessive expectations for an altcoin season.

Following the burn, OKB’s provide is now mounted at 21 million. This determine mirrors Bitcoin’s most provide, making a psychological hyperlink between OKB and the market’s benchmark asset. The transfer features as a advertising and marketing issue, encouraging buyers to check OKB to Bitcoin when valuing it.

Different initiatives have adopted buyback-and-burn fashions, however and not using a mounted provide cap. As an illustration, Tron has burned 7.1 billion TRX since launch, together with 820 million in 2025 alone, but TRX doesn’t have a most restrict.

Smaller, periodic burns and not using a capped provide are inclined to dilute the affect over time. In contrast, OKX’s removing of 65.26 million OKB was decisive, introducing instant deflationary strain and driving a pointy value enhance.

These structural variations helped OKB quadruple in worth in August.

Will OKB Preserve Rising?

An evaluation of OKB’s potential requires wanting past value actions to adjustments in market capitalization.

After the burn, knowledge from CoinGecko signifies OKB’s present market capitalization equals its totally diluted valuation, at simply over $4 billion.

Traditionally, capitalization fluctuated round $3–4 billion earlier than and after the burn. This means that the value rally didn’t essentially mirror a corresponding enhance in whole worth.

“OKX minimize whole OKB provide from 300 million to 21 million. The worth surged 3x, however historical past exhibits token burns don’t robotically create sustainable worth or liquidity,” Bitcoin Suisse AG commented.

BNB’s long-term good points stemmed not solely from burns but in addition from adoption inside the Binance Chain ecosystem. Equally, TRX maintained long-term development because of rising demand for USDT transactions.

Subsequently, increasing OKB’s purposes can be essential for sustaining development in its market capitalization.

A key aggressive benefit for OKB could lie in OKX’s ecosystem, notably with X Layer. X Layer, a public zkEVM-based community developed in partnership with Polygon, launched in 2023. OKB stays the only real gasoline and native token for X Layer.

The publish How the OKB Token Burn Technique Created a 400% Rally appeared first on BeInCrypto.