Bitcoin has not too long ago set new all-time highs, but most of the main Bitcoin treasury firms have been underperforming considerably. Regardless of Bitcoin itself not too long ago pushing properly above $120,000, the share costs of corporations corresponding to (Micro)Technique stay removed from their peaks. Are these firms more likely to see a sustained restoration, or has their interval of outperformance already handed?

Bitcoin Treasury Firms: Large BTC Holdings in 2025

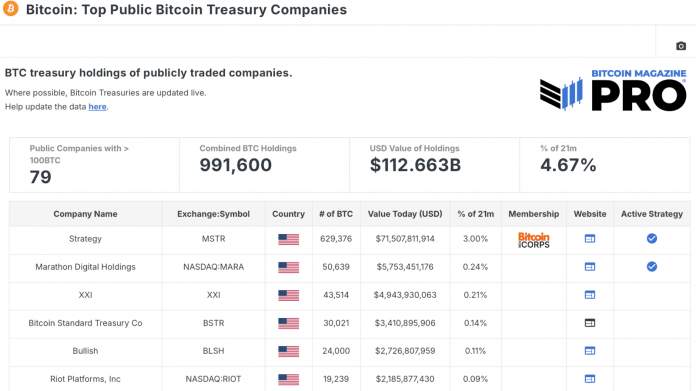

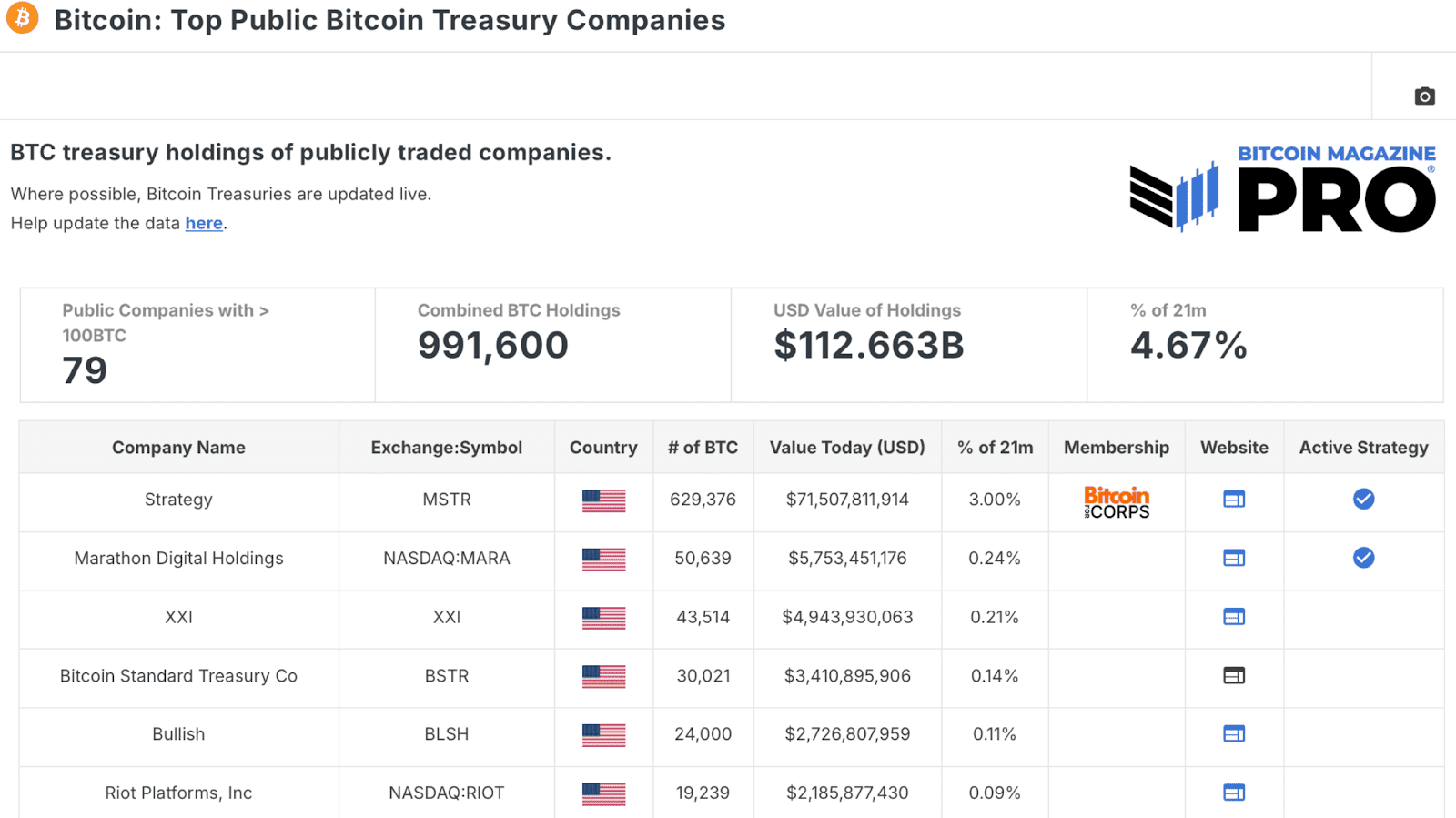

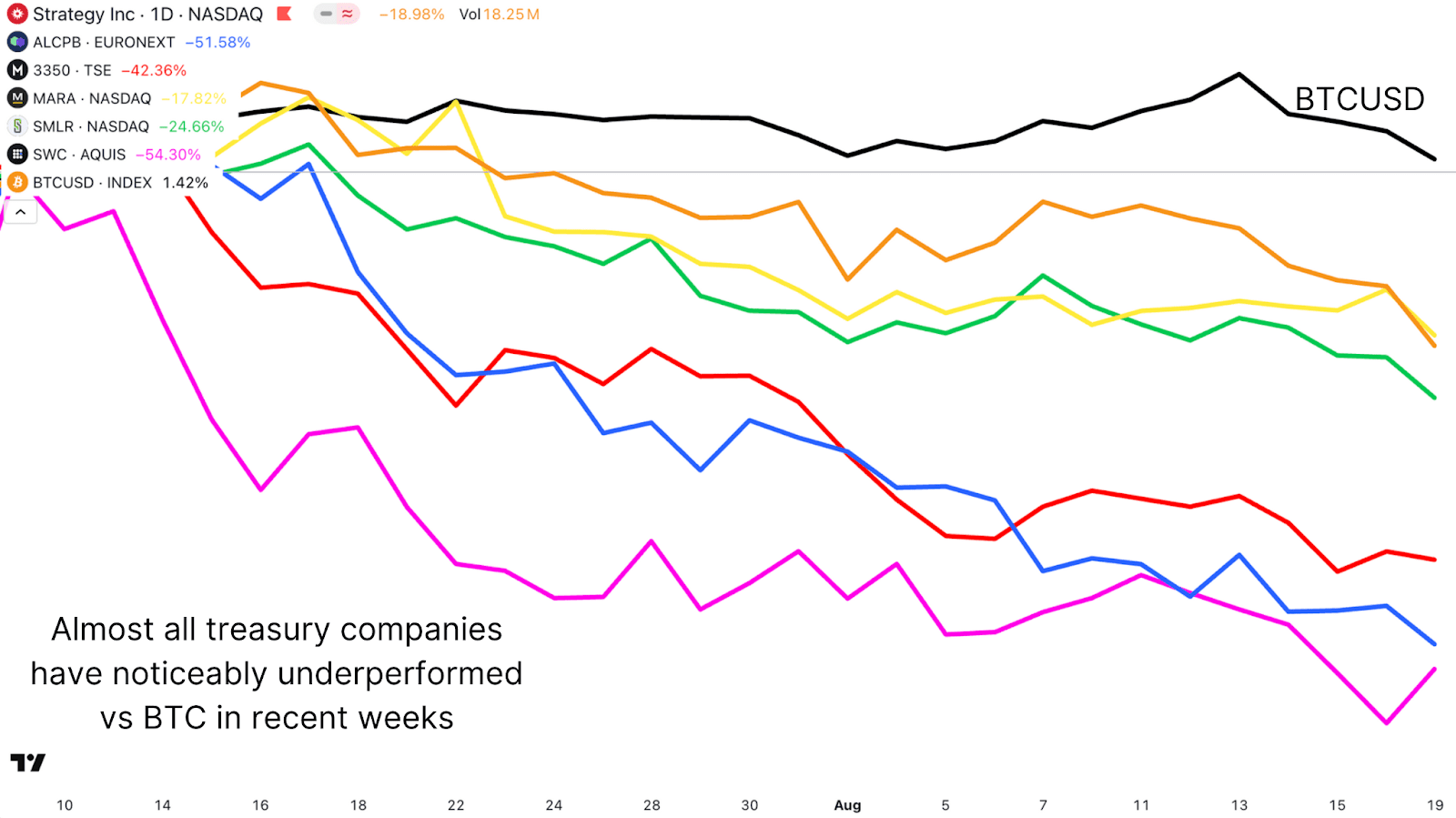

Analyzing the desk of High Public Bitcoin Treasury Firms reveals a complete of 79 public firms maintain at the least 100 BTC, amounting to nearly one million Bitcoin, valued at over $110 billion. A monumental quantity, contemplating a majority of those firms solely began accumulating up to now couple of years!

Of those, twenty-three firms are Lively Bitcoin Treasury Firms, these which can be actively utilizing financing methods to generate extra capital for BTC accumulation, holding a mixed 723,000 BTC and rising quickly. Unsurprisingly, (Micro)Technique dominates this group with the most important allocation of near 630,000 BTC.

This large degree of institutional accumulation highlights the rising significance of Bitcoin on company steadiness sheets. Nonetheless, traders have begun to query whether or not the once-explosive inventory efficiency of those firms can proceed.

Why Bitcoin Treasury Firms Are Underperforming in 2025

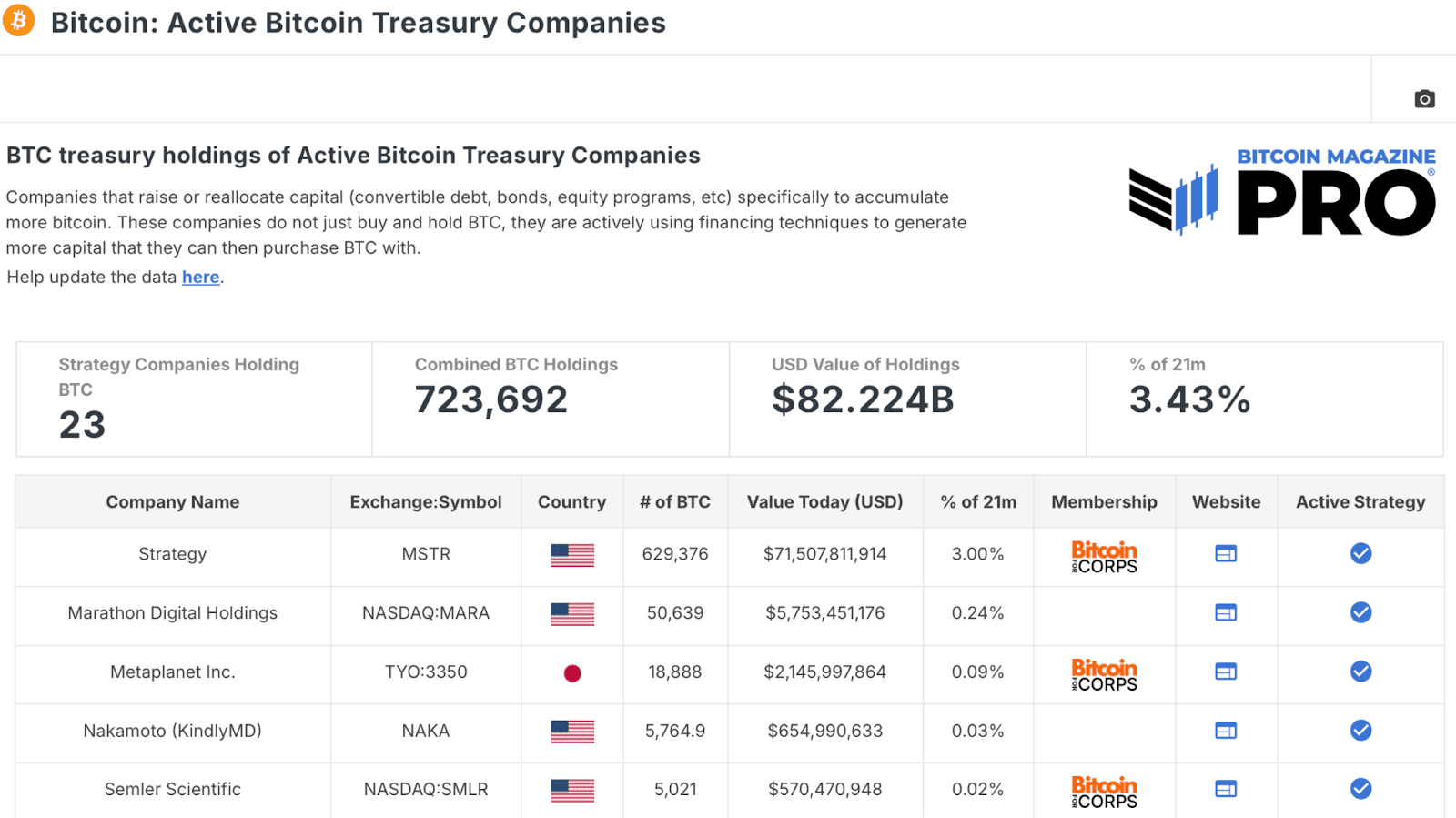

(Micro)Technique has been the flagship Bitcoin treasury firm, however its inventory value has not mirrored Bitcoin’s power in current months. Whereas BTC surged previous $124,000 earlier than its current retracement, MSTR’s share value has languished to as little as $330 not too long ago, properly beneath its $543 highs. In current weeks, nearly all of those treasury firms have considerably underperformed compared to Bitcoin.

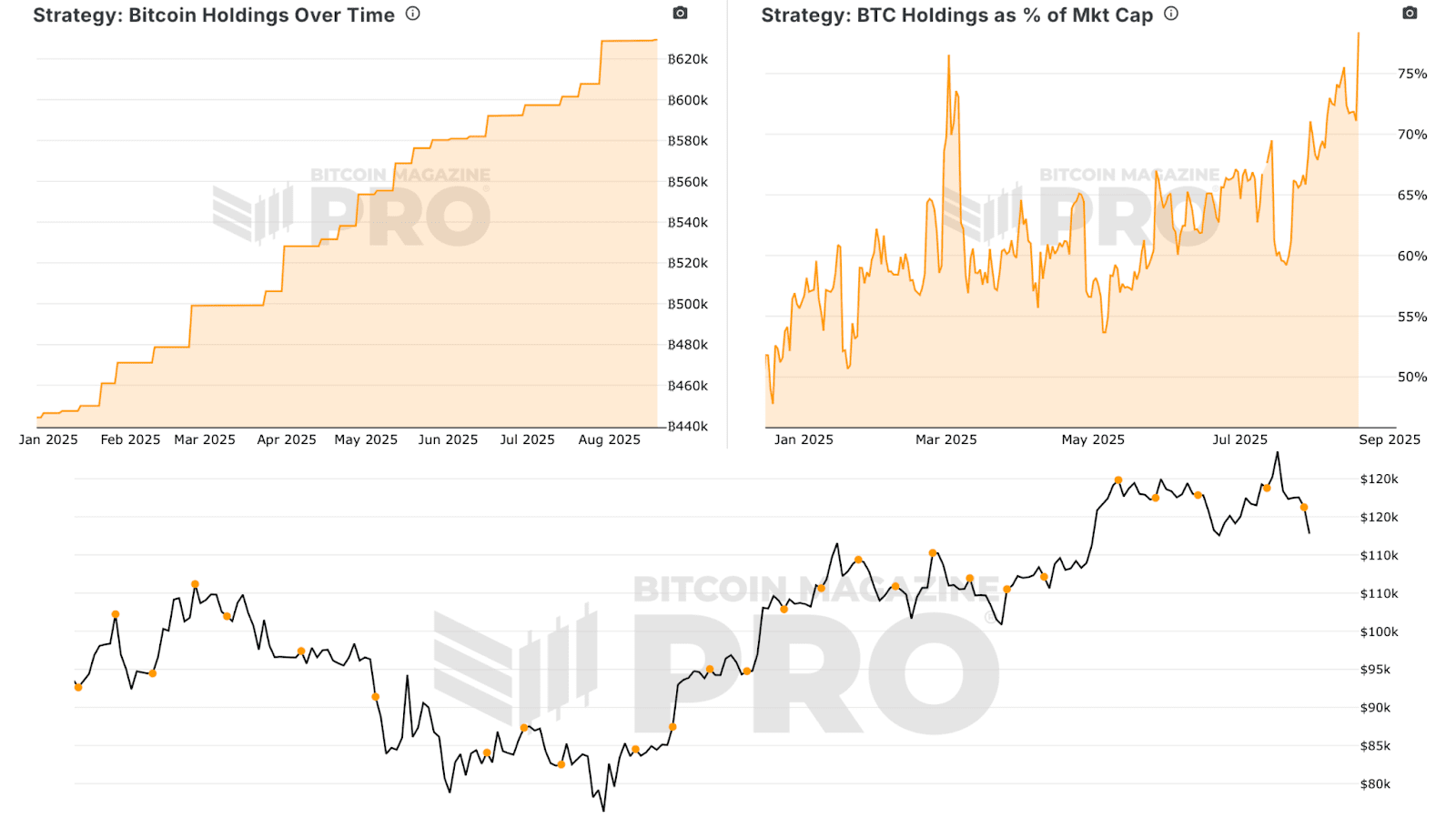

A key cause is the slowing accumulation. Whereas (Micro)Technique made a big buy in July 2025, we are able to see from their Bitcoin Holdings Over Time that the tempo has noticeably tailed off in comparison with its aggressive shopping for in prior years. With out steady and vital accumulation, traders could also be much less prepared to pay a premium for shares.

Share Dilution’s Influence on Bitcoin Treasury Firms’ Inventory Costs

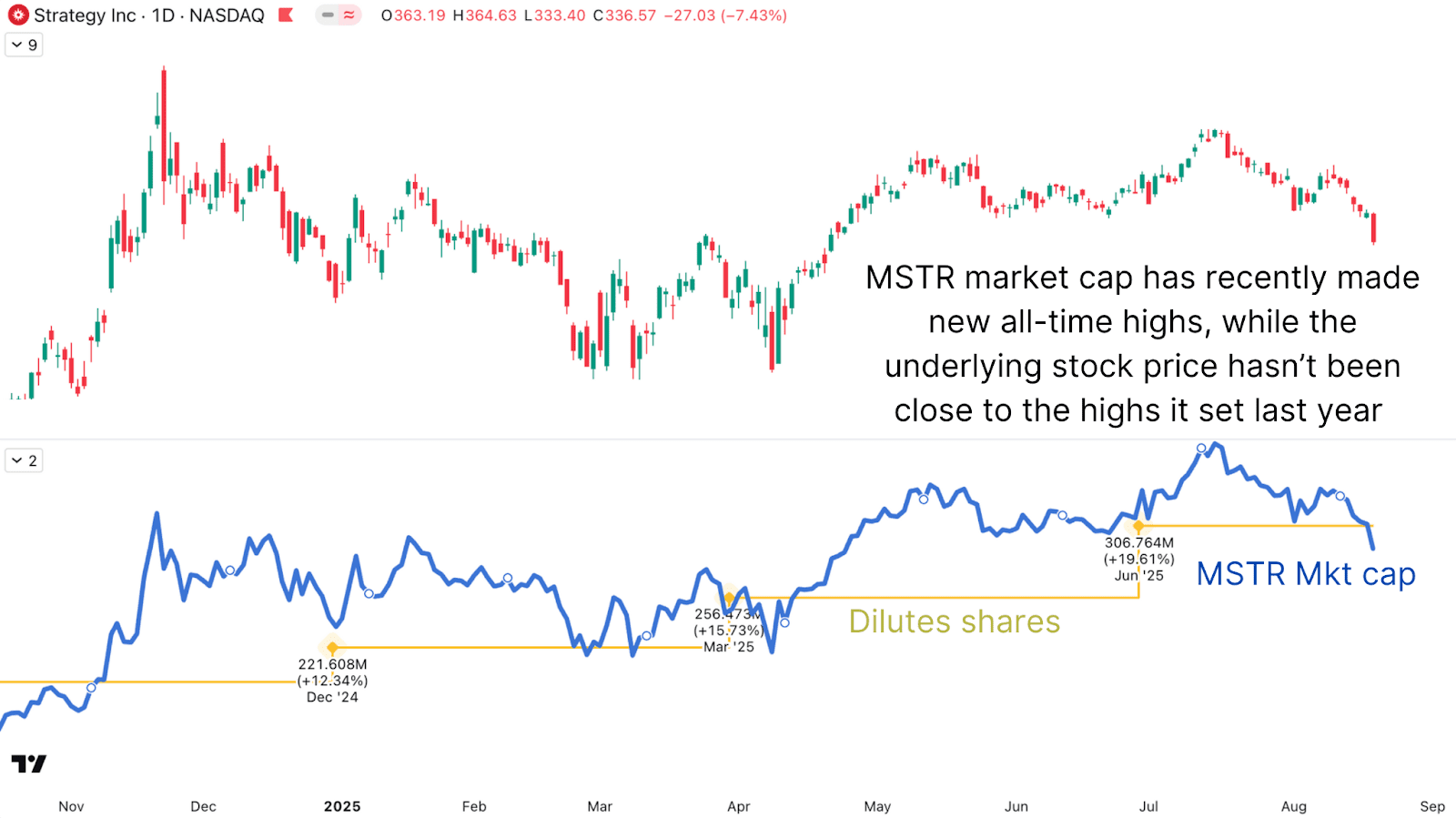

(Micro)Technique continuously points new shares to boost capital for Bitcoin purchases. Whereas this will increase whole holdings, it dilutes present shareholders and weighs on the inventory value. From 2020 to 2025, (Micro)Technique’s diluted share rely rose from round 97 million to over 300 million, reflecting the dimensions of capital elevating for Bitcoin purchases. Whereas this technique has succeeded in amassing monumental BTC reserves, it has additionally capped share value appreciation.

Wanting on the firm’s market cap quite than its share value paints a unique image. Market capitalization, which accounts for excellent shares, truly reached new highs in July 2025, intently monitoring Bitcoin’s rise. The share value alone tells a extra detrimental story due to this heavy dilution.

Bitcoin Treasury Firms: NAV Premiums and Valuations in 2025

The online asset worth (NAV) premium, the premium traders pay for shares in comparison with their Bitcoin per-share worth, has fallen significantly. Traditionally, (Micro)Technique commanded a major NAV premium as one of many solely methods for traders to achieve leveraged Bitcoin publicity. Now, with dozens of treasury firms and ETFs obtainable, that “first mover” benefit has diminished. As extra firms undertake Bitcoin as a reserve asset, the NAV premium throughout the sector will probably development towards one.

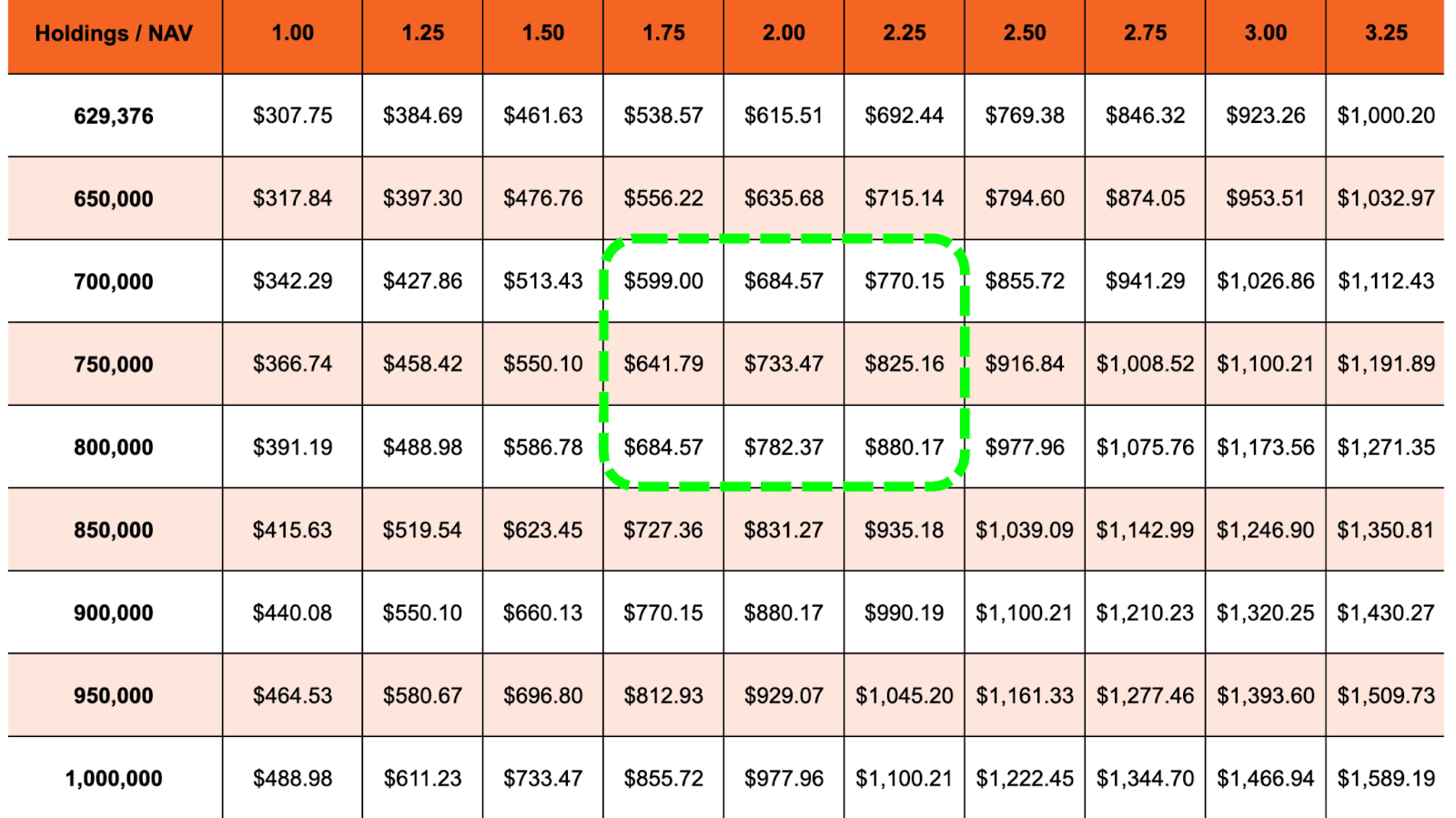

Treasury Firms and their mNAV could have growth/bust cycles, as all markets at all times have. If Bitcoin reaches $150,000, (Micro)Technique’s personal end-of-year prediction, primarily based solely on its present holdings and assuming no extra accumulation or share issuance, its honest worth, with a 1.00x NAV, would sit round $308 per share. With continued accumulation (doubtlessly reaching between 700,000 – 800,000 BTC) and a modest NAV premium of 1.75–2.25x, share costs might attain the $600–$880 vary. This nonetheless appears to be a sensible risk, particularly if we see an S&P 500 inclusion within the coming months alongside a extra sustained BTC upside transfer.

Bitcoin Treasury Firms’ Future: Funding Outlook for 2025

Bitcoin treasury firms like (Micro)Technique have confronted a tough interval of underperformance regardless of Bitcoin’s surge to new highs. Dilution, slowing accumulation, and elevated competitors have weighed closely on share costs. Nonetheless, their elementary function in locking up huge quantities of Bitcoin makes them strategically vital, and in sure market phases, they could nonetheless supply leveraged upside relative to BTC.

The uneven alternative stays, however traders ought to mood expectations: the “simple outperformance” of the early (Micro)Technique days has probably handed, changed by a extra mature and aggressive panorama.

Liked this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra knowledgeable market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to knowledgeable evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding selections.